Answered step by step

Verified Expert Solution

Question

1 Approved Answer

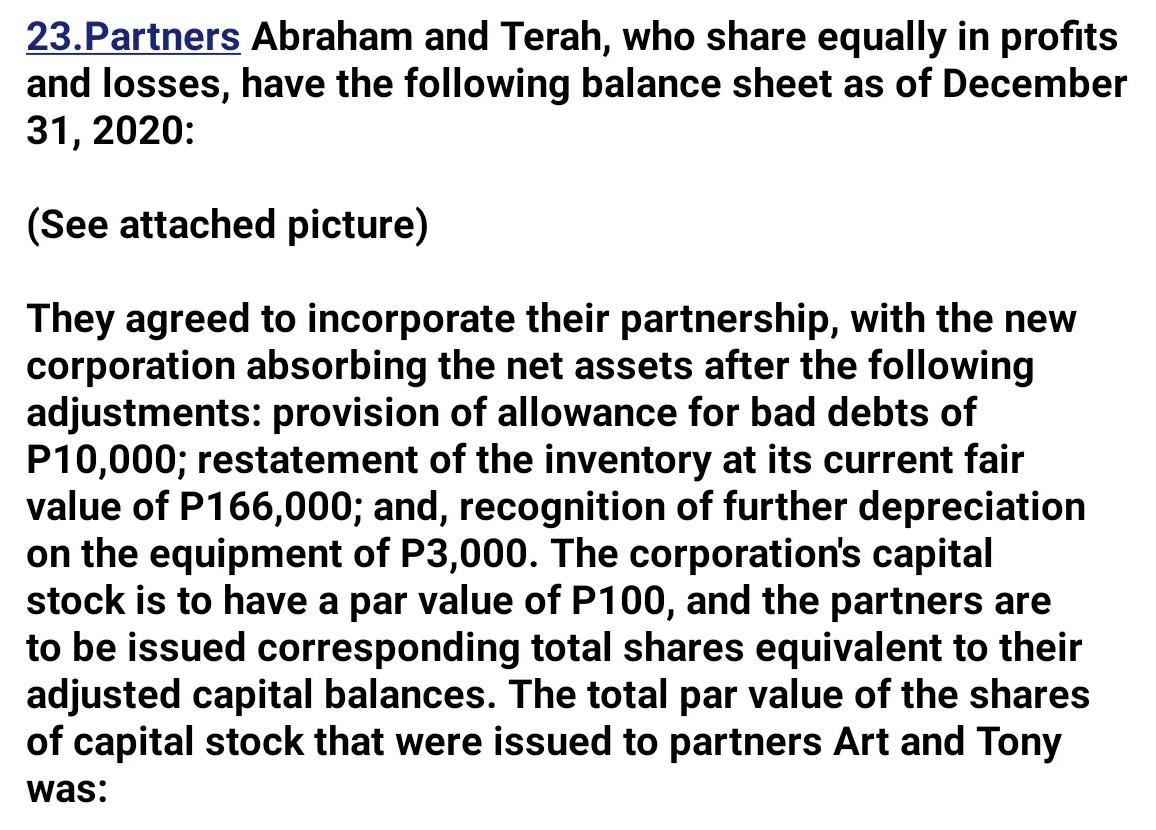

23.Partners Abraham and Terah, who share equally in profits and losses, have the following balance sheet as of December 31, 2020: (See attached picture) They

23.Partners Abraham and Terah, who share equally in profits and losses, have the following balance sheet as of December 31, 2020: (See attached picture) They agreed to incorporate their partnership, with the new corporation absorbing the net assets after the following adjustments: provision of allowance for bad debts of P10,000; restatement of the inventory at its current fair value of P166,000; and, recognition of further depreciation on the equipment of P3,000. The corporation's capital stock is to have a par value of P100, and the partners are to be issued corresponding total shares equivalent to their adjusted capital balances. The total par value of the shares of capital stock that were issued to partners Art and Tony was: Cash Accounts Receivable Inventory Equipment.......... Total ......... P120,000 100,000 140,000 80,000 P440,000 Accounts payable Accum. Dep'n Abraham, Capital Terah, Capital Total P172,000 8,000 140,000 120,000 P440,000 0 260,000 O 267,000 0 273,000 O 280,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started