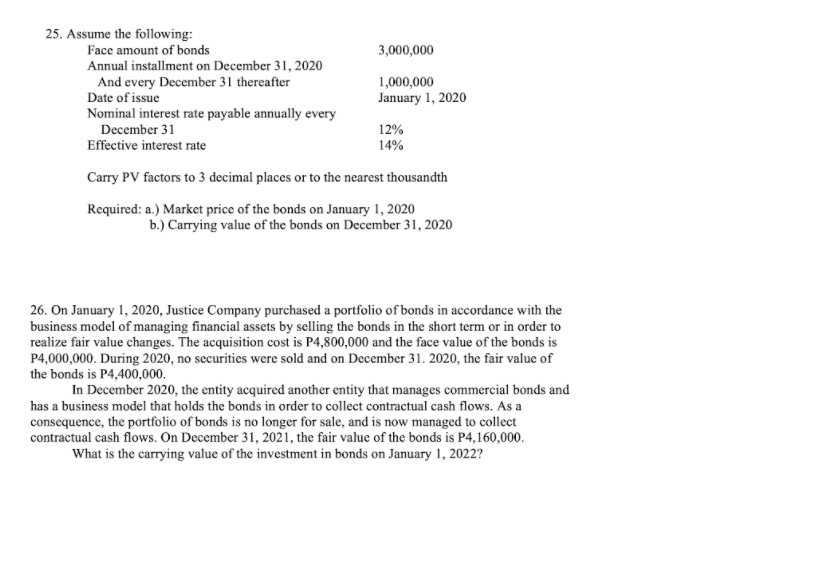

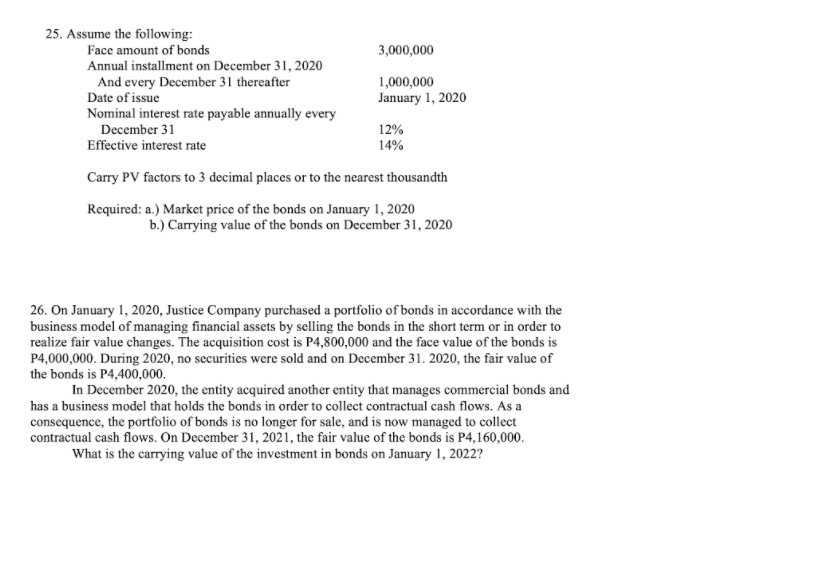

25. Assume the following: Face amount of bonds 3,000,000 Annual installment on December 31, 2020 And every December 31 thereafter 1,000,000 Date of issue January 1, 2020 Nominal interest rate payable annually every December 31 12% Effective interest rate Carry PV factors to 3 decimal places or to the nearest thousandth Required: a.) Market price of the bonds on January 1, 2020 b.) Carrying value of the bonds on December 31, 2020 14% 26. On January 1, 2020, Justice Company purchased a portfolio of bonds in accordance with the business model of managing financial assets by selling the bonds in the short term or in order to realize fair value changes. The acquisition cost is P4,800,000 and the face value of the bonds is P4,000,000. During 2020, no securities were sold and on December 31. 2020, the fair value of the bonds is P4,400,000. In December 2020, the entity acquired another entity that manages commercial bonds and has a business model that holds the bonds in order to collect contractual cash flows. As a consequence, the portfolio of bonds is no longer for sale, and is now managed to collect contractual cash flows. On December 31, 2021, the fair value of the bonds is P4,160,000. What is the carrying value of the investment in bonds on January 1, 2022? 25. Assume the following: Face amount of bonds 3,000,000 Annual installment on December 31, 2020 And every December 31 thereafter 1,000,000 Date of issue January 1, 2020 Nominal interest rate payable annually every December 31 12% Effective interest rate Carry PV factors to 3 decimal places or to the nearest thousandth Required: a.) Market price of the bonds on January 1, 2020 b.) Carrying value of the bonds on December 31, 2020 14% 26. On January 1, 2020, Justice Company purchased a portfolio of bonds in accordance with the business model of managing financial assets by selling the bonds in the short term or in order to realize fair value changes. The acquisition cost is P4,800,000 and the face value of the bonds is P4,000,000. During 2020, no securities were sold and on December 31. 2020, the fair value of the bonds is P4,400,000. In December 2020, the entity acquired another entity that manages commercial bonds and has a business model that holds the bonds in order to collect contractual cash flows. As a consequence, the portfolio of bonds is no longer for sale, and is now managed to collect contractual cash flows. On December 31, 2021, the fair value of the bonds is P4,160,000. What is the carrying value of the investment in bonds on January 1, 2022