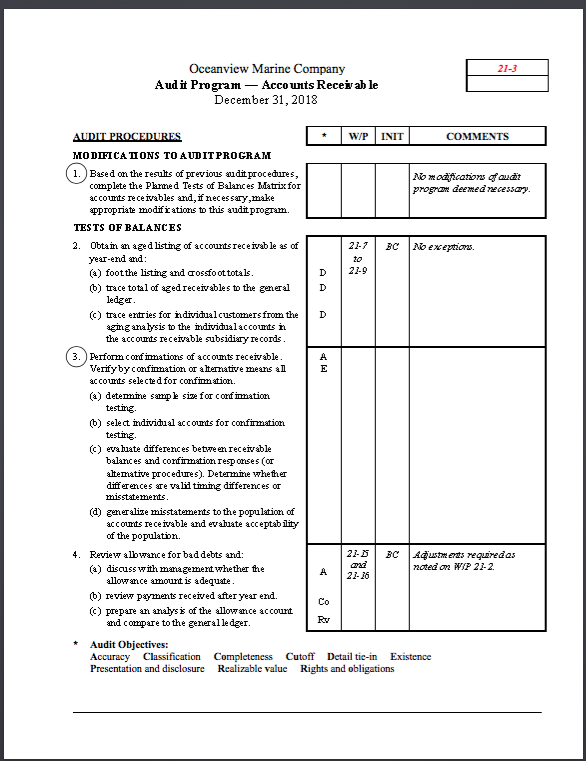

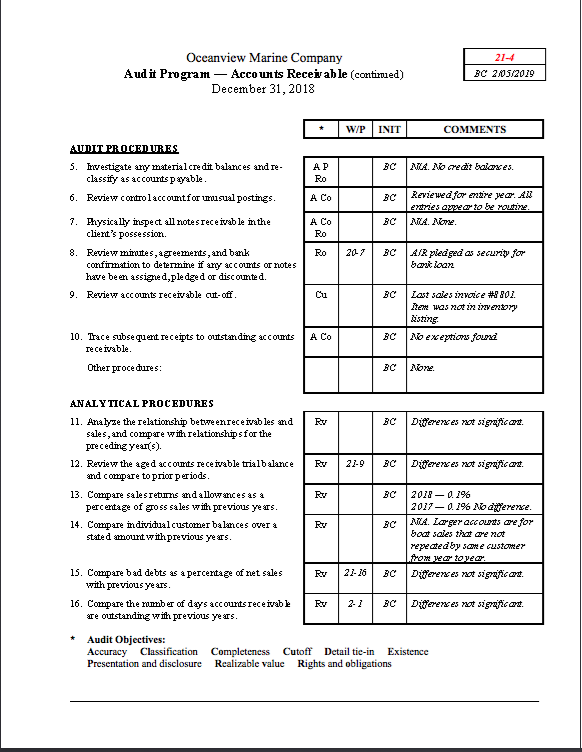

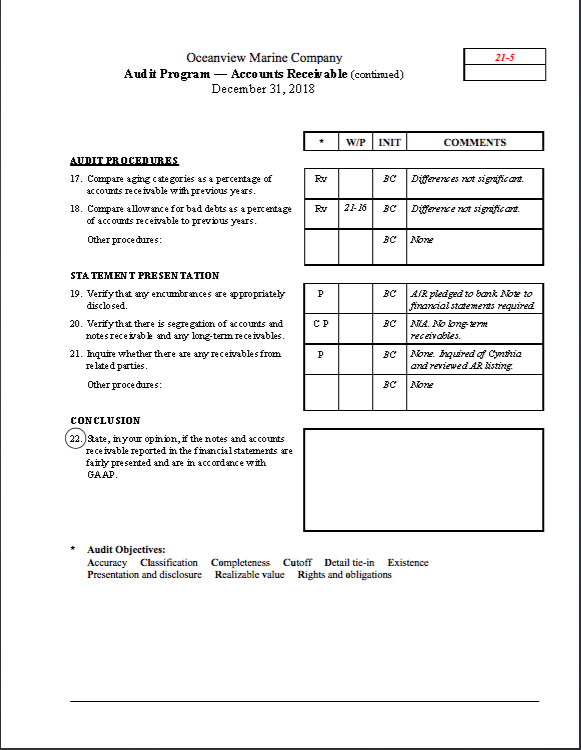

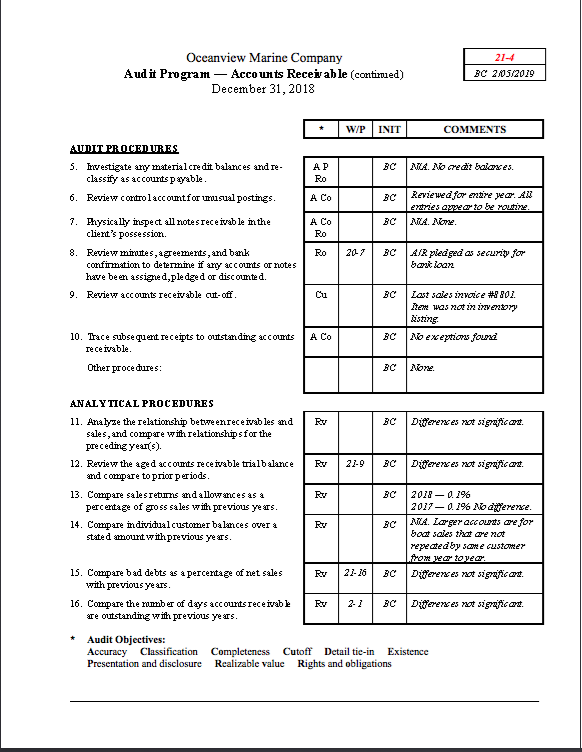

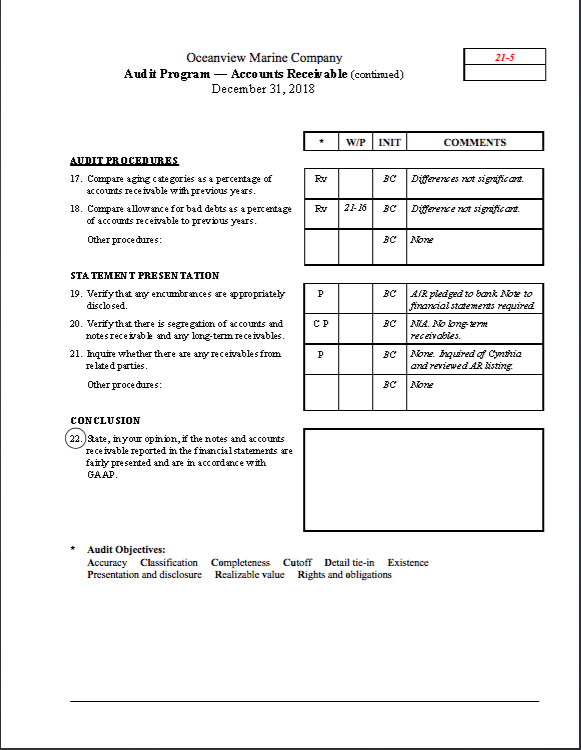

21-3 Oceanview Marine Company Audit Program - Accounts Receivab le December 31, 2018 22.9 A AUDIT PROCEDURES W/P INIT COMMENTS MODIFICA TIONS TO AUDIT PROGRAM 1. Based on the results of previous andit procedures, No modification of audit complete the Parned Tests of Balances Matrix for program deemed necessary accounts receivables and, if necessary, make appropriate modifirations to this audit program. TESTS OF BALANCES 2. Obtain an aged listing of accounts receivable as of 27-7 No exceptions. year-end and (@) foot the listing and arosso ot totals. D 6) trace total of aged receivables to the general D ledger () trace entries for individual customers from the D aging analysis to the individual accounts in the accounts receivable subsidiary records 3.) Perform confimations of accounts receivable. Verify by confirmation or alternative means al E accounts selected for confirmation. (6) detemine sample size for confimation testing 6) select individual accounts for confirmation testing ) evahiste differences between receivable balances and confirmation responses (or alternative procedures). Determine whether differences are valii timing differences or misstatements (d) generalize misstatements to the population of accounts receivable and evabiate acceptability of the population. 4. Review albwance for bad debts and: 21-8 BC Austments required as (a) discuss with management whether the A noted on W/P 21-2. 22-26 allowance amount is adequate 6) review payments received after year end. Co () prepare an analysis of the allowance account Rv and compare to the general ledger. Audit Objectives: Accuracy Classification Completeness Cutoff Detail tie-in Existence Presentation and disclosure Realizable value Rights and obligations 21-4 Oceanview Marine Company Audit Program Accounts Receivable (contimed) December 31, 2018 BC 2/05/2019 W/P INIT COMMENTS BC AP Ro MA. NO edit baiaxes. A Co BC AUDIT PROCEDURES 5. Ivestigate any material credit balances and re- classify as accounts payable. 6. Review control account for usual postings. 7. Physically inspect all notes receivable in the client's possession 8. Review mirates, Teements, and bank confirmation to determine if any accounts or notes have been assigned,pledged or discounted. 