Answered step by step

Verified Expert Solution

Question

1 Approved Answer

23. If a project is risker than the firm's weighted average cost of capital (WACC), a subjective rate could be used that would be: a.

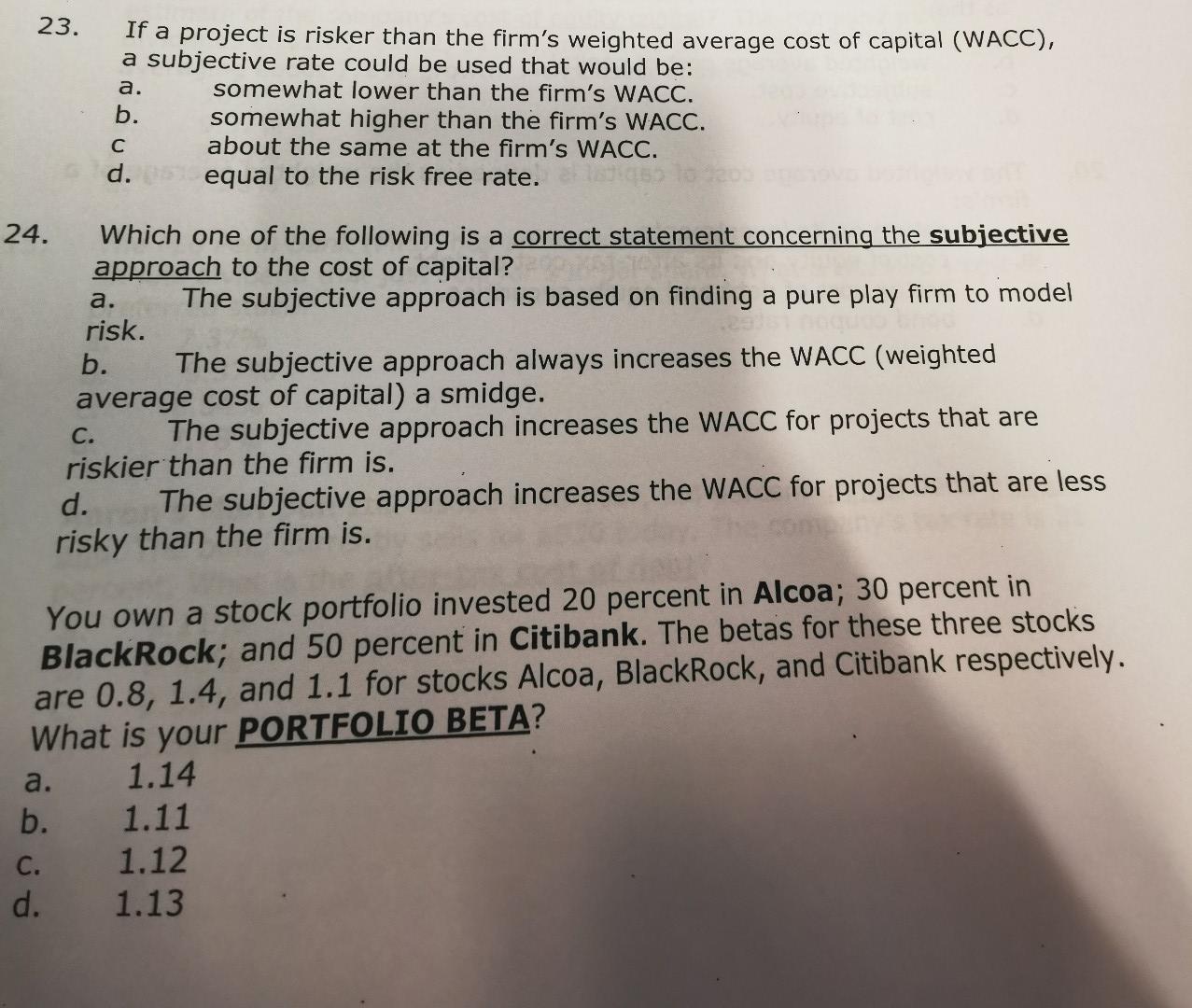

23. If a project is risker than the firm's weighted average cost of capital (WACC), a subjective rate could be used that would be: a. somewhat lower than the firm's WACC. b. somewhat higher than the firm's WACC. about the same at the firm's WACC. equal to the risk free rate. C a. 24. Which one of the following is a correct statement concerning the subjective approach to the cost of capital? The subjective approach is based on finding a pure play firm to model risk. b. The subjective approach always increases the WACC (weighted average cost of capital) a smidge. C. The ubjective approach increases the WACC for projects that are riskier than the firm is. d. The subjective approach increases the WACC for projects that are less risky than the firm is. You own a stock portfolio invested 20 percent in Alcoa; 30 percent in BlackRock; and 50 percent in Citibank. The betas for these three stocks are 0.8, 1.4, and 1.1 for stocks Alcoa, BlackRock, and Citibank respectively. What is your PORTFOLIO BETA? a. 1.14 b. 1.11 1.12 d. 1.13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started