Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2.3 John, 58 years old, a resident of South Africa, disposed of a few items in 2022. He was unsure on how to calculate the

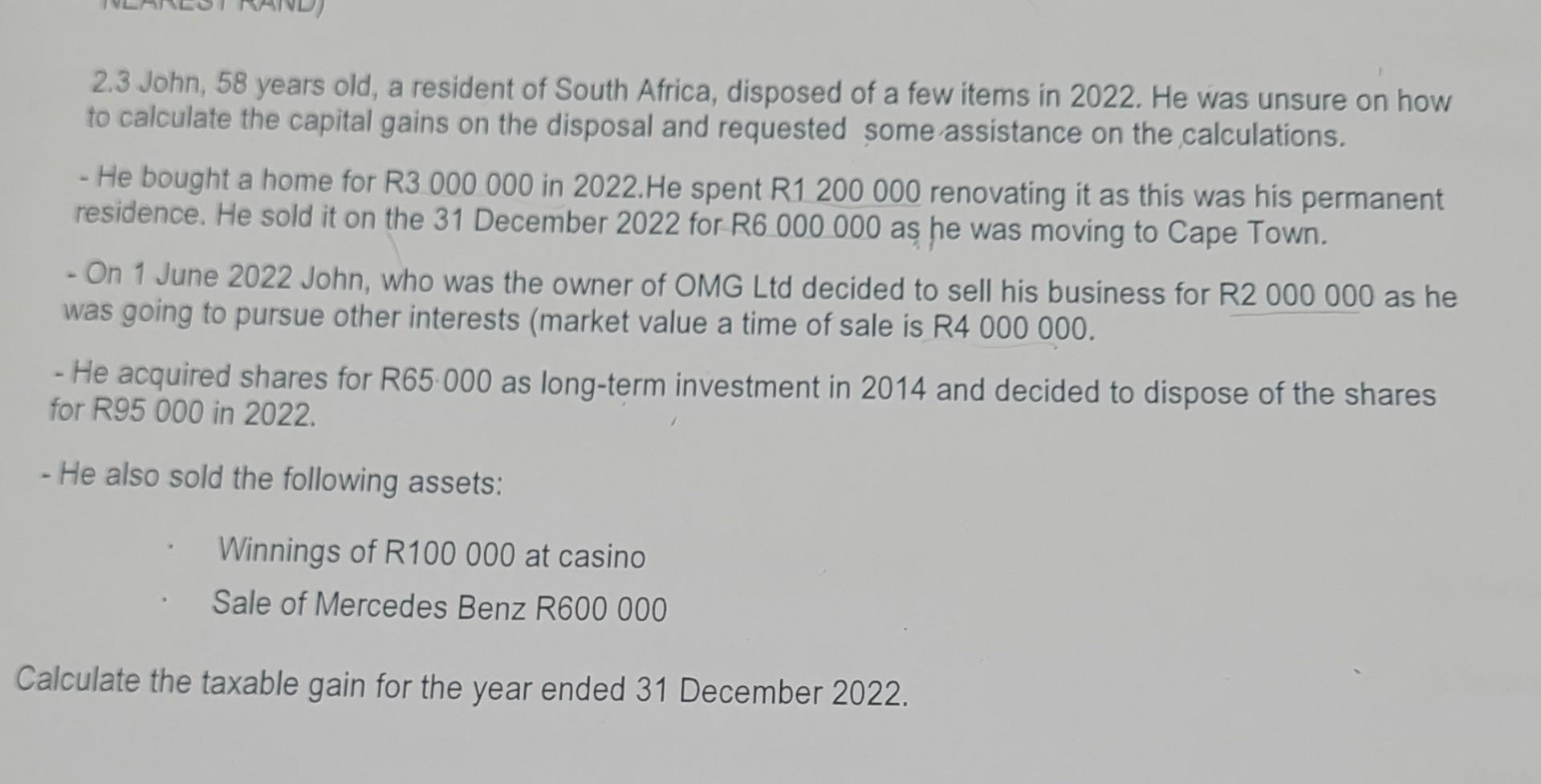

2.3 John, 58 years old, a resident of South Africa, disposed of a few items in 2022. He was unsure on how to calculate the capital gains on the disposal and requested some assistance on the calculations. - He bought a home for R3 000000 in 2022. He spent R1 200000 renovating it as this was his permanent residence. He sold it on the 31 December 2022 for R6 000000 as he was moving to Cape Town. - On 1 June 2022 John, who was the owner of OMG Ltd decided to sell his business for R2 000000 as he was going to pursue other interests (market value a time of sale is R4 000000 . - He acquired shares for R65.000 as long-term investment in 2014 and decided to dispose of the shares for R95 000 in 2022. - He also sold the following assets: Winnings of R100 000 at casino Sale of Mercedes Benz R600 000 Calculate the taxable gain for the year ended 31 December 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started