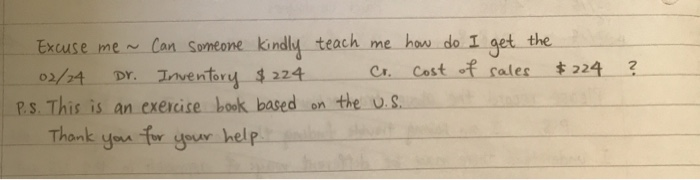

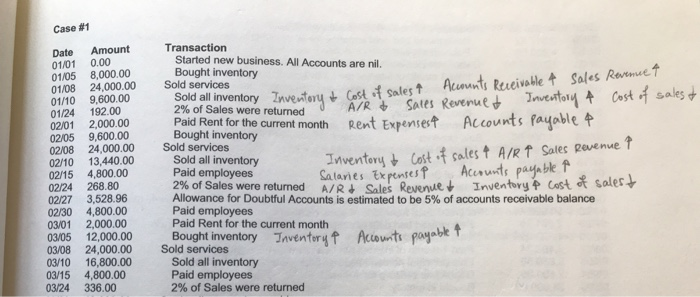

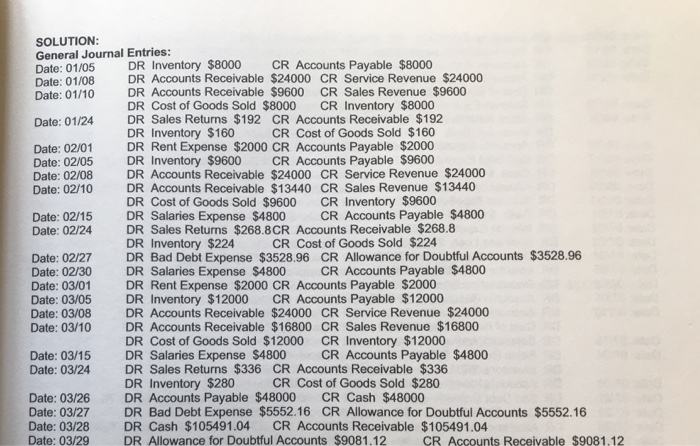

$224 ? Excuse me ~ Can someone kindly teach me how do I get the 02/24 Dr. Inventory $224 Cr. Cost of sales P.S. This is an exercise book based on the U.S. Thank you for your help but Case #1 Date Amount 01/01 0.00 01/05 8,000.00 01/08 24,000.00 01/10 9,600.00 01/24 192.00 02/01 2,000.00 02/05 9,600.00 02/08 24,000.00 02/10 13,440.00 02/15 4,800.00 02/24 268.80 02/27 3,528.96 02/30 4,800.00 03/01 2,000.00 03/05 12,000.00 03/08 24,000.00 03/10 16,800.00 03/15 4,800.00 03/24 336.00 Transaction Started new business. All Accounts are nil. Bought inventory Sold services Sales Revenue 1 Acuunts Receivable + inventory Inventory Cost of Sales 2% of Sales were returned 9 A/R Sales Revenuet Inventory 4 Cost of sales to current month Rent Expensest Accounts payable 4 Bought inventory Sold services Sold all inventory Inventory + Cost of sales + AIR Sales Revenue 1 Paid employees Salaries Expenses Acerunts payable to 2% of Sales were returned A/R Sales Revenue Inventory + Cost of sales Allowance for Doubtful Accounts is estimated to be 5% of accounts receivable balance Paid employees Paid Rent for the current month Bought inventory Inventory P Accounts payable T Sold services Sold all inventory Paid employees 2% of Sales were returned SOLUTION: General Journal Entries: Date: 01/05 DR Inventory $8000 CR Accounts Payable $8000 Date: 01/08 DR Accounts Receivable $24000 CR Service Revenue $24000 Date: 01/10 DR Accounts Receivable $9600 CR Sales Revenue $9600 DR Cost of Goods Sold $8000 CR Inventory $8000 Date: 01/24 DR Sales Returns $192 CR Accounts Receivable $192 DR Inventory $160 CR Cost of Goods Sold $160 Date: 02/01 DR Rent Expense $2000 CR Accounts Payable $2000 Date: 02/05 DR Inventory $9600 CR Accounts Payable $9600 Date: 02/08 DR Accounts Receivable $24000 CR Service Revenue $24000 Date: 02/10 DR Accounts Receivable $13440 CR Sales Revenue $13440 DR Cost of Goods Sold $9600 CR Inventory $9600 Date: 02/15 DR Salaries Expense $4800 CR Accounts Payable $4800 Date: 02/24 DR Sales Returns $268.8CR Accounts Receivable $268.8 DR Inventory $224 CR Cost of Goods Sold $224 Date: 02/27 DR Bad Debt Expense $3528.96 CR Allowance for Doubtful Accounts $3528.96 Date: 02/30 DR Salaries Expense $4800 CR Accounts Payable $4800 Date: 03/01 DR Rent Expense $2000 CR Accounts Payable $2000 Date: 03/05 DR Inventory $12000 CR Accounts Payable $12000 Date: 03/08 DR Accounts Receivable $24000 CR Service Revenue $24000 Date: 03/10 DR Accounts Receivable $16800 CR Sales Revenue $16800 DR Cost of Goods Sold $12000 CR Inventory $12000 Date: 03/15 DR Salaries Expense $4800 CR Accounts Payable $4800 Date: 03/24 DR Sales Returns $336 CR Accounts Receivable $336 DR Inventory $280 CR Cost of Goods Sold $280 Date: 03/26 DR Accounts Payable $48000 CR Cash $48000 Date: 03/27 DR Bad Debt Expense $5552.16 CR Allowance for Doubtful Accounts $5552.16 Date: 03/28 DR Cash $105491.04 CR Accounts Receivable $105491.04 Date: 03/29 DR Allowance for Doubtful Accounts S9081.12 CR Accounts Receivable $9081.12