Question

25 Given below is information from the statement of financial position of Paris Co During the year ended 31 December 20X2 machinery that had

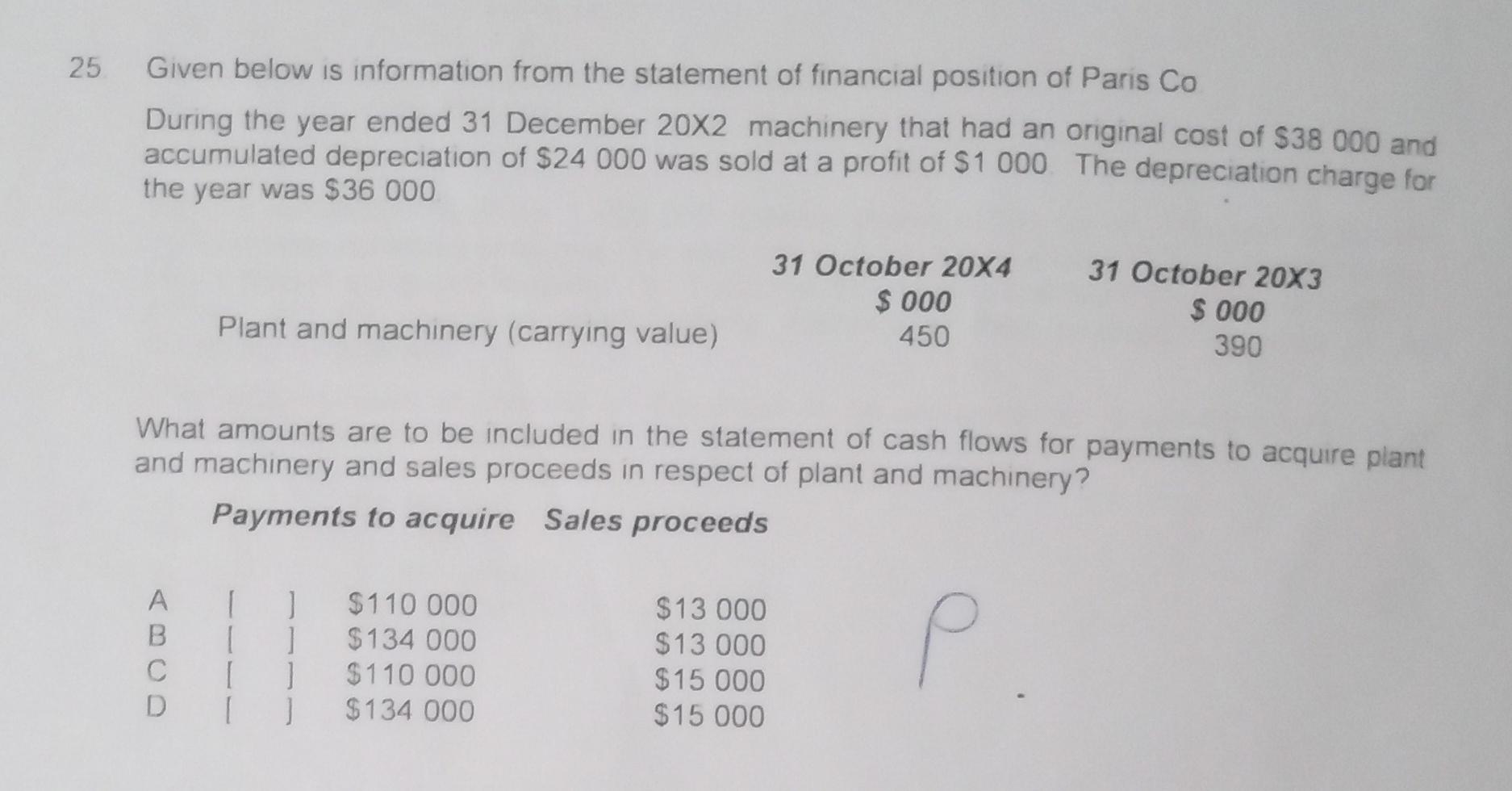

25 Given below is information from the statement of financial position of Paris Co During the year ended 31 December 20X2 machinery that had an original cost of $38 000 and accumulated depreciation of $24 000 was sold at a profit of $1 000 The depreciation charge for the year was $36 000 Plant and machinery (carrying value) A [ ] [ ] C[] I What amounts are to be included in the statement of cash flows for payments to acquire plant and machinery and sales proceeds in respect of plant and machinery? Payments to acquire Sales proceeds P ] $110 000 $134 000 $110 000 $134 000 31 October 20X4 $ 000 450 $13 000 $13 000 $15 000 $15 000 31 October 20X3 $ 000 390

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the amounts to be included in the statement of cash flows for payments to acquire plant ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting

Authors: Barry Elliott, Jamie Elliott

17th edition

978-0273778172, 027377817X, 978-1292080505

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App