Answered step by step

Verified Expert Solution

Question

1 Approved Answer

24. IBM issues 200,000 shares of stock with a par value of $0.01 for $150 per share. Three years later, it repurchases these shares

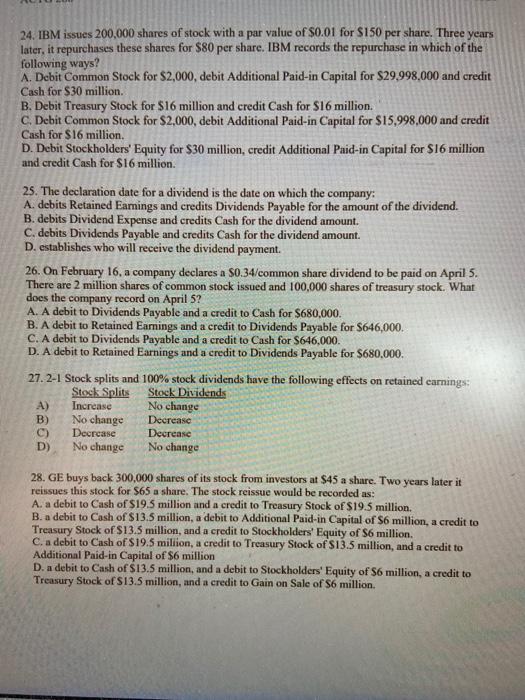

24. IBM issues 200,000 shares of stock with a par value of $0.01 for $150 per share. Three years later, it repurchases these shares for $80 per share. IBM records the repurchase in which of the following ways? A. Debit Common Stock for $2,000, debit Additional Paid-in Capital for $29,998,000 and credit Cash for $30 million. B. Debit Treasury Stock for $16 million and credit Cash for $16 million. C. Debit Common Stock for $2,000, debit Additional Paid-in Capital for $15,998,000 and credit Cash for $16 million. D. Debit Stockholders' Equity for $30 million, credit Additional Paid-in Capital for $16 million and credit Cash for $16 million. 25. The declaration date for a dividend is the date on which the company: A. debits Retained Eamings and credits Dividends Payable for the amount of the dividend. B. debits Dividend Expense and credits Cash for the dividend amount. C. debits Dividends Payable and credits Cash for the dividend amount. D. establishes who will receive the dividend payment. 26. On February 16, a company declares a $0.34/common share dividend to be paid on April 5. There are 2 million shares of common stock issued and 100,000 shares of treasury stock. What does the company record on April 5? A. A debit to Dividends Payable and a credit to Cash for $680,000. B. A debit to Retained Earnings and a credit to Dividends Payable for $646,000. C. A debit to Dividends Payable and a credit to Cash for $646,000. D. A debit to Retained Earnings and a credit to Dividends Payable for $680,000. 27. 2-1 Stock splits and Stock Splits Increase 100% stock dividends have the following effects on retained earnings: Stock Dividends No change Decrease A) B) No change Decrease D) No change No change 0 Decrease 28. GE buys back 300,000 shares of its stock from investors at $45 a share. Two years later it reissues this stock for $65 a share. The stock reissue would be recorded as: A. a debit to Cash of $19.5 million and a credit to Treasury Stock of $19.5 million. B. a debit to Cash of $13.5 million, a debit to Additional Paid-in Capital of $6 million, a credit to Treasury Stock of $13.5 million, and a credit to Stockholders' Equity of $6 million. C. a debit to Cash of $19.5 million, a credit to Treasury Stock of $13.5 million, and a credit to Additional Paid-in Capital of $6 million D. a debit to Cash of $13.5 million, and a debit to Stockholders' Equity of $6 million, a credit to Treasury Stock of $13.5 million, and a credit to Gain on Sale of $6 million.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

24 B Debit Treasury Stock for 16 million and credit Cash for 16 million 25 C debits Dividends Payable and credits Cash for the dividend amount 26 C A debit to Dividends Payable and a credit to Cash fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started