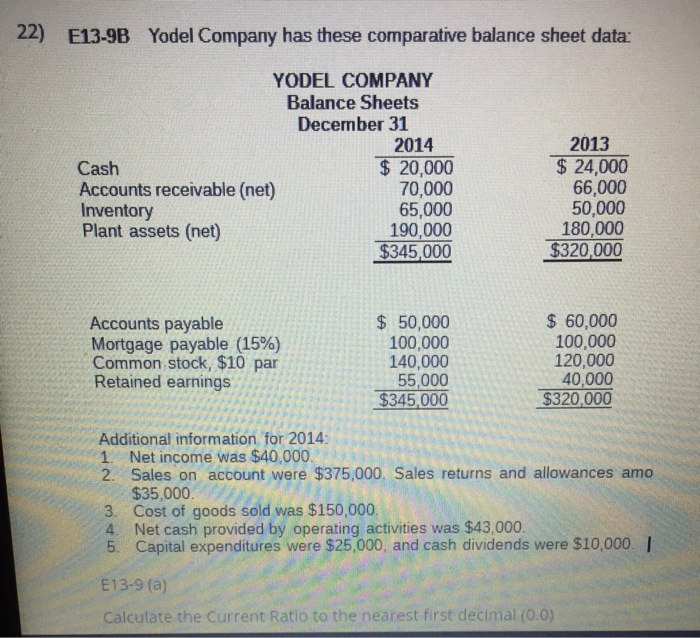

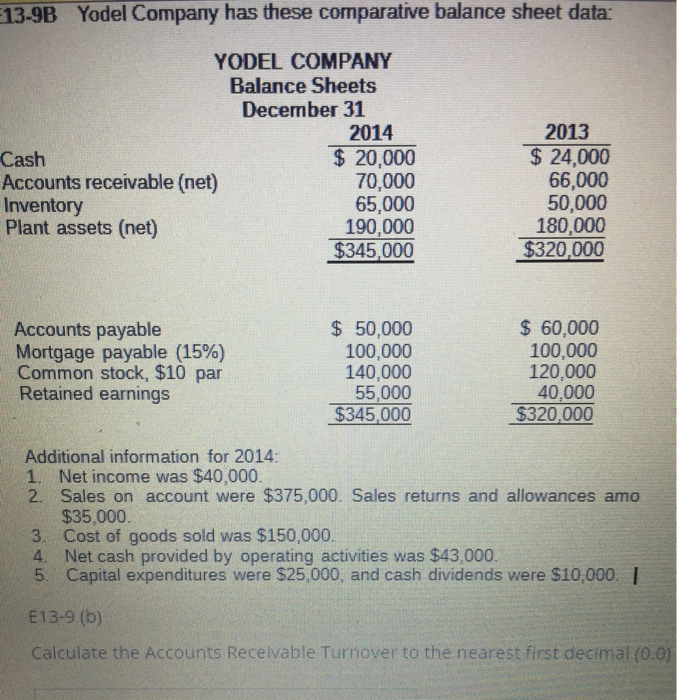

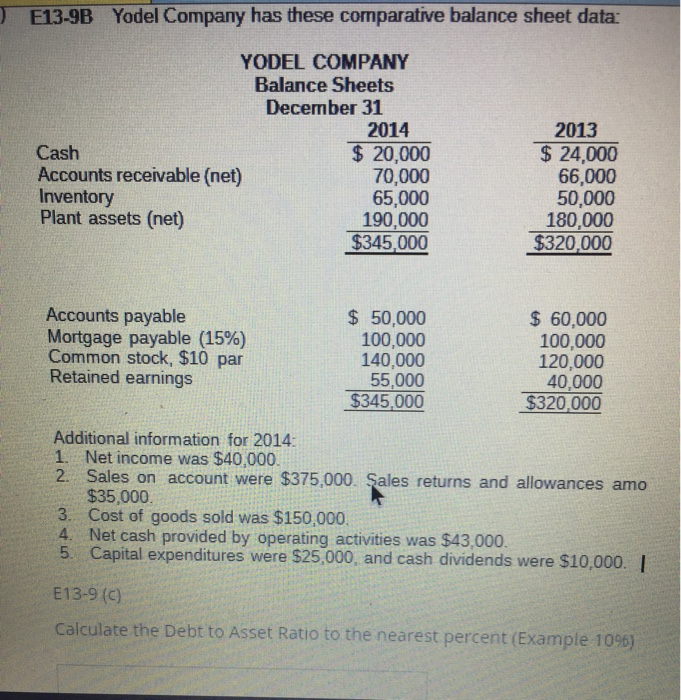

22) E13-9B Yodel Company has these comparative balance sheet data: YODEL COMPANY Balance Sheets December 31 2014 Cash $ 20,000 Accounts receivable (net) 70,000 Inventory 65,000 Plant assets (net) 190,000 $345.000 2013 $ 24,000 66,000 50,000 180,000 $320,000 Accounts payable Mortgage payable (15%) Common stock, $10 par Retained earnings $ 50,000 100,000 140,000 55,000 $345.000 $ 60,000 100.000 120,000 40,000 $320,000 Additional information for 2014: 1. Net income was $40.000. 2. Sales on account were $375,000. Sales returns and allowances amo $35,000. 3. Cost of goods sold was $150,000. 4. Net cash provided by operating activities was $43,000. 5. Capital expenditures were $25,000, and cash dividends were $10,000. E13-9 (a) Calculate the Current Ratio to the nearest first decimal (0.0) 13-9B Yodel Company has these comparative balance sheet data: YODEL COMPANY Balance Sheets December 31 2014 Cash $ 20,000 Accounts receivable (net) 70,000 Inventory 65,000 Plant assets (net) 190.000 $345,000 2013 $ 24,000 66,000 50,000 180,000 $320,000 Accounts payable Mortgage payable (15%) Common stock, $10 par Retained earnings $ 50,000 100,000 140,000 55,000 $345,000 $ 60,000 100.000 120,000 40,000 $320.000 Additional information for 2014: 1. Net income was $40,000. 2. Sales on account were $375,000. Sales returns and allowances amo $35,000. 3. Cost of goods sold was $150,000. 4. Net cash provided by operating activities was $43,000. 5. Capital expenditures were $25,000, and cash dividends were $10,000. I E13-9 (b) Calculate the Accounts Receivable Turnover to the nearest first decimal 0.01 ) E13-9B Yodel Company has these comparative balance sheet data: YODEL COMPANY Balance Sheets December 31 2014 Cash $ 20,000 Accounts receivable (net) 70,000 Inventory 65,000 Plant assets (net) 190,000 $345,000 2013 $ 24,000 66,000 50,000 180,000 $320,000 Accounts payable Mortgage payable (15%) Common stock, $10 par Retained earnings $ 50,000 100,000 140,000 55,000 $345.000 $ 60,000 100,000 120,000 40.000 $320,000 Additional information for 2014: 1. Net income was $40,000 2. Sales on account were $375,000. Sales returns and allowances amo $35,000 3. Cost of goods sold was $150,000. 4. Net cash provided by Operating activities was $43.000. 5. Capital expenditures were $25,000, and cash dividends were $10,000. E13-9 (C) Calculate the Debt to Asset Ratio to the nearest percent (Example 1095)