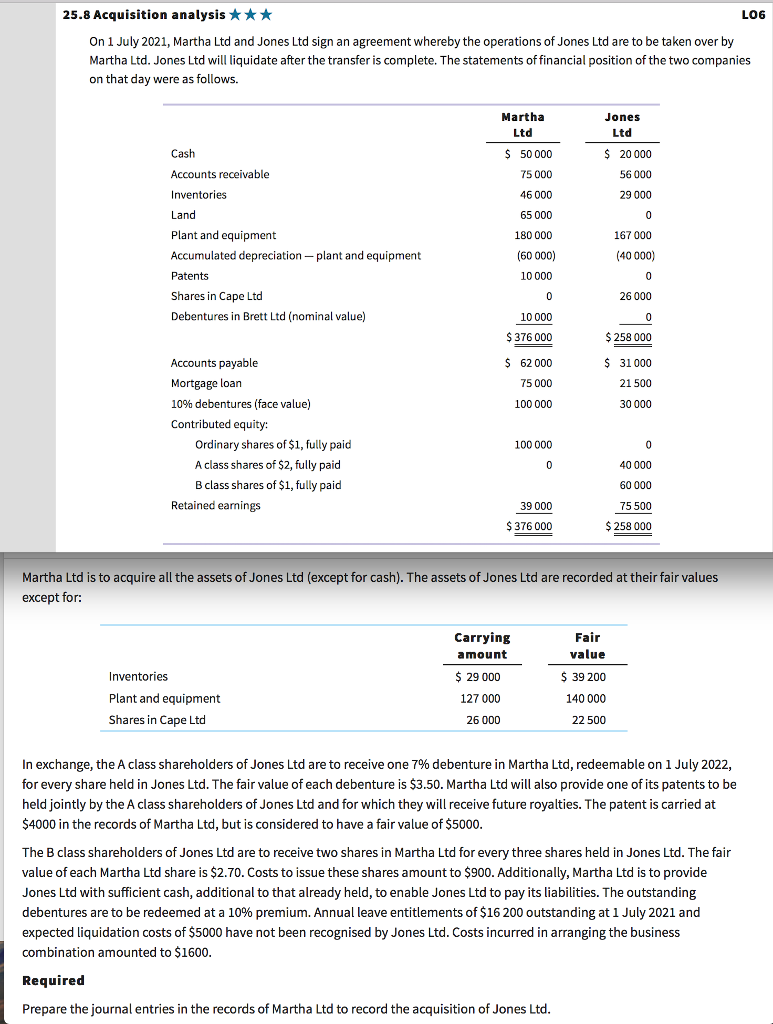

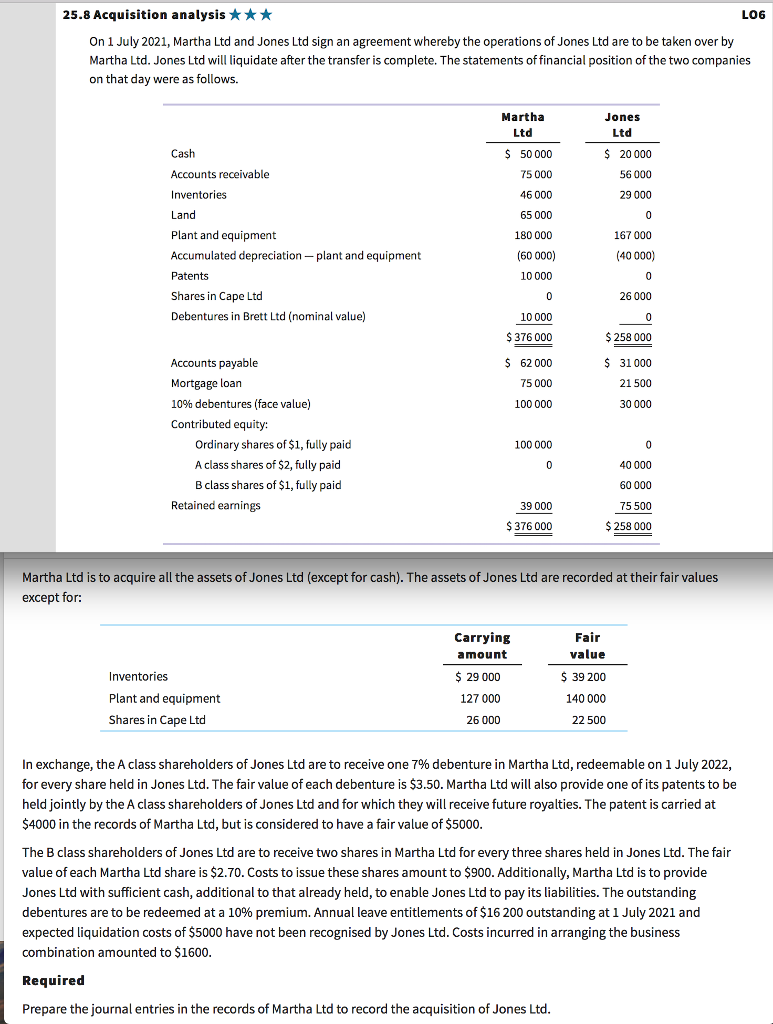

25.8 Acquisition analysis ? ? ? ?06 On 1 July 2021, Martha Ltd and Jones Ltd sign an agreement whereby the operations of Jones Ltd are to be taken over by Martha Ltd. Jones Ltd will liquidate after the transfer is complete. The statements offinancial position of the two companies on that day were as follows. Martha Ltd Jones Ltd Cash Accounts receivable Inventories Land Plant and equipment Accumulated depreciation plant and equipment Patents Shares in Cape Ltd Debentures in Brett Ltd (nominal value) $50000 5 000 46 000 65 000 180 000 (60 000) 10000 $20000 56 000 29 000 167 000 (40 000) 26 000 Accounts payable Mortgage loan 10% debentures (face value) Contributed equity: 10 000 376 000 $ 62000 75 000 100 000 258 000 31000 21 500 30 000 Ordinary shares of $1, fully paid A class shares of $2, fully paid B class shares of S1, fully paid 100 000 40 000 60 000 75 500 $258 000 Retained earnings 39 000 376000 Martha Ltd is to acquire all the assets of Jones Ltd (except for cash). The assets of Jones Ltd are recorded at their fair values except for: Inventories Plant and equipment Shares in Cape Ltd Carrying amount 29 000 127 000 26 000 Fair value S 39 200 140 000 22 500 In exchange, the A class shareholders of Jones Ltd are to receive one 7% debenture in Martha Ltd, redeemable on 1 July 2022, for every share held in Jones Ltd. The fair value of each debenture is $3.50. Martha Ltd will also provide one of its patents to be held jointly by the A class shareholders of Jones Ltd and for which they will receive future royalties. The patent is carried at $4000 in the records of Martha Ltd, but is considered to have a fair value of $5000 The B class shareholders of Jones Ltd are to receive two shares in Martha Ltd for every three shares held in Jones Ltd. The fair value of each Martha Ltd share is $2.70. Costs to issue these shares amount to $900. Additionally, Martha Ltd is to provide Jones Ltd with sufficient cash, additional to that already held, to enable Jones Ltd to pay its liabilities. The outstanding debentures are to be redeemed at a 10% premium. Annual leave entitlements of $16 200 outstanding at 1 July 2021 and expected liquidation costs of $5000 have not been recognised by Jones Ltd. Costs incurred in arranging the business combination amounted to $1600 Required Prepare the journal entries in the records of Martha Ltd to record the acquisition of Jones Ltd