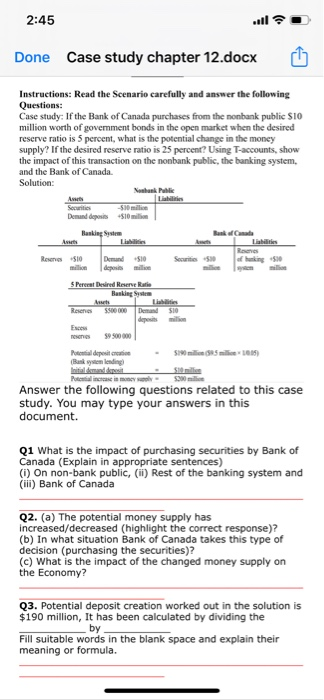

2:45 Done Case study chapter 12.docx Instructions: Read the Scenario carefully and answer the following Questions: Case study: If the Bank of Canada purchases from the nonbank public SIO million worth of government bonds in the open market when the desired reserve ratio is 5 percent, what is the potential change in the money supply? If the desired reserve ratio is 25 percent? Using T-accounts, show the impact of this transaction on the nonbank public, the banking system, and the Bank of Canada. Solution: Art Demandes 510 Ranking Set Rennes 10 Dead 10 Secure 530 S Pererat Desired Reserve Ratio Banking System Reserves S500 000 Demand $10 dewi moins 900 000 - 00 Passetial medias Bakwending Answer the following questions related to this case study. You may type your answers in this document. Q1 What is the impact of purchasing securities by Bank of Canada (Explain in appropriate sentences) (i) On non-bank public, (ii) Rest of the banking system and (iii) Bank of Canada Q2. (a) The potential money supply has increased/decreased (highlight the correct response)? (b) In what situation Bank of Canada takes this type of decision (purchasing the securities)? (c) What is the impact of the changed money supply on the Economy? Q3. Potential deposit creation worked out in the solution is $190 million, It has been calculated by dividing the Fill suitable words in the blank space and explain their meaning or formula. 2:45 Done Case study chapter 12.docx Instructions: Read the Scenario carefully and answer the following Questions: Case study: If the Bank of Canada purchases from the nonbank public SIO million worth of government bonds in the open market when the desired reserve ratio is 5 percent, what is the potential change in the money supply? If the desired reserve ratio is 25 percent? Using T-accounts, show the impact of this transaction on the nonbank public, the banking system, and the Bank of Canada. Solution: Art Demandes 510 Ranking Set Rennes 10 Dead 10 Secure 530 S Pererat Desired Reserve Ratio Banking System Reserves S500 000 Demand $10 dewi moins 900 000 - 00 Passetial medias Bakwending Answer the following questions related to this case study. You may type your answers in this document. Q1 What is the impact of purchasing securities by Bank of Canada (Explain in appropriate sentences) (i) On non-bank public, (ii) Rest of the banking system and (iii) Bank of Canada Q2. (a) The potential money supply has increased/decreased (highlight the correct response)? (b) In what situation Bank of Canada takes this type of decision (purchasing the securities)? (c) What is the impact of the changed money supply on the Economy? Q3. Potential deposit creation worked out in the solution is $190 million, It has been calculated by dividing the Fill suitable words in the blank space and explain their meaning or formula