Answered step by step

Verified Expert Solution

Question

1 Approved Answer

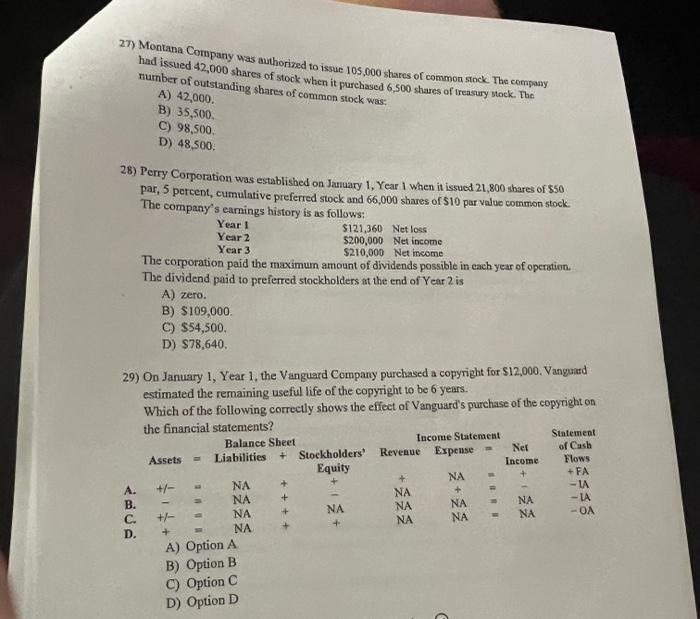

27) Montana Company was authorized to issue 105,000 shares of common stock. The company had issued 42,000 shares of stock when it purchased 6,500 shares

27) Montana Company was authorized to issue 105,000 shares of common stock. The company had issued 42,000 shares of stock when it purchased 6,500 shares of treasury stock. The number of outstanding shares of common stock was: A) 42,000. B) 35,500. C) 98,500. D) 48,500. 28) Perry Corporation was established on January 1, Year 1 when it issued 21,800 shares of $50 par, 5 percent, cumulative preferred stock and 66,000 shares of $10 par value common stock. The company's earnings history is as follows: Year 1 Year 2 Year 3 A. B. C. D. $121,360 Net loss $200,000 Net income $210,000 Net income The corporation paid the maximum amount of dividends possible in each year of operation. The dividend paid to preferred stockholders at the end of Year 2 is A) zero. B) $109,000. C) $54,500. D) $78,640. 29) On January 1, Year 1, the Vanguard Company purchased a copyright for $12,000. Vanguard estimated the remaining useful life of the copyright to be 6 years. Which of the following correctly shows the effect of Vanguard's purchase of the copyright on the financial statements? Assets +/- 1 +/- + = = Balance Sheet Liabilities + A) Option A B) Option B C) Option C D) Option D + ++++ Revenue Stockholders' Equity + + Income Statement Expense + + 1 = = = Net Income + 12 / Statement of Cash Flows + FA -LA -LA - OA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started