9. Review accounts receivable cut-off. Reviewed for entire yem'. AN entries gyvee to be routine. MA NON BC A Co Ro Ro 207 BC A/R pledged as security for Gant loon Cu Last sales invoice #7801. Item was not in tory disting No exception found A Co 10. Trace subsequent receipts to outstanding accounts receivable. Other procedures: BC None. ANALYTICAL PROCEDURES 11. Analyze the relationship betweenreceivables and Ry BC Difereres ret sigraficos. sales, and compare with relationships for the preceding years). 12. Review the aged accounts receivable trialbalance RY 22.9 Difereres et sigrafico and compare to prior periods. 13. Compare sales returns and allowances as a RY 2018- 0.19 percentage of gross sales with previous years. 2017-0196 No Werewe. 14. Compare individual customer balances over 4 Rv ATLA. Larger accounts re for stated amount with previous years. Goat sales that are not repeated by come customer from @tove. 15. Compare bad debts as a percentage of net sales RY 22-26 Diterer es ut significant with previous yeurs 16. Compare the romber of days accounts receivable BC Difereres ret sigraficos. are outstanding with previous years. Audit Objectives: Accuracy Classification Completeness Cutoff Detail tie-in Existence Presentation and disclosure Realizable value Rights and obligations 2- + 21-5 Oceanview Marine Company Audit Program Accounts Receivable continued) December 31, 2018 W/P INIT COMMENTS RY Diferentes not sigraficant AUDIT PROCEDURES 17. Compare aging Categories as a percentage of accounts receivable with previous years. 18. Compare allowance for bad debts as a percentage of accounts receivable to previous years. Other procedures: 22-26 BC Diferene t szerzicos. None P CP STA TEMENT PRESENTATION 19. Verify that wy encumbraces re propriately disclosed 20. Verify that there is segregation of accounts and notes receivable and any long-term receivables. 21. Equire whether there are any receivables from related parties. Other procedures: BC A/R pledged to bank Now to firmial statements required BC MIA No bng ter receivables. Non Buquind of Cynthia and reviewed AR listing. None CONCLUSION 22. State, in your opinon, if the notes and accounts receivable reported in the financial statements are fairly presented and are in accordance with GAAP Audit Objectives: Accuracy Classification