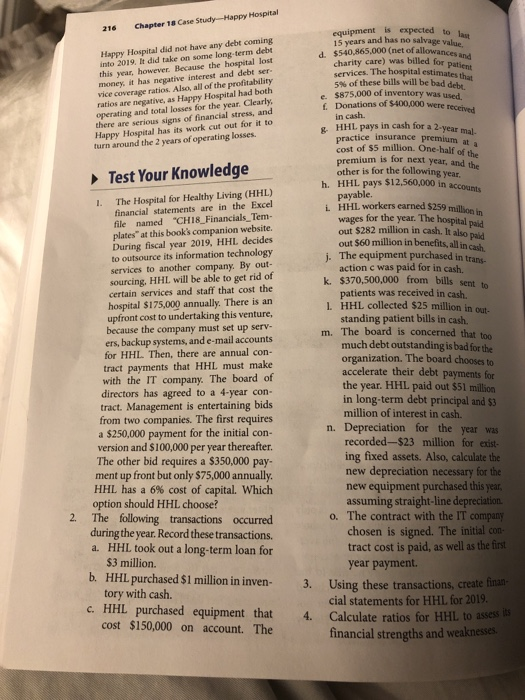

216 Chapter 18 Case Study-Happy Hospital Happy Hospital did not have any debt coming into 2019. It did take on some long-term debt this year, however. Because the hospital lost money, it has negative interest and debt ser vice coverage ratios. Also, all of the profitability ratios are negative, as Happy Hospital had both operating and total losses for the year. Clearly, there are serious signs of financial stress, and Happy Hospital has its work cut out for it to turn around the 2 years of operating losses. equipment is expected to 15 years and has no salvage value $540,865,000 (net of allowances charity care) was billed for pati services. The hospital estimates th 5% of these bills will be bad debe $875,000 of inventory was used Donations of $400,000 were recen in cash HHL pays in cash for a 2-year mal practice insurance premium at cost of $5 million. One-half of the premium is for next year, and the other is for the following year HHL pays $12,560,000 in account h payable. Test Your Knowledge 1. The Hospital for Healthy Living (HHL) financial statements are in the Excel file named "CH18_Financials_Tem- plates at this book's companion website. During fiscal year 2019, HHL decides to outsource its information technology services to another company. By out- sourcing, HHL will be able to get rid of certain services and staff that cost the hospital $175,000 annually. There is an upfront cost to undertaking this venture, because the company must set up serv- ers, backup systems, and e-mail accounts for HHL Then, there are annual con- tract payments that HHL must make with the IT company. The board of directors has agreed to a 4-year con- tract Management is entertaining bids from two companies. The first requires a $250,000 payment for the initial con- version and $100,000 per year thereafter. The other bid requires a $350,000 pay- ment up front but only $75,000 annually. HHL has a 6% cost of capital. Which option should HHL choose? The following transactions occurred during the year. Record these transactions. a. HHL took out a long-term loan for $3 million. b. HHL purchased $1 million in inven- tory with cash. c. HHL purchased equipment that cost $150,000 on account. The HHL workers earned $259 million wages for the year. The hospital paid out $282 million in cash. It also paid out $60 million in benefits, all in cash 1. The equipment purchased in trans action c was paid for in cash. k. $370,500,000 from bills sent to patients was received in cash. L HHL collected $25 million in out- standing patient bills in cash. m. The board is concerned that too much debt outstanding is bad for the organization. The board chooses to accelerate their debt payments for the year. HHL paid out $51 million in long-term debt principal and $3 million of interest in cash. n. Depreciation for the year was recorded-$23 million for exist ing fixed assets. Also, calculate the new depreciation necessary for the new equipment purchased this year, assuming straight-line depreciation o. The contract with the IT company chosen is signed. The initial con- tract cost is paid, as well as the first year payment 3. Using these transactions, create finan- cial statements for HHL for 2019. 4. Calculate ratios for HHL to assess its financial strengths and weaknesses