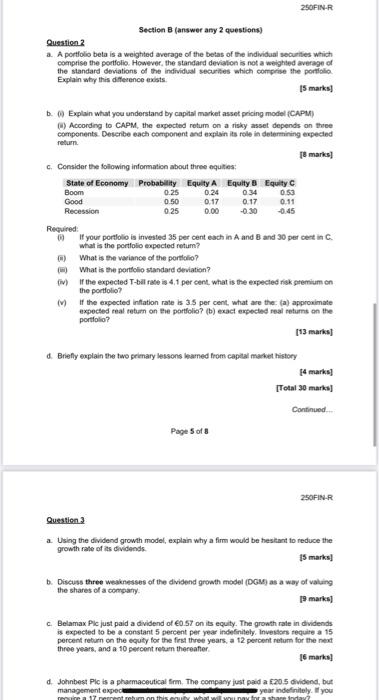

250FIN-R Section B (answer any 2 questions) Question 2 a. A portfolio beta is a weighted average of the beas of the individual securities which comprise the portfolio. However, the standard deviation is not a weighted average of the standard deviations of the individual securities which comprise the portfolio Explain why this difference exists. 15 mars 0.24 053 b. Explain what you understand by capital market asset pricing model (CAPM) ) According to CAPM, the expected return on a risky asset depends on three components Desenbe each component and explain its role in determining expected retum 18 marks Consider the following information about three equities: State of Economy Probability Equity A Equity Equity Boom 0.25 0.34 Good 0.50 0.17 0.17 0.11 Recession 0.25 0.00 -0.30 -0.45 Required If your portfolio is invested 35 per cent each in A and B and 30 per cent in C what is the portfolio expected retur? What is the variance of the portfolio? What is the portfolio Standard deviation? ) If the expected T-bill rate is 4.1 percent, what is the expected risk premium on the portfolio? M I the expected Inflation rate is 35 per cent, what are the: (a) approximate expected real return on the portfolio? (b) exact expected real returns on the portfolio? [13 marks] & Briefly explain the two primary lessons learned from capital market history 4 marks [Total 30 marks] Continued Page 5 of 8 250FIN-R Question 3 a Using the dividend growth model, explain why a firm would be hesitant to reduce the growth rate of its dividends. 15 marks] b. Discuss three weaknesses of the dividend growth model (DGM) as a way of valuing the shares of a company 19 marks) c Belamax Pic just paid a dividend of 0.57 on its equity. The growth rate in dividends is expected to be a constant 5 percent per year indefinitely. Investors require a 15 percent return on the equity for the first three years, a 12 percent return for the next three years, and a 10 percent return thereafter 15 marks! d Johnbest Pic is a pharmaceutical firm. The company just paida [20.5 dividend, but management expect year indefinitely. If you rese 17 rement remon this way for a standa 250FIN-R Section B (answer any 2 questions) Question 2 a. A portfolio beta is a weighted average of the beas of the individual securities which comprise the portfolio. However, the standard deviation is not a weighted average of the standard deviations of the individual securities which comprise the portfolio Explain why this difference exists. 15 mars 0.24 053 b. Explain what you understand by capital market asset pricing model (CAPM) ) According to CAPM, the expected return on a risky asset depends on three components Desenbe each component and explain its role in determining expected retum 18 marks Consider the following information about three equities: State of Economy Probability Equity A Equity Equity Boom 0.25 0.34 Good 0.50 0.17 0.17 0.11 Recession 0.25 0.00 -0.30 -0.45 Required If your portfolio is invested 35 per cent each in A and B and 30 per cent in C what is the portfolio expected retur? What is the variance of the portfolio? What is the portfolio Standard deviation? ) If the expected T-bill rate is 4.1 percent, what is the expected risk premium on the portfolio? M I the expected Inflation rate is 35 per cent, what are the: (a) approximate expected real return on the portfolio? (b) exact expected real returns on the portfolio? [13 marks] & Briefly explain the two primary lessons learned from capital market history 4 marks [Total 30 marks] Continued Page 5 of 8 250FIN-R Question 3 a Using the dividend growth model, explain why a firm would be hesitant to reduce the growth rate of its dividends. 15 marks] b. Discuss three weaknesses of the dividend growth model (DGM) as a way of valuing the shares of a company 19 marks) c Belamax Pic just paid a dividend of 0.57 on its equity. The growth rate in dividends is expected to be a constant 5 percent per year indefinitely. Investors require a 15 percent return on the equity for the first three years, a 12 percent return for the next three years, and a 10 percent return thereafter 15 marks! d Johnbest Pic is a pharmaceutical firm. The company just paida [20.5 dividend, but management expect year indefinitely. If you rese 17 rement remon this way for a standa