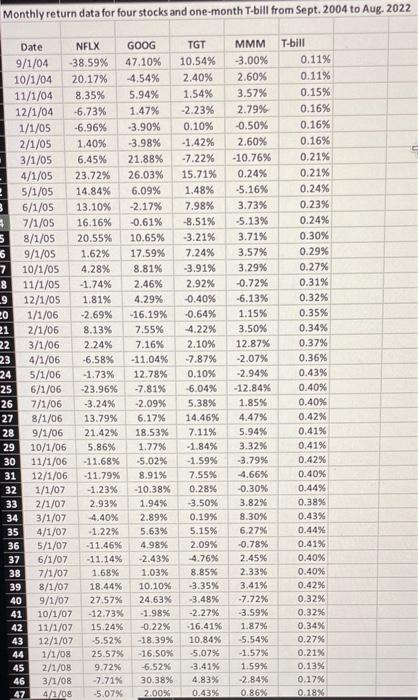

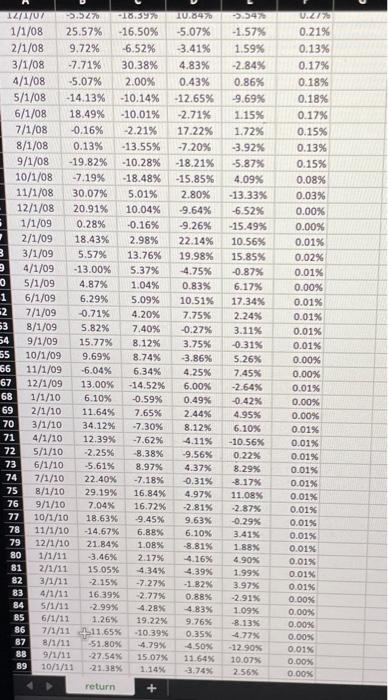

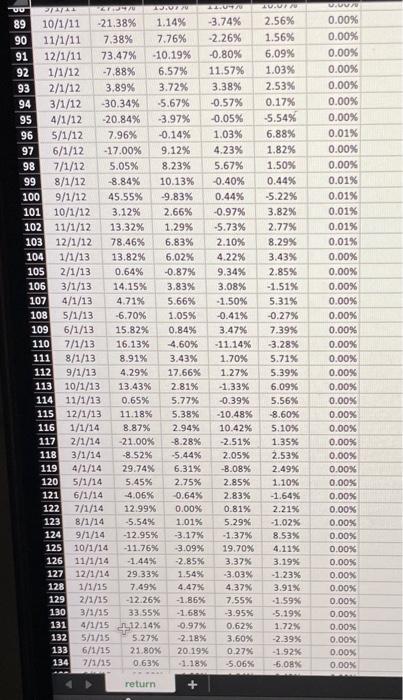

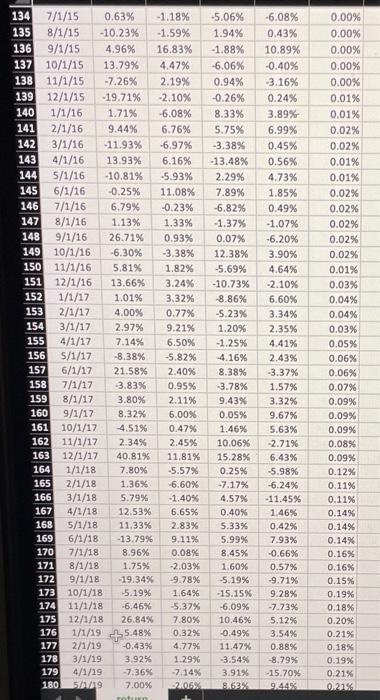

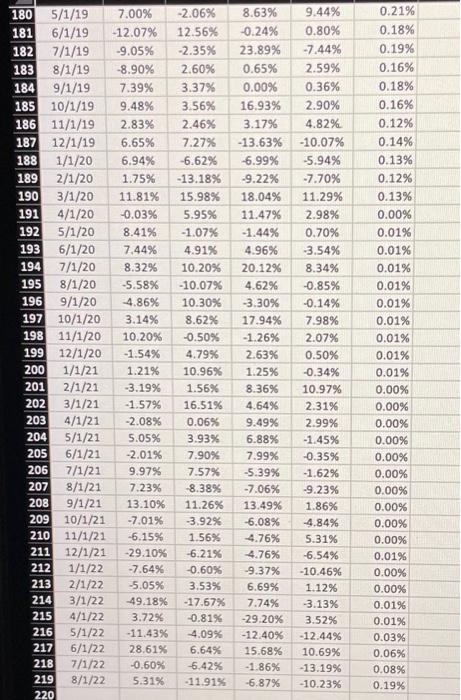

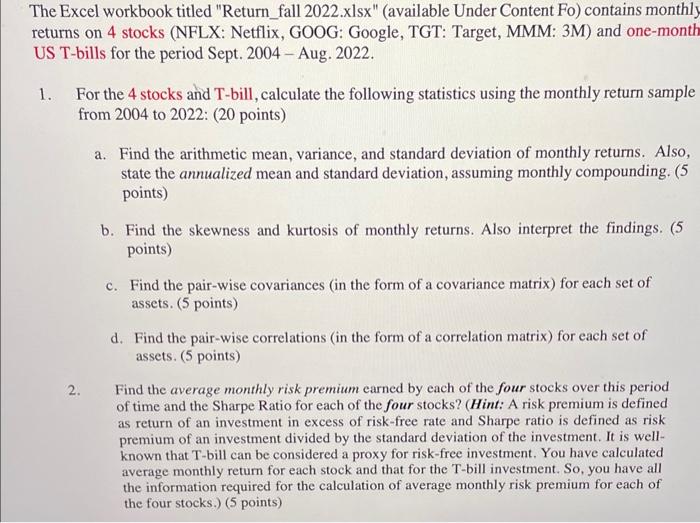

22 he Excel workbook titled "Return_fall 2022.xlsx" (available Under Content Fo) contains monthl eturns on 4 stocks (NFLX: Netflix, GOOG: Google, TGT: Target, MMM: 3M) and one-mont JS T-bills for the period Sept. 2004 - Aug. 2022. 1. For the 4 stocks and T-bill, calculate the following statistics using the monthly return sample from 2004 to 2022: (20 points) a. Find the arithmetic mean, variance, and standard deviation of monthly returns. Also, state the annualized mean and standard deviation, assuming monthly compounding. ( 5 points) b. Find the skewness and kurtosis of monthly returns. Also interpret the findings. (5 points) c. Find the pair-wise covariances (in the form of a covariance matrix) for each set of assets. (5 points) d. Find the pair-wise correlations (in the form of a correlation matrix) for each set of assets. ( 5 points) 2. Find the average monthly risk premium earned by each of the four stocks over this period of time and the Sharpe Ratio for each of the four stocks? (Hint: A risk premium is defined as return of an investment in excess of risk-free rate and Sharpe ratio is defined as risk premium of an investment divided by the standard deviation of the investment. It is wellknown that T-bill can be considered a proxy for risk-free investment. You have calculated average monthly return for each stock and that for the T-bill investment. So, you