Answered step by step

Verified Expert Solution

Question

1 Approved Answer

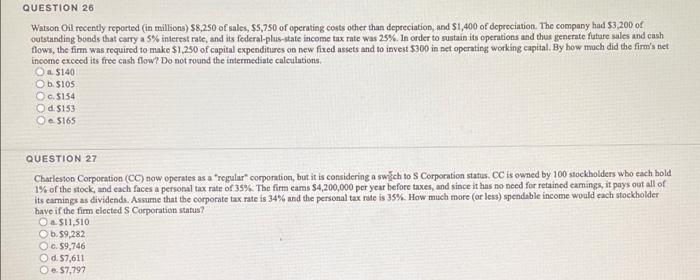

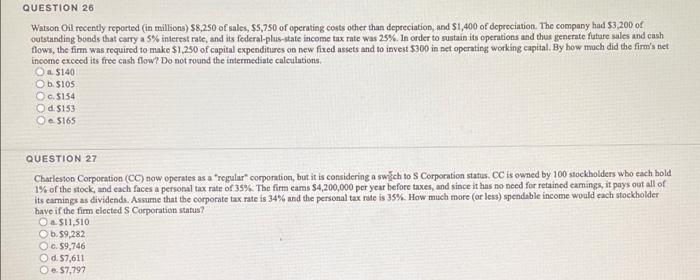

26 and 27 QUESTION 26 Watson Oil recently reported (in millions) $8,250 of sales, 85,750 of operating costs other than depreciation, and $1,400 of depreciation.

26 and 27

QUESTION 26 Watson Oil recently reported (in millions) $8,250 of sales, 85,750 of operating costs other than depreciation, and $1,400 of depreciation. The company had $3,200 of outstanding boods that carry a 5% interest rate, and its federal-plus-state income tax rate was 25%. In order to sustain its operations and thus generate future sales and cash flows, the fim was required to make $1,250 of capital expenditures on new fixed assets and to invest $300 in net operating working capital. By how much did the firm's net income exceed its free cash flow? Do not found the intermediate calculations O a $140 Ob $105 O c.5134 Od. $153 e 5165 QUESTION 27 Charleston Corporation (CC) now operates as a regular corporation, but it is considering a swich to S Corporation status. CC is owned by 100 stockholders wbo each hold 1% of the stock, and each faces a personal tax rate of 35%. The firm cams $4,200,000 per year before taxes, and since it has no need for retained camings, it pays out all of its camings as dividends. Assume that the corporate tax rate is 34% and the personal tax rate is 35% How much more or less) spendable income would each stockholder have if the fimm elected S Corporation status? O a $11,510 b.9,282 C. 59,746 d. 57,611 O. 57,797

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started