Answered step by step

Verified Expert Solution

Question

1 Approved Answer

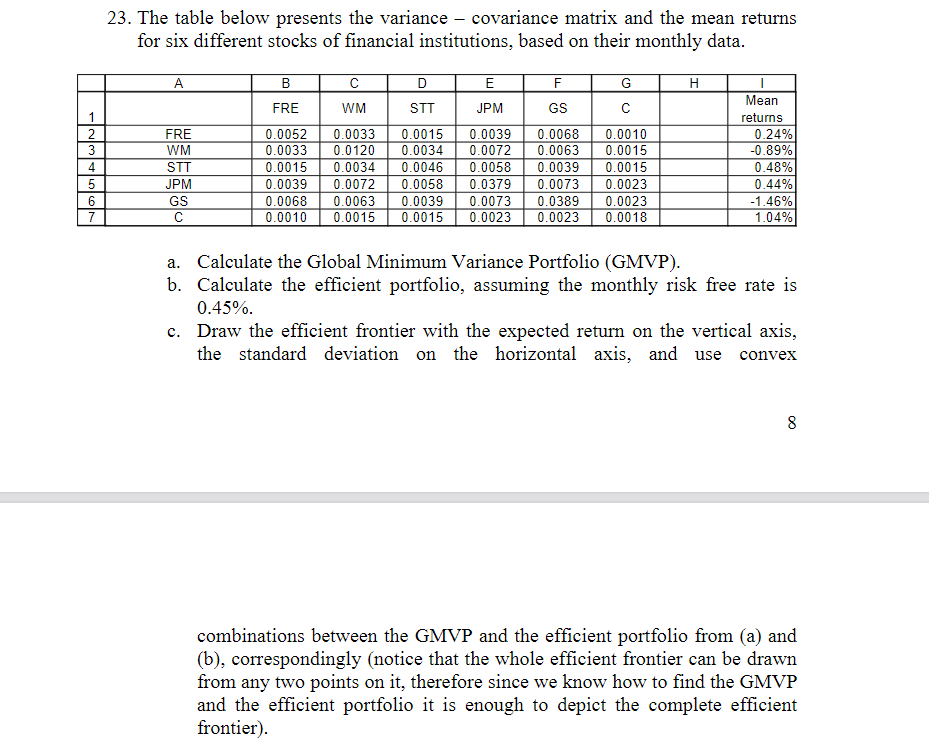

23. The table below presents the variance - covariance matrix and the mean returns for six different stocks of financial institutions, based on their

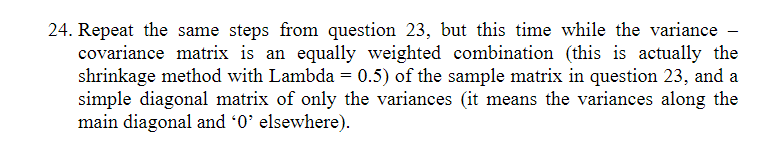

23. The table below presents the variance - covariance matrix and the mean returns for six different stocks of financial institutions, based on their monthly data. A B C D E F G H Mean FRE WM STT JPM GS 1 returns 2 FRE 0.0052 0.0033 0.0015 3 WM 0.0033 0.0120 0.0034 0.0039 0.0068 0.0010 0.0072 0.0063 0.0015 0.24% -0.89% 4 STT 0.0015 0.0034 5 JPM 0.0039 0.0072 6 GS 7 C 0.0046 0.0058 0.0379 0.0068 0.0063 0.0039 0.0073 0.0010 0.0015 0.0015 0.0023 0.0058 0.0039 0.0015 0.48% 0.0073 0.0023 0.0389 0.0023 0.0023 0.0018 0.44% -1.46% 1.04% a. Calculate the Global Minimum Variance Portfolio (GMVP). b. Calculate the efficient portfolio, assuming the monthly risk free rate is 0.45%. c. Draw the efficient frontier with the expected return on the vertical axis, the standard deviation on the horizontal axis, and use convex 8 combinations between the GMVP and the efficient portfolio from (a) and (b), correspondingly (notice that the whole efficient frontier can be drawn from any two points on it, therefore since we know how to find the GMVP and the efficient portfolio it is enough to depict the complete efficient frontier). 24. Repeat the same steps from question 23, but this time while the variance - covariance matrix is an equally weighted combination (this is actually the shrinkage method with Lambda = 0.5) of the sample matrix in question 23, and a simple diagonal matrix of only the variances (it means the variances along the main diagonal and '0' elsewhere).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started