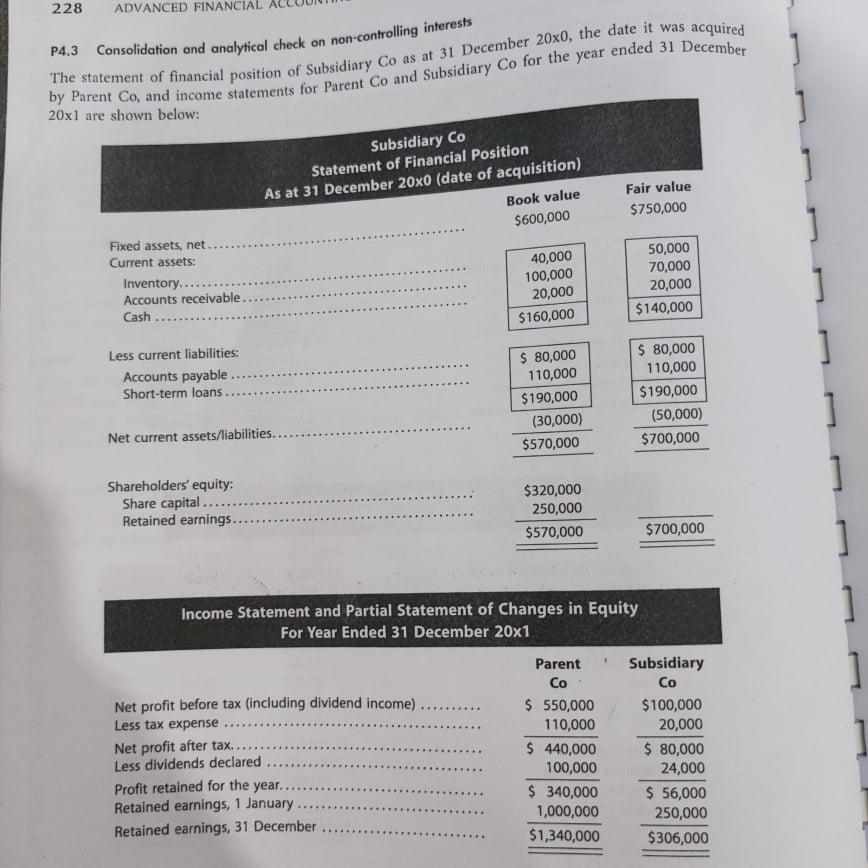

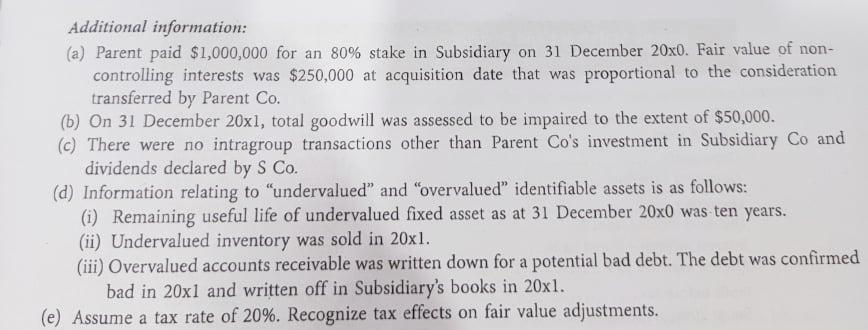

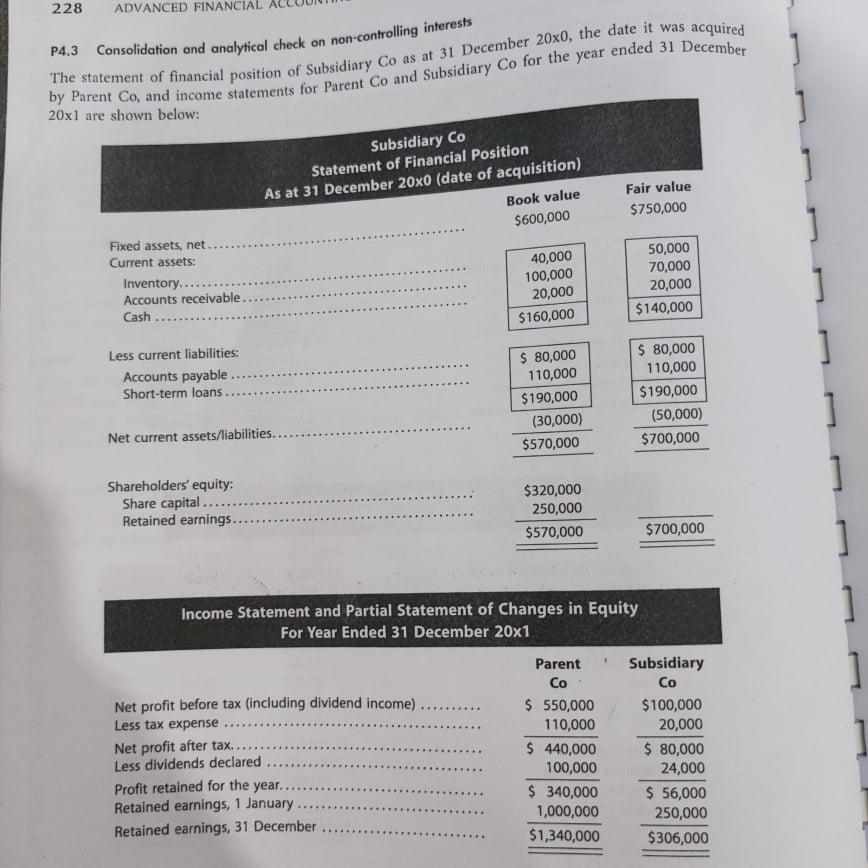

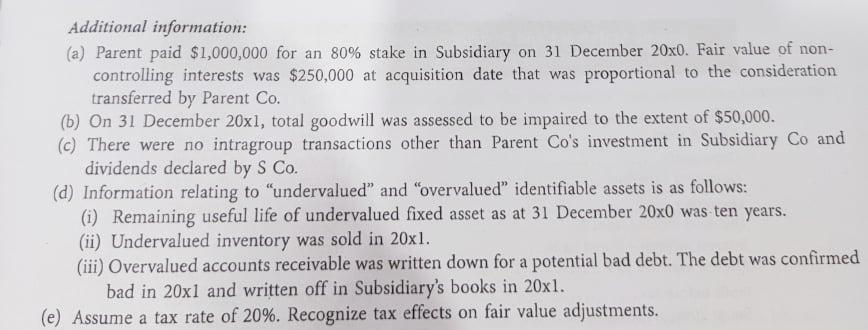

228 ADVANCED FINANCIAL P4.3 Consolidation and analytical check on non-controlling interests by Parent Co, and income statements for Parent Co and Subsidiary Co for the year ended 31 December The statement of financial position of Subsidiary Co as at 31 December 20x0, the date it was acquired 20x1 are shown below: Subsidiary Co Statement of Financial Position As at 31 December 20x0 (date of acquisition) Book value $600,000 Fair value $750,000 Fixed assets, net Current assets: Inventory.... Accounts receivable. Cash 40,000 100,000 20,000 $160,000 50,000 70,000 20,000 $140,000 ] ] ] ] Less current liabilities: Accounts payable Short-term loans. $ 80,000 110,000 $190,000 (30,000) $570,000 $ 80,000 110,000 $190,000 (50,000) $700,000 ] Net current assets/liabilities.. ] Shareholders' equity: Share capital ...... Retained earnings.. $320,000 250,000 $570,000 $700,000 ] 1 1 . Co . Income Statement and Partial Statement of Changes in Equity For Year Ended 31 December 20x1 Parent Subsidiary Net profit before tax (including dividend income). $ 550,000 $100,000 Less tax expense 110,000 20,000 Net profit after tax.. $ 440,000 $ 80,000 Less dividends declared 100,000 24,000 Profit retained for the year... $ 340,000 $ 56,000 Retained earnings, 1 January. 