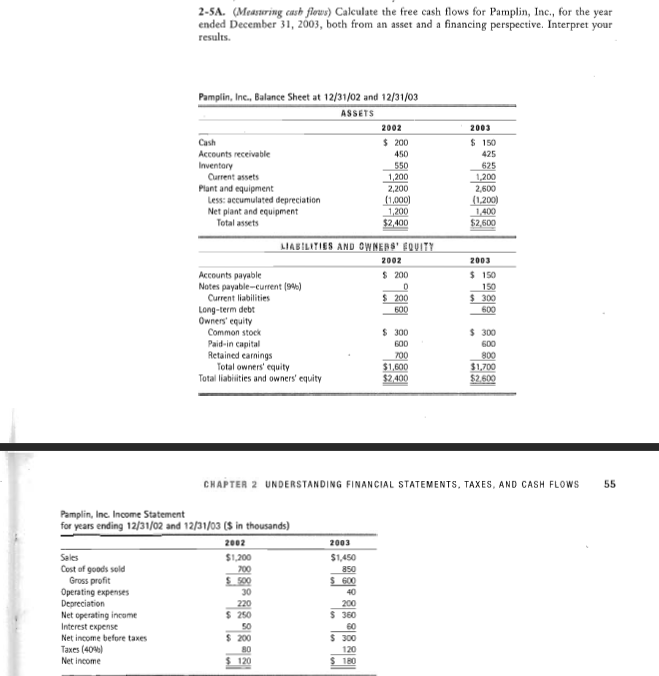

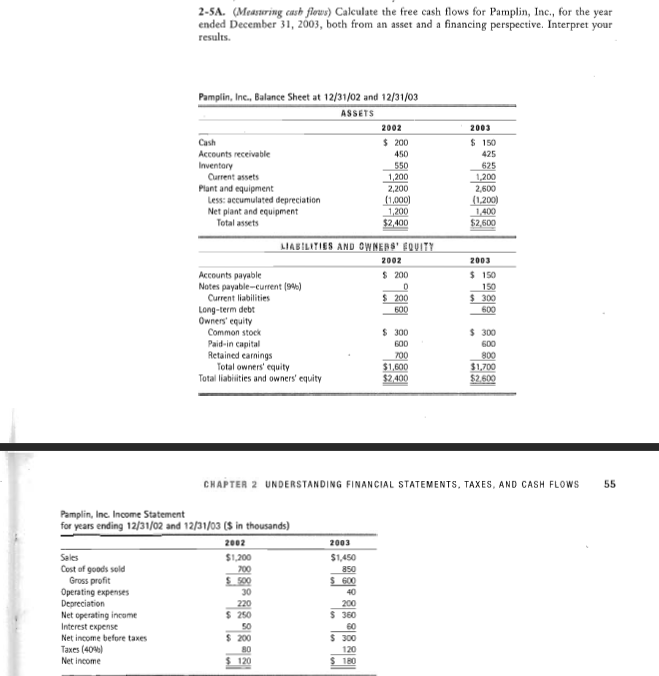

2-5A. (Measing cash flows) Calculate the free cash flows for Pamplin, Inc., for the year ended December 31, 2003, both from an asset and a financing perspective. Interpret your results. Pamplin, Inc., Balance Sheet at 12/31/02 and 12/31/03 ASSETS 2002 2003 $ 200 $ 150 Cash Accounts receivable Inventory Current assets Plant and equipment Less: accumulated depreciation Net plant and equipment Total assets 550 1,200 2,200 (1,000) 1,200 $2,400 625 1.200 2.600 (1,200) 1400 $2,600 2003 $ 150 150 $ 300 500 LIABILITIES AND OWNERS' EQUITY 2002 Accounts payable $ 200 Notes payable-current (94) Current liabilities $ 200 Long-term debt 500 Owners' equity Common stock $ 300 Paid-in capital 600 Retained earnings 700 Total owners' equity $1,600 Total liabilities and owners' equity $2,400 $ 300 600 800 $1,700 $2.500 CHAPTER 2 UNDERSTANDING FINANCIAL STATEMENTS, TAXES, AND CASH FLOWS 55 Pamplin, Inc. Income Statement for years ending 12/31/02 and 12/31/03 (s in thousands) 2002 2003 $1.200 $1.450 200 $ 500 $ 600 Sales Cost of goods sold Gross profit Operating expenses Depreciation Net operating income Interest expense Net income before taxes Taxes (40%) Net Income 220 $ 250 200 360 $ 200 $ 120 $ 180 2-5A. (Measing cash flows) Calculate the free cash flows for Pamplin, Inc., for the year ended December 31, 2003, both from an asset and a financing perspective. Interpret your results. Pamplin, Inc., Balance Sheet at 12/31/02 and 12/31/03 ASSETS 2002 2003 $ 200 $ 150 Cash Accounts receivable Inventory Current assets Plant and equipment Less: accumulated depreciation Net plant and equipment Total assets 550 1,200 2,200 (1,000) 1,200 $2,400 625 1.200 2.600 (1,200) 1400 $2,600 2003 $ 150 150 $ 300 500 LIABILITIES AND OWNERS' EQUITY 2002 Accounts payable $ 200 Notes payable-current (94) Current liabilities $ 200 Long-term debt 500 Owners' equity Common stock $ 300 Paid-in capital 600 Retained earnings 700 Total owners' equity $1,600 Total liabilities and owners' equity $2,400 $ 300 600 800 $1,700 $2.500 CHAPTER 2 UNDERSTANDING FINANCIAL STATEMENTS, TAXES, AND CASH FLOWS 55 Pamplin, Inc. Income Statement for years ending 12/31/02 and 12/31/03 (s in thousands) 2002 2003 $1.200 $1.450 200 $ 500 $ 600 Sales Cost of goods sold Gross profit Operating expenses Depreciation Net operating income Interest expense Net income before taxes Taxes (40%) Net Income 220 $ 250 200 360 $ 200 $ 120 $ 180