Answered step by step

Verified Expert Solution

Question

1 Approved Answer

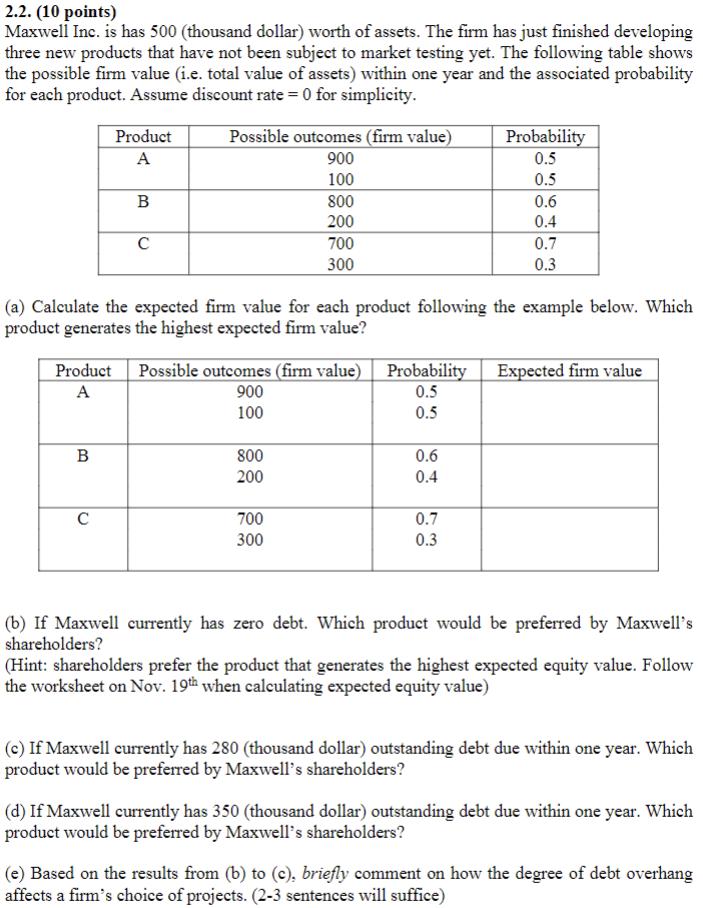

2.2. (10 points) Maxwell Inc. is has 500 (thousand dollar) worth of assets. The firm has just finished developing three new products that have

2.2. (10 points) Maxwell Inc. is has 500 (thousand dollar) worth of assets. The firm has just finished developing three new products that have not been subject to market testing yet. The following table shows the possible firm value (i.e. total value of assets) within one year and the associated probability for each product. Assume discount rate=0 for simplicity. Product A B B C C Possible outcomes (firm value) 900 100 Product Possible outcomes (firm value) Probability A 900 0.5 100 0.5 (a) Calculate the expected firm value for each product following the example below. Which product generates the highest expected firm value? 800 200 700 300 800 200 700 300 0.6 0.4 Probability 0.5 0.5 0.6 0.4 0.7 0.3 0.7 0.3 Expected firm value (b) If Maxwell currently has zero debt. Which product would be preferred by Maxwell's shareholders? (Hint: shareholders prefer the product that generates the highest expected equity value. Follow the worksheet on Nov. 19th when calculating expected equity value) (c) If Maxwell currently has 280 (thousand dollar) outstanding debt due within one year. Which product would be preferred by Maxwell's shareholders? (d) If Maxwell currently has 350 (thousand dollar) outstanding debt due within one year. Which product would be preferred by Maxwell's shareholders? (e) Based on the results from (b) to (c), briefly comment on how the degree of debt overhang affects a firm's choice of projects. (2-3 sentences will suffice)

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Lets calculate the expected firm value for each product For Product A EFVA 90005 10005 500 50 550 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started