27)

28)

29)

30)

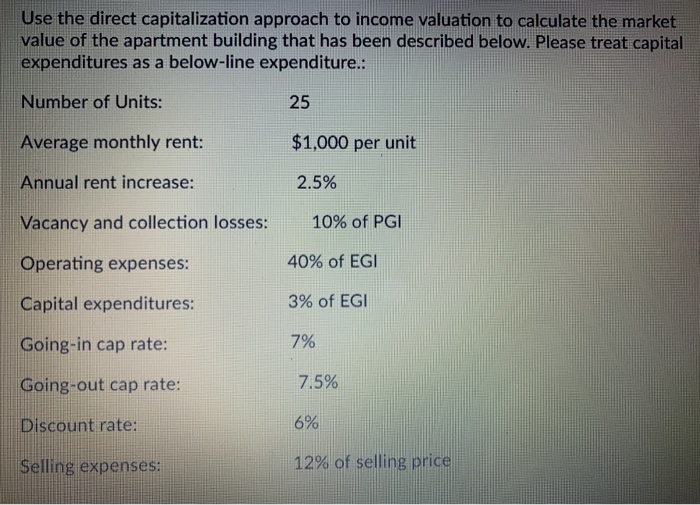

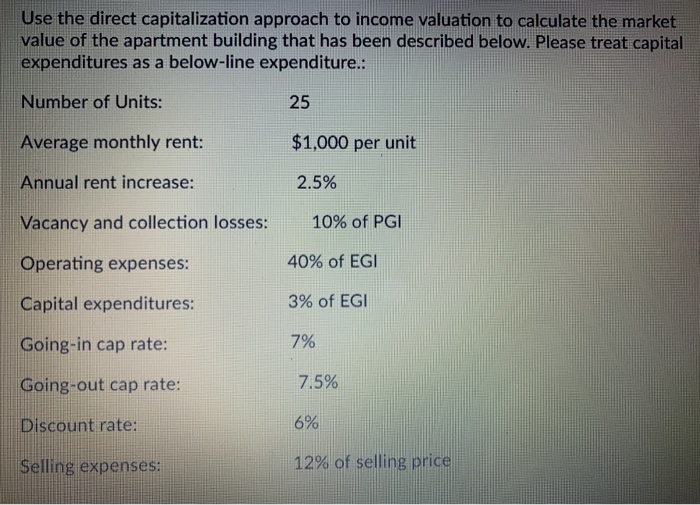

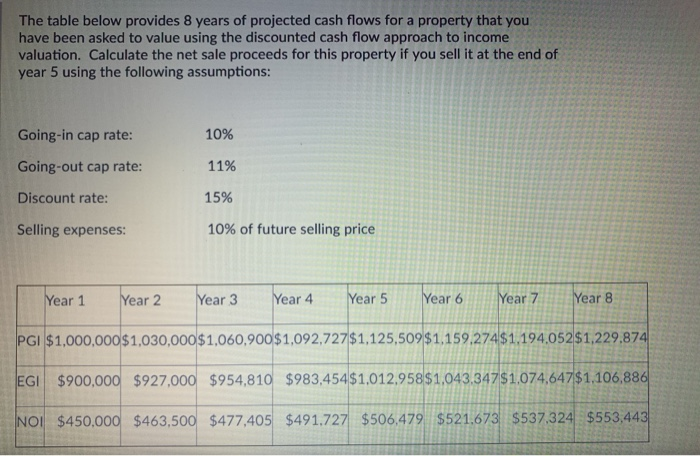

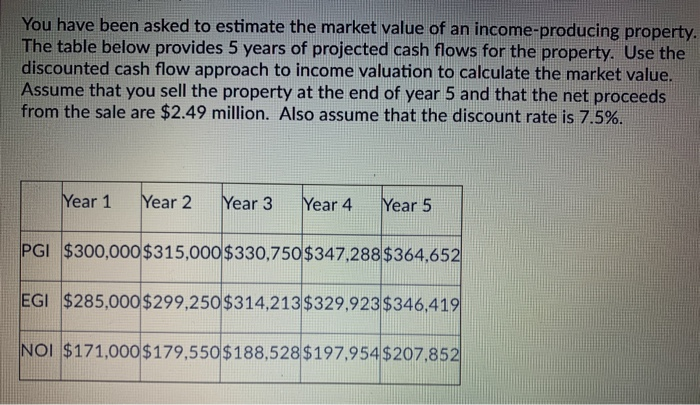

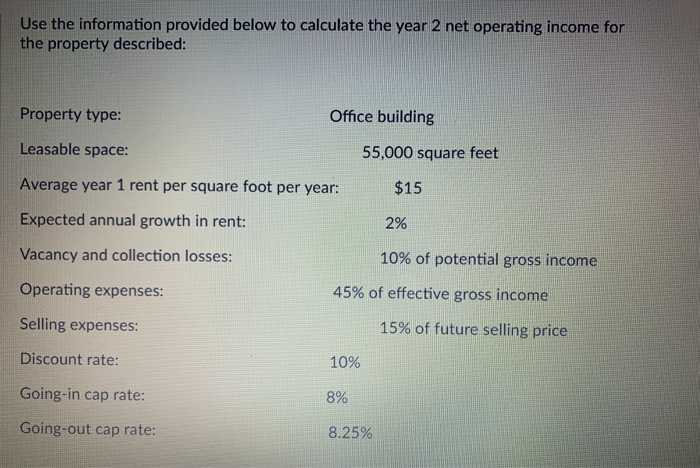

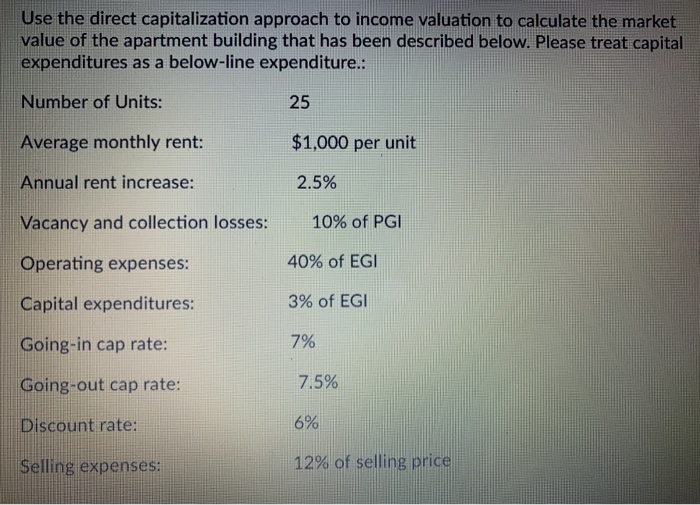

Use the direct capitalization approach to income valuation to calculate the market value of the apartment building that has been described below. Please treat capital expenditures as a below-line expenditure.: Number of Units: 25 Average monthly rent: $1,000 per unit Annual rent increase: 2.5% Vacancy and collection losses: 10% of PGI Operating expenses: 40% of EGI Capital expenditures: 3% of EGI 7% Going-in cap rate: 7.5% Going-out cap rate: 6% Discount rate: 12% of selling price Selling expenses: The table below provides 8 years of projected cash flows for a property that you have been asked to value using the discounted cash flow approach to income valuation. Calculate the net sale proceeds for this property if you sell it at the end of year 5 using the following assumptions: 10% Going-in cap rate: Going-out cap rate: 11% Discount rate: 15% 10% of future selling price Selling expenses: Year 5 Year 7 Year 8 Year 4 Year 6 Year 1 Year 2 Year 3 PGI $1,000,000$1,030,000$1,060,900$1,092,727$1,125,509$1,159,274$1,194,052$1,229.874 EGI $900,000 $927,000 $954,810 $983,454$1,012,958 $1,043.347$1.074,647$1,106,886 NOI $450,000 $463,500 $477,405 $491,727 $506.479 $521.673 $537,324 $553,443 Use the information provided below to calculate the year 2 net operating income for the property described: Property type: Office building Leasable space: 55,000 square feet Average year 1 rent per square foot per year: $15 Expected annual growth in rent: 2% Vacancy and collection losses: 10% of potential gross income Operating expenses: 45% of