Question

Job Co acquired 90% of the 1 000 000 ordinary shares of Sid Co on 1 October 20X7 The consideration consisted of $5 million

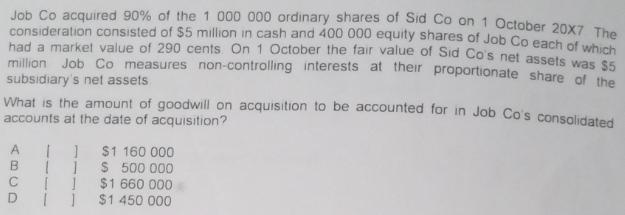

Job Co acquired 90% of the 1 000 000 ordinary shares of Sid Co on 1 October 20X7 The consideration consisted of $5 million in cash and 400 000 equity shares of Job Co each of which had a market value of 290 cents. On 1 October the fair value of Sid Co's net assets was $5 million Job Co measures non-controlling interests at their proportionate share of the subsidiary's net assets What is the amount of goodwill on acquisition to be accounted for in Job Co's consolidated accounts at the date of acquisition? [] 1 1 1 $1 160 000 $ 500 000 $1 660 000 $1 450 000

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the amount of goodwill on acquisition we need to determine the fair ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Financial Reporting and Analysis

Authors: David Alexander, Anne Britton, Ann Jorissen

5th edition

978-1408032282, 1408032287, 978-1408075012

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App