Answered step by step

Verified Expert Solution

Question

1 Approved Answer

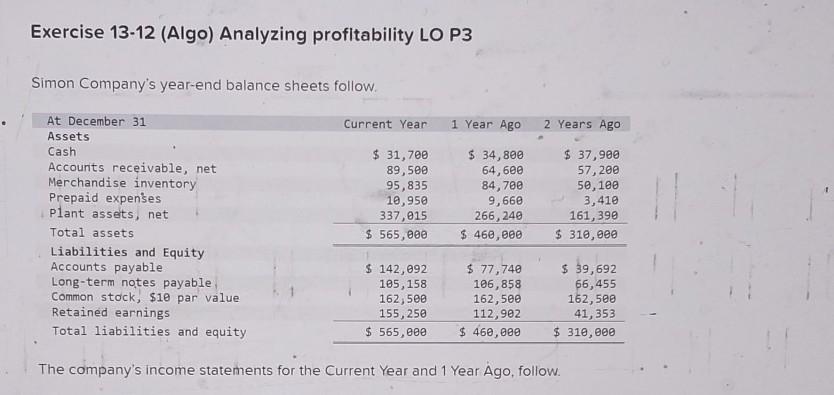

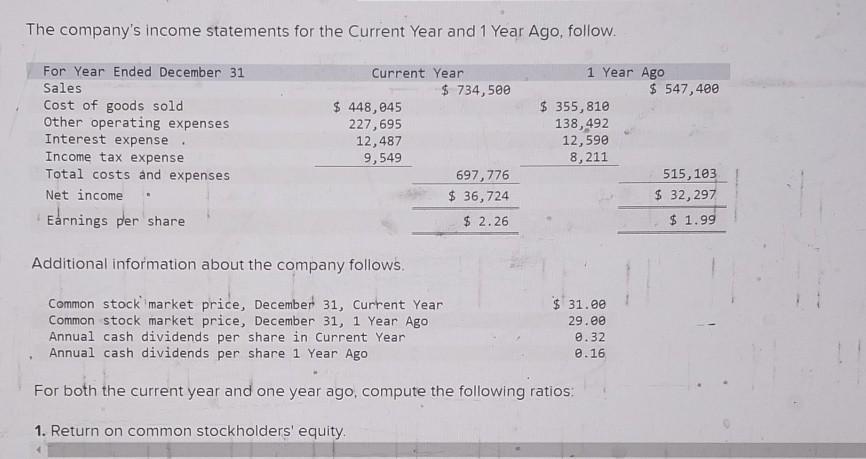

solve ASAP correctly. Exercise 13-12 (Algo) Analyzing profitability LO P3 Simon Company's year-end balance sheets follow. The company's income statements for the Current Year and

solve ASAP correctly.

