Answered step by step

Verified Expert Solution

Question

1 Approved Answer

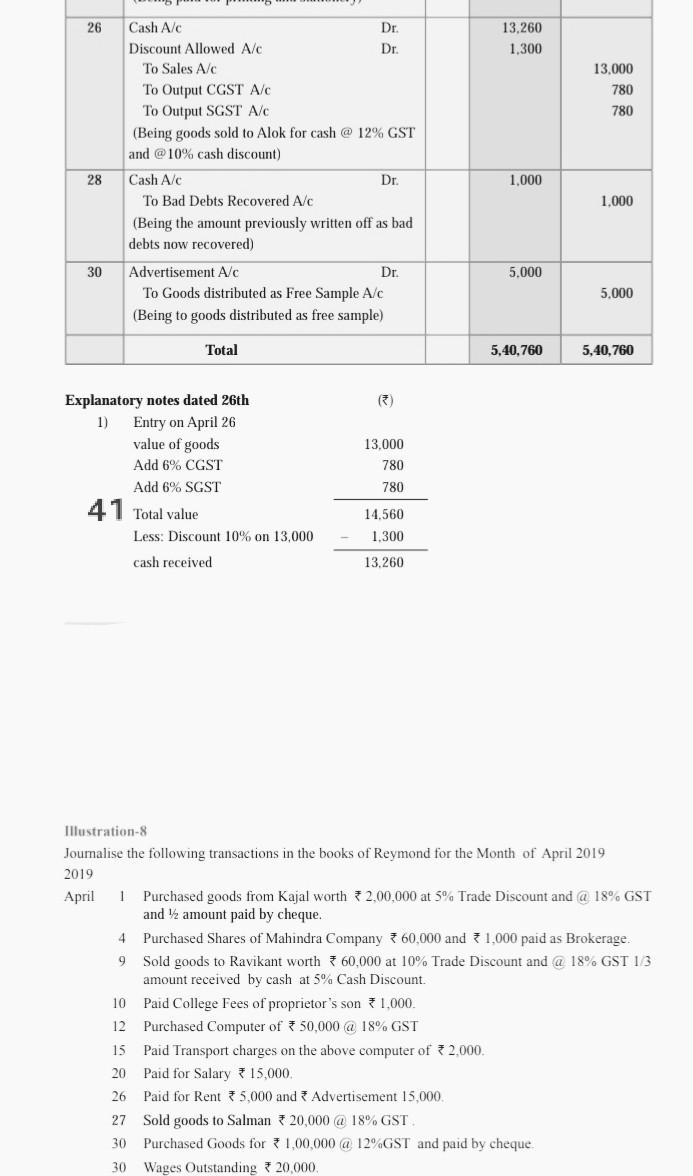

26 13,260 1,300 13,000 780 780 Cash A/C Dr Discount Allowed A/c Dr. To Sales Alc To Output CGST A/C To Output SGST A/C (Being

26 13,260 1,300 13,000 780 780 Cash A/C Dr Discount Allowed A/c Dr. To Sales Alc To Output CGST A/C To Output SGST A/C (Being goods sold to Alok for cash @ 12% GST and @10% cash discount) Cash A/C Dr. To Bad Debts Recovered A/c (Being the amount previously written off as bad debts now recovered) 28 1,000 1.000 30 5.000 Advertisement A/C Dr. To Goods distributed as Free Sample A/c (Being to goods distributed as free sample) 5.000 Total 5,40,760 5.40,760 (3) Explanatory notes dated 26th 1) Entry on April 26 value of goods Add 6% CGST Add 6% SGST 13,000 780 780 41 Total value 14.560 1.300 Less: Discount 10% on 13,000 cash received 13.260 Illustration-8 Journalise the following transactions in the books of Reymond for the Month of April 2019 2019 April 1 Purchased goods from Kajal worth 2,00,000 at 5% Trade Discount and @ 18% GST and amount paid by cheque. 4 Purchased Shares of Mahindra Company 360,000 and 31,000 paid as Brokerage. 9 Sold goods to Ravikant worth 60.000 at 10% Trade Discount and @ 18% GST 13 amount received by cash at 5% Cash Discount. 10 Paid College Fees of proprietor's son 1,000 12 Purchased Computer of 350,000 @ 18% GST 15 Paid Transport charges on the above computer of 2,000 20 Paid for Salary 315,000. 26 Paid for Rent 35,000 and Advertisement 15,000 27 Sold goods to Salman 20,000 @ 18% GST 30 Purchased Goods for 3 1,00,000 @ 12% GST and paid by cheque 30 Wages Outstanding 20,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started