1,000,000 250,000 Retained earnings, 31 December $1,340,000 $306,000 . .... ..... ...... Additional information: (a) Parent paid $1,000,000 for an 80% stake in Subsidiary on 31 December 20x0. Fair value of non- controlling interests was $250,000 at acquisition date that was proportional to the consideration transferred by Parent Co. (b) On 31 December 20x1, total goodwill was assessed to be impaired to the extent of $50,000. (c) There were no intragroup transactions other than Parent Co's investment in Subsidiary Co and dividends declared by S Co. (d) Information relating to "undervalued" and "overvalued identifiable assets is as follows: (i) Remaining useful life of undervalued fixed asset as at 31 December 20x0 was ten years. (ii) Undervalued inventory was sold in 20xl. (iii) Overvalued accounts receivable was written down for a potential bad debt. The debt was confirmed bad in 20xl and written off in Subsidiary's books in 20x1. (e) Assume a tax rate of 20%. Recognize tax effects on fair value adjustments. Prepare the consolidation adjustments for the year ended 31 December 20xl. Perform an analytical check on the non-controlling interests' balance as at 31 December 20xl. Show the consolidation adjustments that need to be passed in 20x2 to re-enact the consolidation adjustments of 20x1. Prepare the consolidated income statement for the year ended 31 December 20x1. Consolidation and analytical check on non-controlling interests