Completeness Cutoff Detail tie-in Existence Presentation and disclosure Realizable value Rights and obligations 21-3 Oceanview Marine Company Audit Program - Accounts Receivab le December 31, 2018 22.9 A AUDIT PROCEDURES W/P INIT COMMENTS MODIFICA TIONS TO AUDIT PROGRAM 1. Based on the results of previous andit procedures, No modification of audit complete the Parned Tests of Balances Matrix for program deemed necessary accounts receivables and, if necessary, make appropriate modifirations to this audit program. TESTS OF BALANCES 2. Obtain an aged listing of accounts receivable as of 27-7 No exceptions. year-end and (@) foot the listing and arosso ot totals. D 6) trace total of aged receivables to the general D ledger () trace entries for individual customers from the D aging analysis to the individual accounts in the accounts receivable subsidiary records 3.) Perform confimations of accounts receivable. Verify by confirmation or alternative means al E accounts selected for confirmation. (6) detemine sample size for confimation testing 6) select individual accounts for confirmation testing ) evahiste differences between receivable balances and confirmation responses (or alternative procedures). Determine whether differences are valii timing differences or misstatements (d) generalize misstatements to the population of accounts receivable and evabiate acceptability of the population. 4. Review albwance for bad debts and: 21-8 BC Austments required as (a) discuss with management whether the A noted on W/P 21-2. 22-26 allowance amount is adequate 6) review payments received after year end. Co () prepare an analysis of the allowance account Rv and compare to the general ledger. Audit Objectives: Accuracy Classification Completeness Cutoff Detail tie-in Existence Presentation and disclosure Realizable value Rights and obligations 21-4 Oceanview Marine Company Audit Program Accounts Receivable (contimed) December 31, 2018 BC 2/05/2019 W/P INIT COMMENTS BC AP Ro MA. NO edit baiaxes. A Co BC AUDIT PROCEDURES 5. Ivestigate any material credit balances and re- classify as accounts payable. 6. Review control account for usual postings. 7. Physically inspect all notes receivable in the client's possession 8. Review mirates, Teements, and bank confirmation to determine if any accounts or notes have been assigned,pledged or discounted. 