effective gross income Selling expenses: 15% of future selling price Discount rate: 10% Going-in cap rate: 8% Going-out cap rate: 8.25% Use the direct capitalization approach to income valuation to calculate the market value of the apartment building that has been described below. Please treat capital expenditures as a below-line expenditure.: Number of Units: 25 Average monthly rent: $1,000 per unit Annual rent increase: 2.5% Vacancy and collection losses: 10% of PGI Operating expenses: 40% of EGI Capital expenditures: 3% of EGI 7% Going-in cap rate: 7.5% Going-out cap rate: 6% Discount rate: 12% of selling price Selling expenses: The table below provides 8 years of projected cash flows for a property that you have been asked to value using the discounted cash flow approach to income valuation. Calculate the net sale proceeds for this property if you sell it at the end of year 5 using the following assumptions: 10% Going-in cap rate: Going-out cap rate: 11% Discount rate: 15% 10% of future selling price Selling expenses: Year 5 Year 7 Year 8 Year 4 Year 6 Year 1 Year 2 Year 3 PGI $1,000,000$1,030,000$1,060,900$1,092,727$1,125,509$1,159,274$1,194,052$1,229.874 EGI $900,000 $927,000 $954,810 $983,454$1,012,958 $1,043.347$1.074,647$1,106,886 NOI $450,000 $463,500 $477,405 $491,727 $506.479 $521.673 $537,324 $553,443 Use the information provided below to calculate the year 2 net operating income for the property described: Property type: Office building Leasable space: 55,000 square feet Average year 1 rent per square foot per year: $15 Expected annual growth in rent: 2% Vacancy and collection losses: 10% of potential gross income Operating expenses: 45% of effective gross income Selling expenses: 15% of future selling price Discount rate: 10% Going-in cap rate: 8% Going-out cap rate: 8.25%