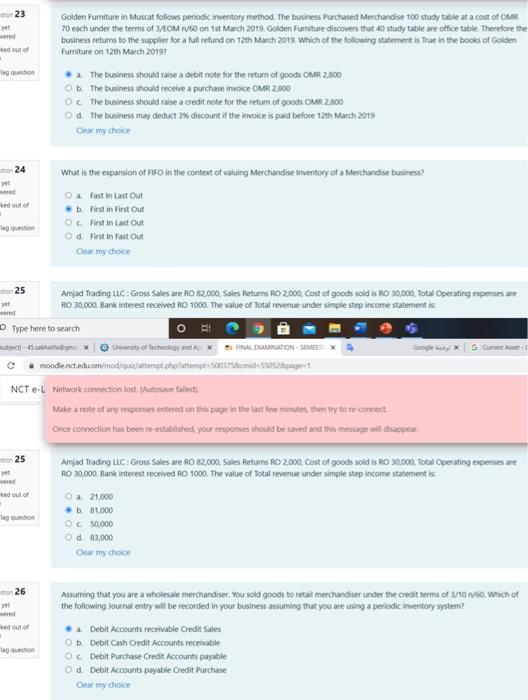

23 xed out of laguti Golden Furniture in Muscat follows periodic inventory method. The business Purchased Merchandise 100 study table at a cost of OMR 70 each under the terms of 3/EOM 1/60 on 1st March 2019. Golden Furniture discovers that 40 study table are office table. Therefore the business returns to the supplier for a full refund on 12th March 2019. Which of the following statement is true in the books of Golden Furniture on 12th March 2019 The business should take a debit note for the return of goods OMR 2.800 Ob The business should receive a purchase invoice OMR 2.900 O c The business should raise a credit note for the return of goods OMR 2,800 Od the business may deduct 3% discount at the invoice is paid before 12th March 2019 Clear my choice 24 ed out of . taggio What is the expansion of Firo in the context of valuing Merchandise Inventory of a Merchandise business? O a fast in Cast Out First in First Out OC First in Last Out Od Fiestin Fast Out Clear my choice 25 S. Amjad Trading LLC Geoss Sales ate RO 82,000, Sales Returns RO 2000 Cost of goods sold RO30,000. Total Operating expenses RO 30.000. Bank interest received RO 1000. The value of Total revenue under simple step income statement is Type here to search OH 4 * wenty of Technology and A X HAMILTON-SEMES Google moodle.netedu.om/mod/quie/actumot.php?attempt 500375&icimid 590526paget NCT e-L Network connection tott. Autoritve taled Make a note of any responses entered on this page in the last few minutes, then try to re-connect Once connection tus been re-established, your responses should be saved and this message will disapped. ther 25 yet xed out of Amjad Trading LLC Gross Sales are RO 82,000, Sales Returns RD 2.000, Cost of goods sold is RO 30,000, Total Operating expenses are RO 30,000 Bank interest received RO 1000. The value of total revenue under simple step income statement is Oa 21.000 #b: 81,000 O 50,000 Od 85,000 Clear my choice lag Questo 26 ed out of Assuming that you are a wholesale merchandiser You sold goods to retail merchandiser under the credit terms of 3/10, which of the following journal entry will be recorded in your business assuming that you are using a periodic inventory system? Debit Accounts receivable Credit Sales ob Debit Cash Credit Accounts receivable O Debit Purchase Credit Accounts payable Od Debit Accounts payable Credit Purchase Clear my choice Tag 23 xed out of laguti Golden Furniture in Muscat follows periodic inventory method. The business Purchased Merchandise 100 study table at a cost of OMR 70 each under the terms of 3/EOM 1/60 on 1st March 2019. Golden Furniture discovers that 40 study table are office table. Therefore the business returns to the supplier for a full refund on 12th March 2019. Which of the following statement is true in the books of Golden Furniture on 12th March 2019 The business should take a debit note for the return of goods OMR 2.800 Ob The business should receive a purchase invoice OMR 2.900 O c The business should raise a credit note for the return of goods OMR 2,800 Od the business may deduct 3% discount at the invoice is paid before 12th March 2019 Clear my choice 24 ed out of . taggio What is the expansion of Firo in the context of valuing Merchandise Inventory of a Merchandise business? O a fast in Cast Out First in First Out OC First in Last Out Od Fiestin Fast Out Clear my choice 25 S. Amjad Trading LLC Geoss Sales ate RO 82,000, Sales Returns RO 2000 Cost of goods sold RO30,000. Total Operating expenses RO 30.000. Bank interest received RO 1000. The value of Total revenue under simple step income statement is Type here to search OH 4 * wenty of Technology and A X HAMILTON-SEMES Google moodle.netedu.om/mod/quie/actumot.php?attempt 500375&icimid 590526paget NCT e-L Network connection tott. Autoritve taled Make a note of any responses entered on this page in the last few minutes, then try to re-connect Once connection tus been re-established, your responses should be saved and this message will disapped. ther 25 yet xed out of Amjad Trading LLC Gross Sales are RO 82,000, Sales Returns RD 2.000, Cost of goods sold is RO 30,000, Total Operating expenses are RO 30,000 Bank interest received RO 1000. The value of total revenue under simple step income statement is Oa 21.000 #b: 81,000 O 50,000 Od 85,000 Clear my choice lag Questo 26 ed out of Assuming that you are a wholesale merchandiser You sold goods to retail merchandiser under the credit terms of 3/10, which of the following journal entry will be recorded in your business assuming that you are using a periodic inventory system? Debit Accounts receivable Credit Sales ob Debit Cash Credit Accounts receivable O Debit Purchase Credit Accounts payable Od Debit Accounts payable Credit Purchase Clear my choice Tag