Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The 3-month treasury yield increases to 4.75%. As a result of a potential decline in economic activity, S&P 500 index is now expected to return

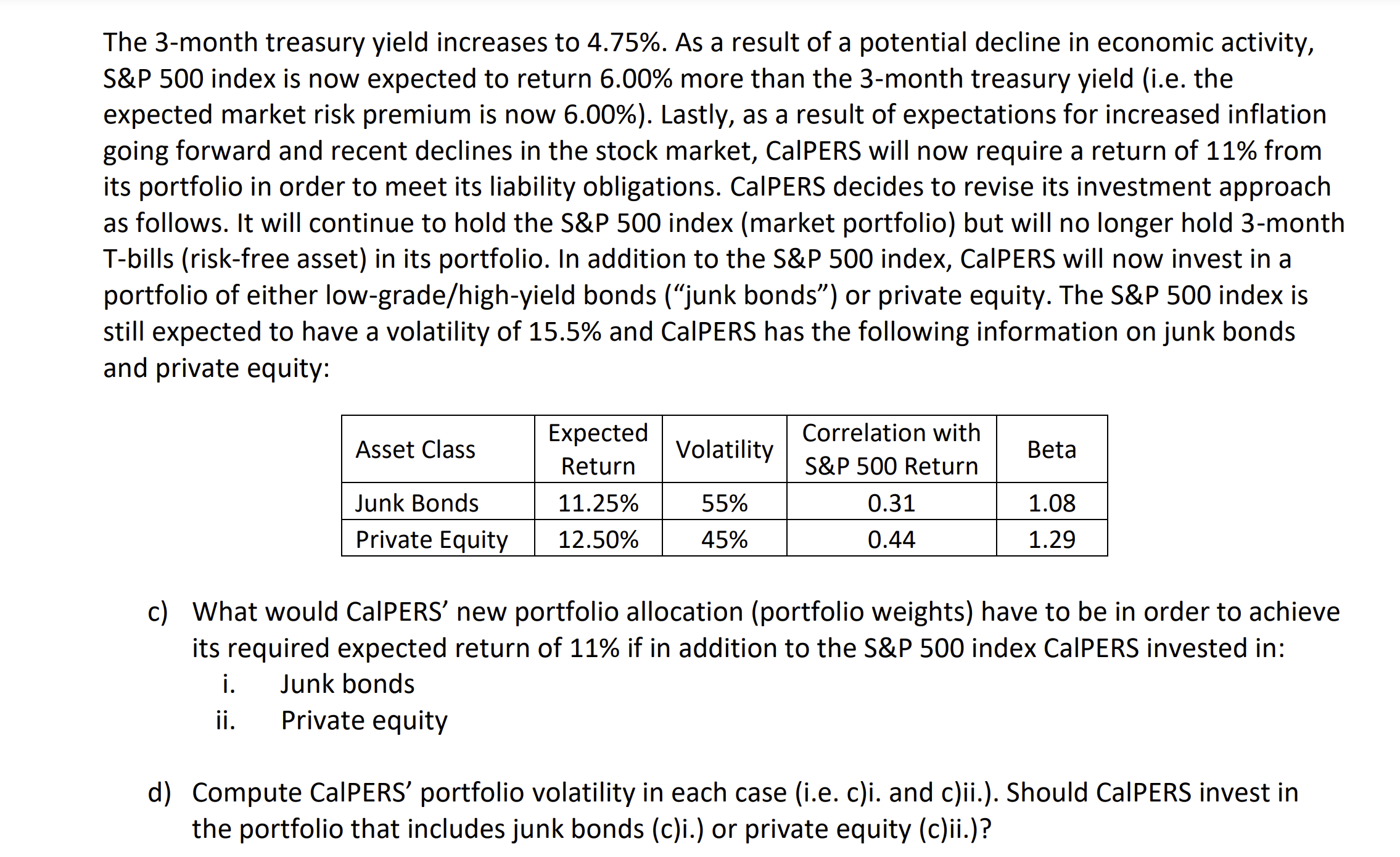

The 3-month treasury yield increases to 4.75%. As a result of a potential decline in economic activity, S\&P 500 index is now expected to return 6.00% more than the 3-month treasury yield (i.e. the expected market risk premium is now 6.00%). Lastly, as a result of expectations for increased inflation going forward and recent declines in the stock market, CalPERS will now require a return of 11% from its portfolio in order to meet its liability obligations. CalPERS decides to revise its investment approach as follows. It will continue to hold the S\&P 500 index (market portfolio) but will no longer hold 3-month T-bills (risk-free asset) in its portfolio. In addition to the S\&P 500 index, CalPERS will now invest in a portfolio of either low-grade/high-yield bonds ("junk bonds") or private equity. The S\&P 500 index is still expected to have a volatility of 15.5% and CalPERS has the following information on junk bonds and private equity: c) What would CalPERS' new portfolio allocation (portfolio weights) have to be in order to achieve its required expected return of 11% if in addition to the S\&P 500 index CalPERS invested in: i. Junk bonds ii. Private equity d) Compute CalPERS' portfolio volatility in each case (i.e. c)i. and c)ii.). Should CalPERS invest in the portfolio that includes junk bonds (c)i.) or private equity (c)ii.)? The 3-month treasury yield increases to 4.75%. As a result of a potential decline in economic activity, S\&P 500 index is now expected to return 6.00% more than the 3-month treasury yield (i.e. the expected market risk premium is now 6.00%). Lastly, as a result of expectations for increased inflation going forward and recent declines in the stock market, CalPERS will now require a return of 11% from its portfolio in order to meet its liability obligations. CalPERS decides to revise its investment approach as follows. It will continue to hold the S\&P 500 index (market portfolio) but will no longer hold 3-month T-bills (risk-free asset) in its portfolio. In addition to the S\&P 500 index, CalPERS will now invest in a portfolio of either low-grade/high-yield bonds ("junk bonds") or private equity. The S\&P 500 index is still expected to have a volatility of 15.5% and CalPERS has the following information on junk bonds and private equity: c) What would CalPERS' new portfolio allocation (portfolio weights) have to be in order to achieve its required expected return of 11% if in addition to the S\&P 500 index CalPERS invested in: i. Junk bonds ii. Private equity d) Compute CalPERS' portfolio volatility in each case (i.e. c)i. and c)ii.). Should CalPERS invest in the portfolio that includes junk bonds (c)i.) or private equity (c)ii.)