9. Review accounts receivable cut-off. Reviewed for entire yem'. AN entries gyvee to be routine. MA NON BC A Co Ro Ro 207 BC A/R pledged as security for Gant loon Cu Last sales invoice #7801. Item was not in tory disting No exception found A Co 10. Trace subsequent receipts to outstanding accounts receivable. Other procedures: BC None. ANALYTICAL PROCEDURES 11. Analyze the relationship betweenreceivables and Ry BC Difereres ret sigraficos. sales, and compare with relationships for the preceding years). 12. Review the aged accounts receivable trialbalance RY 22.9 Difereres et sigrafico and compare to prior periods. 13. Compare sales returns and allowances as a RY 2018- 0.19 percentage of gross sales with previous years. 2017-0196 No Werewe. 14. Compare individual customer balances over 4 Rv ATLA. Larger accounts re for stated amount with previous years. Goat sales that are not repeated by come customer from @tove. 15. Compare bad debts as a percentage of net sales RY 22-26 Diterer es ut significant with previous yeurs 16. Compare the romber of days accounts receivable BC Difereres ret sigraficos. are outstanding with previous years. Audit Objectives: Accuracy Classification Completeness Cutoff Detail tie-in Existence Presentation and disclosure Realizable value Rights and obligations 2- + 21-5 Oceanview Marine Company Audit Program Accounts Receivable continued) December 31, 2018 W/P INIT COMMENTS RY Diferentes not sigraficant AUDIT PROCEDURES 17. Compare aging Categories as a percentage of accounts receivable with previous years. 18. Compare allowance for bad debts as a percentage of accounts receivable to previous years. Other procedures: 22-26 BC Diferene t szerzicos. None P CP STA TEMENT PRESENTATION 19. Verify that wy encumbraces re propriately disclosed 20. Verify that there is segregation of accounts and notes receivable and any long-term receivables. 21. Equire whether there are any receivables from related parties. Other procedures: BC A/R pledged to bank Now to firmial statements required BC MIA No bng ter receivables. Non Buquind of Cynthia and reviewed AR listing. None CONCLUSION 22. State, in your opinon, if the notes and accounts receivable reported in the financial statements are fairly presented and are in accordance with GAAP Audit Objectives: Accuracy Classification Completeness Cutoff Detail tie-in Existence Presentation and disclosure Realizable value Rights and obligations