have all the information required for the calculation of average monthly risk premium for each of the four stocks.) (5 points) 22 he Excel workbook titled "Return_fall 2022.xlsx" (available Under Content Fo) contains monthl eturns on 4 stocks (NFLX: Netflix, GOOG: Google, TGT: Target, MMM: 3M) and one-mont JS T-bills for the period Sept. 2004 - Aug. 2022. 1. For the 4 stocks and T-bill, calculate the following statistics using the monthly return sample from 2004 to 2022: (20 points) a. Find the arithmetic mean, variance, and standard deviation of monthly returns. Also, state the annualized mean and standard deviation, assuming monthly compounding. ( 5 points) b. Find the skewness and kurtosis of monthly returns. Also interpret the findings. (5 points) c. Find the pair-wise covariances (in the form of a covariance matrix) for each set of assets. (5 points) d. Find the pair-wise correlations (in the form of a correlation matrix) for each set of assets. ( 5 points) 2. Find the average monthly risk premium earned by each of the four stocks over this period of time and the Sharpe Ratio for each of the four stocks? (Hint: A risk premium is defined as return of an investment in excess of risk-free rate and Sharpe ratio is defined as risk premium of an investment divided by the standard deviation of the investment. It is wellknown that T-bill can be considered a proxy for risk-free investment. You have calculated average monthly return for each stock and that for the T-bill investment. So, you have all the information required for the calculation of average monthly risk premium for each of the four stocks.) (5 points)