Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 20X1, the risks and rewards of ownership of a new Lear jet passed to Flight Bhd. The jet, which is to

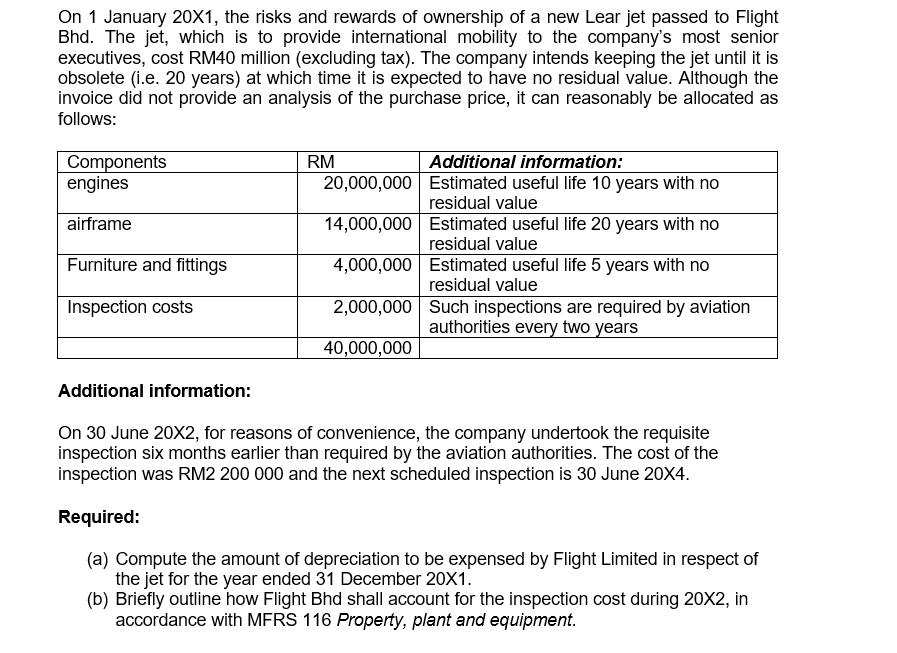

On 1 January 20X1, the risks and rewards of ownership of a new Lear jet passed to Flight Bhd. The jet, which is to provide international mobility to the company's most senior executives, cost RM40 million (excluding tax). The company intends keeping the jet until it is obsolete (i.e. 20 years) at which time it is expected to have no residual value. Although the invoice did not provide an analysis of the purchase price, it can reasonably be allocated as follows: Components engines airframe Furniture and fittings Inspection costs RM 20,000,000 14,000,000 4,000,000 2,000,000 40,000,000 Additional information: Estimated useful life 10 years with no residual value Estimated useful life 20 years with no residual value Estimated useful life 5 years with no residual value Such inspections are required by aviation authorities every two years Additional information: On 30 June 20X2, for reasons of convenience, the company undertook the requisite inspection six months earlier than required by the aviation authorities. The cost of the inspection was RM2 200 000 and the next scheduled inspection is 30 June 20X4. Required: (a) Compute the amount of depreciation to be expensed by Flight Limited in respect of the jet for the year ended 31 December 20X1. (b) Briefly outline how Flight Bhd shall account for the inspection cost during 20X2, in accordance with MFRS 116 Property, plant and equipment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started