The 3-month treasury yield increases to 4.75%. As a result of a potential decline in economic activity, S\&P 500 index is now expected to return 6.00% more than the 3-month treasury yield (i.e. the expected market risk premium is now 6.00%). Lastly, as a result of expectations for increased inflation going forward and recent declines in the stock market, CalPERS will now require a return of 11% from its portfolio in order to meet its liability obligations. CalPERS decides to revise its investment approach as follows. It will continue to hold the S\&P 500 index (market portfolio) but will no longer hold 3-month T-bills (risk-free asset) in its portfolio. In addition to the S\&P 500 index, CalPERS will now invest in a portfolio of either low-grade/high-yield bonds ("junk bonds") or private equity. The S\&P 500 index is still expected to have a volatility of 15.5% and CalPERS has the following information on junk bonds and private equity: c) What would CalPERS' new portfolio allocation (portfolio weights) have to be in order to achieve its required expected return of 11% if in addition to the S\&P 500 index CalPERS invested in: i. Junk bonds ii. Private equity d) Compute CalPERS' portfolio volatility in each case (i.e. c)i. and c)ii.). Should CalPERS invest in the portfolio that includes junk bonds (c)i.) or private equity (c)ii.)? The 3-month treasury yield increases to 4.75%. As a result of a potential decline in economic activity, S\&P 500 index is now expected to return 6.00% more than the 3-month treasury yield (i.e. the expected market risk premium is now 6.00%). Lastly, as a result of expectations for increased inflation going forward and recent declines in the stock market, CalPERS will now require a return of 11% from its portfolio in order to meet its liability obligations. CalPERS decides to revise its investment approach as follows. It will continue to hold the S\&P 500 index (market portfolio) but will no longer hold 3-month T-bills (risk-free asset) in its portfolio. In addition to the S\&P 500 index, CalPERS will now invest in a portfolio of either low-grade/high-yield bonds ("junk bonds") or private equity. The S\&P 500 index is still expected to have a volatility of 15.5% and CalPERS has the following information on junk bonds and private equity: c) What would CalPERS' new portfolio allocation (portfolio weights) have to be in order to achieve its required expected return of 11% if in addition to the S\&P 500 index CalPERS invested in: i. Junk bonds ii. Private equity d) Compute CalPERS' portfolio volatility in each case (i.e. c)i. and c)ii.). Should CalPERS invest in the portfolio that includes junk bonds (c)i.) or private equity (c)ii.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started