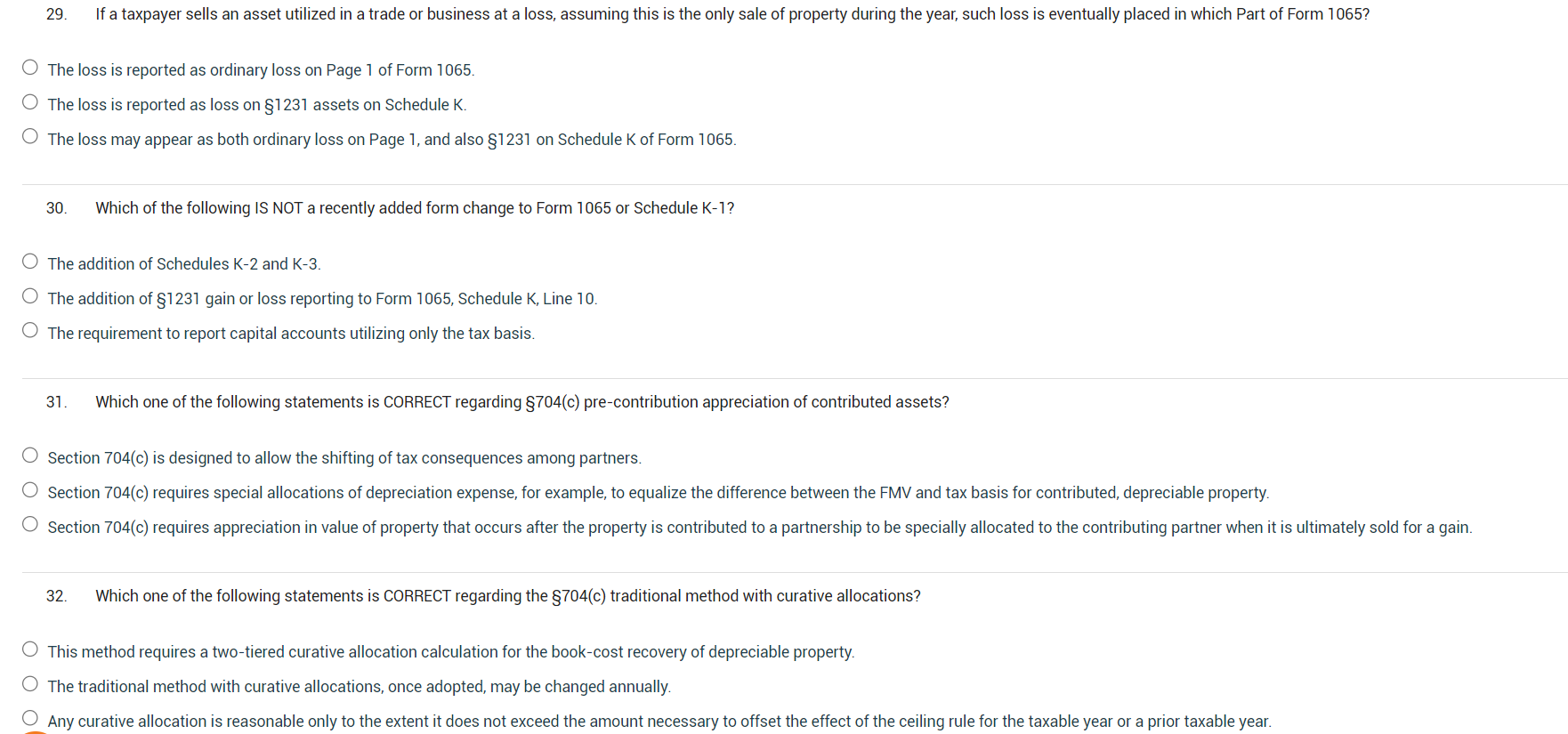

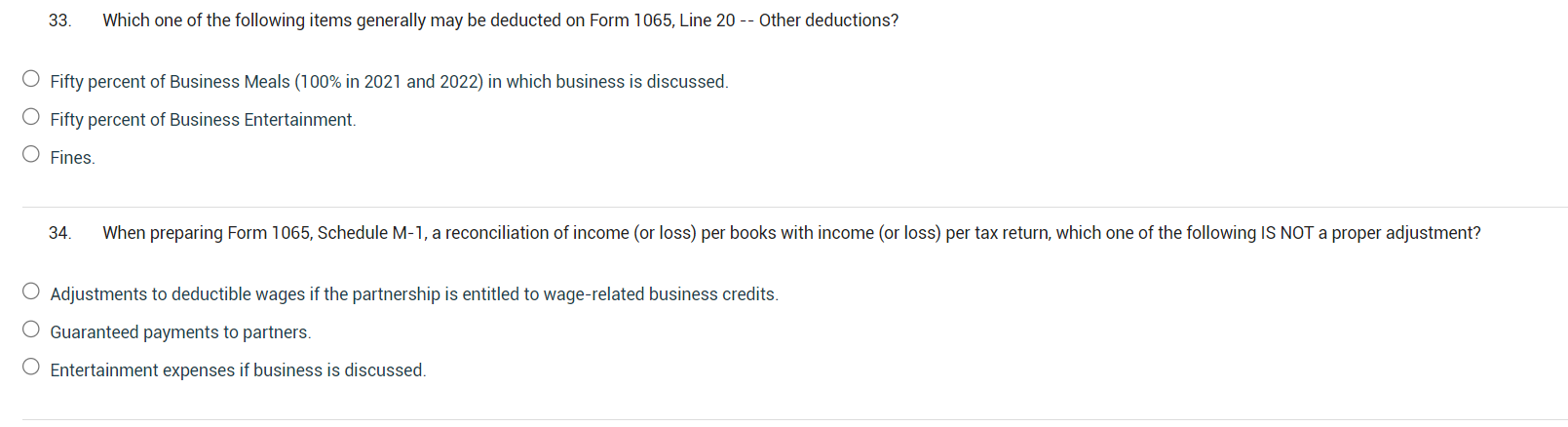

26. Which of the following statements is CORRECT? make the election. An eligible entity can override its default classification by filing an election on Form 8832. 27. Which one of the following types of property sales are generally NOT reported on Form 4797 ? The sale of personal property used in a trade or business. The sale of real property used in a trade or business. The sale of stock traded for investment purposes. The gain is reported as ordinary income on Page 1 of Form 1065. The gain is reported as gain on 1231 assets on Schedule K. The gain may appear as both ordinary income on Page 1, and also 1231 on Schedule K of Form 1065. The loss is reported as ordinary loss on Page 1 of Form 1065. The loss is reported as loss on 1231 assets on Schedule K. The loss may appear as both ordinary loss on Page 1, and also 1231 on Schedule K of Form 1065. 30. Which of the following IS NOT a recently added form change to Form 1065 or Schedule K-1? The addition of Schedules K-2 and K-3. The addition of 1231 gain or loss reporting to Form 1065, Schedule K, Line 10. The requirement to report capital accounts utilizing only the tax basis. 31. Which one of the following statements is CORRECT regarding 704 (c) pre-contribution appreciation of contributed assets? Section 704(c) is designed to allow the shifting of tax consequences among partners. Section 704(c) requires special allocations of depreciation expense, for example, to equalize the difference between the FMV and tax basis for contributed, depreciable property. 32. Which one of the following statements is CORRECT regarding the 704(c) traditional method with curative allocations? This method requires a two-tiered curative allocation calculation for the book-cost recovery of depreciable property. The traditional method with curative allocations, once adopted, may be changed annually. Any curative allocation is reasonable only to the extent it does not exceed the amount necessary to offset the effect of the ceiling rule for the taxable year or a prior taxable year. 33. Which one of the following items generally may be deducted on Form 1065 , Line 20-Other deductions? Fifty percent of Business Meals (100% in 2021 and 2022) in which business is discussed. Fifty percent of Business Entertainment. Fines. 34. When preparing Form 1065, Schedule M-1, a reconciliation of income (or loss) per books with income (or loss) per tax return, which one of the following IS NOT a proper adjustment? Adjustments to deductible wages if the partnership is entitled to wage-related business credits. Guaranteed payments to partners. Entertainment expenses if business is discussed