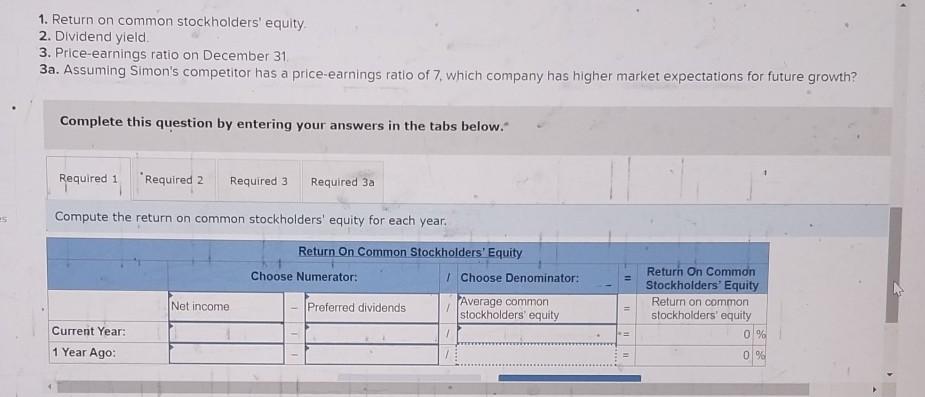

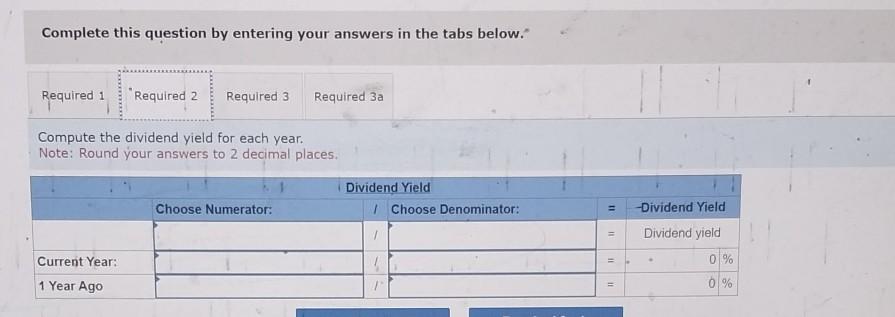

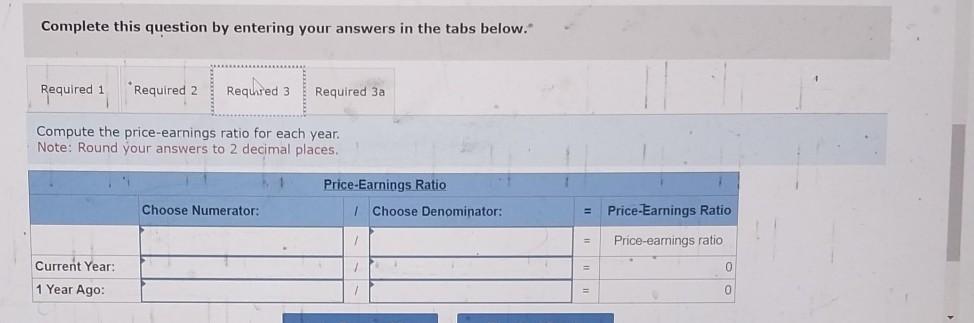

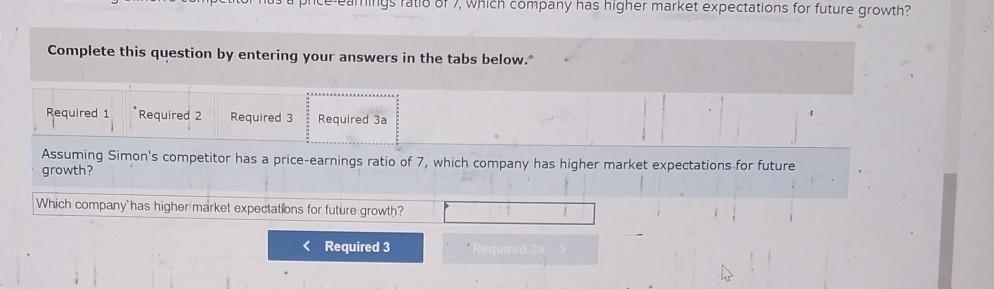

Exercise 13-12 (Algo) Analyzing profitability LO P3 Simon Company's year-end balance sheets follow. The company's income statements for the Current Year and 1 Year Ago, follow. The company's income statements for the Current Year and 1 Year Ago, follow. Additional information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Dividend yield. 3. Price-earnings ratio on December 31 3a. Assuming Simon's competitor has a price-earnings ratio of 7 , which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below.: Compute the return on common stockholders' equity for each year. Complete this question by entering your answers in the tabs below:" Compute the dividend yield for each year. Note: Round your answers to 2 decimal places. Complete this question by entering your answers in the tabs below." Compute the price-earnings ratio for each year. Note: Round your answers to 2 decimal places. Complete this question by entering your answers in the tabs below. Assuming Simon's competitor has a price-earnings ratio of 7 , which company has higher market expectations for future growth? Which company' has higher markel expectations for future growthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started