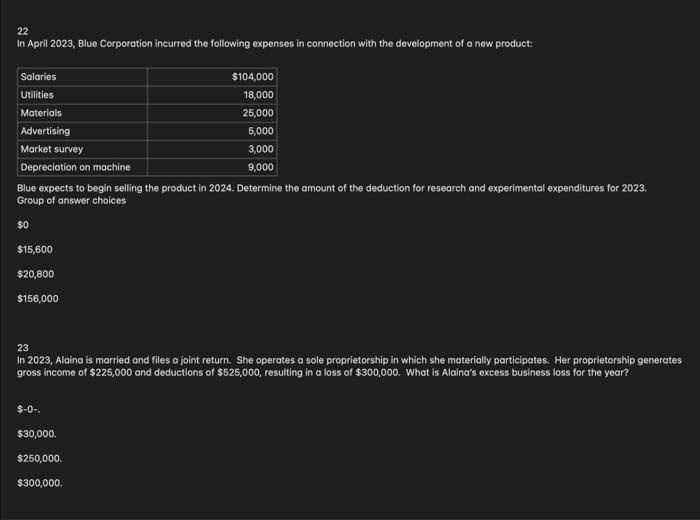

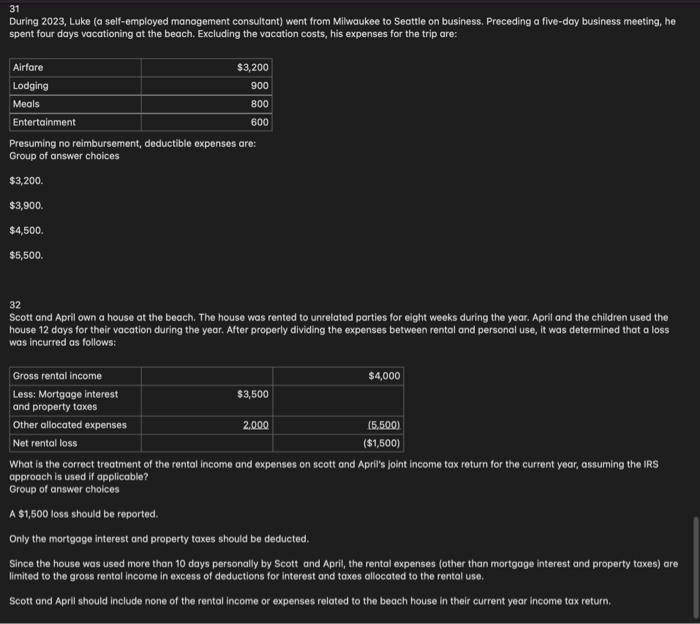

22 In April 2023, Blue Corporation incurred the following expenses in connection with the development of a new product: \begin{tabular}{|l|r|} \hline Salaries & $104,000 \\ \hline Utilities & 18,000 \\ \hline Materials & 25,000 \\ \hline Advertising & 5,000 \\ \hline Market survey & 3,000 \\ \hline Depreciation on machine & 9,000 \\ \hline \end{tabular} Blue expects to begin selling the product in 2024. Determine the amount of the deduction for research and experimental expenditures for 2023. Group of answer choices 50 $15,600 $20,800 $156,000 23 In 2023, Alaina is married and files a joint return. She operates a sole proprietorship in which she materially participates. Her proprietorship generates gross income of $225,000 and deductions of $525,000, resulting in a loss of $300,000. What is Alaina's excess business loss for the year? \$-0-. $30,000. $250,000. $300,000. 31 During 2023, Luke (a self-employed manogement consultant) went from Milwaukee to Seattle on business. Preceding a five-day business meeting, he spent four days vacationing at the beach. Excluding the vacation costs, his expenses for the trip are: Presuming no reimbursement, deductible expenses are: Group of answer choices $3,200. $3,900. $4,500. $5,500. 32 Scott and April own a house at the beach. The house was rented to unrelated parties for eight weeks during the year. April and the children used the house 12 days for their vacation during the year. After properly dividing the expenses between rental and personal use, it was determined that a loss was incurred as follows: What is the correct treatment of the rental income and expenses on scott and April's joint income tax return for the current year, assuming the IRS approach is used if applicable? Group of answer cholces A $1,500 loss should be reported. Only the mortgage interest and property taxes should be deducted. Since the house was used more than 10 days personally by Scott and April, the rental expenses (other than mortgage interest and property taxes) are limited to the gross rentol income in excess of deductions for interest and taxes allocated to the rental use. Scott and April should include none of the rental income or expenses related to the beach house in their current year income tax return