Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#27-30 on my hw There are 5 different questions to go along with this problem ! Required information The following information applies to the questions

#27-30 on my hw

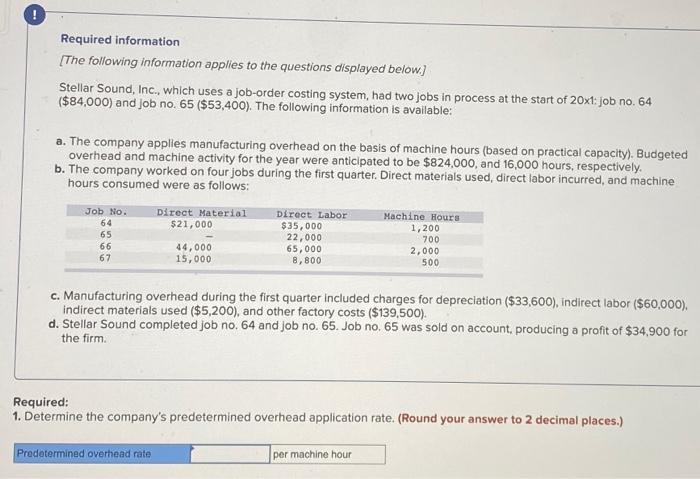

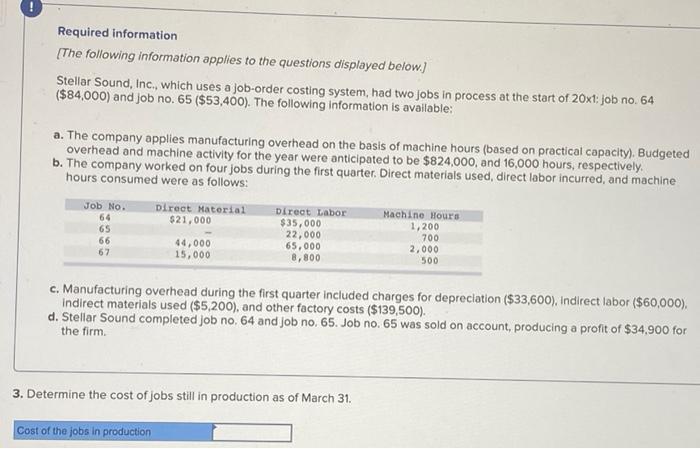

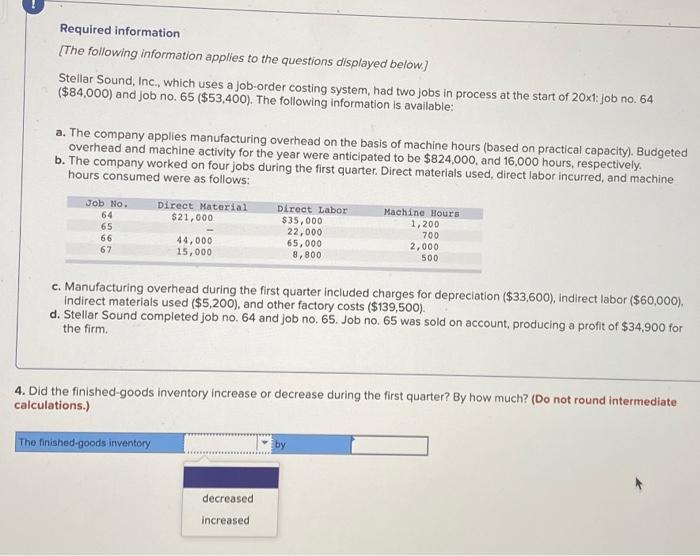

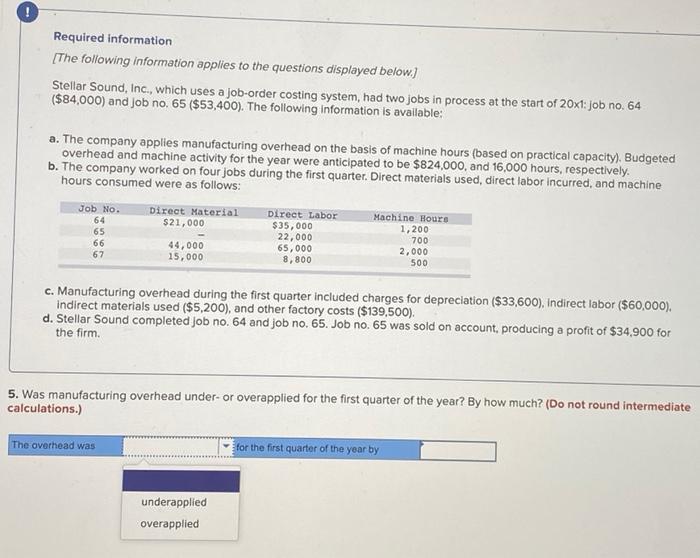

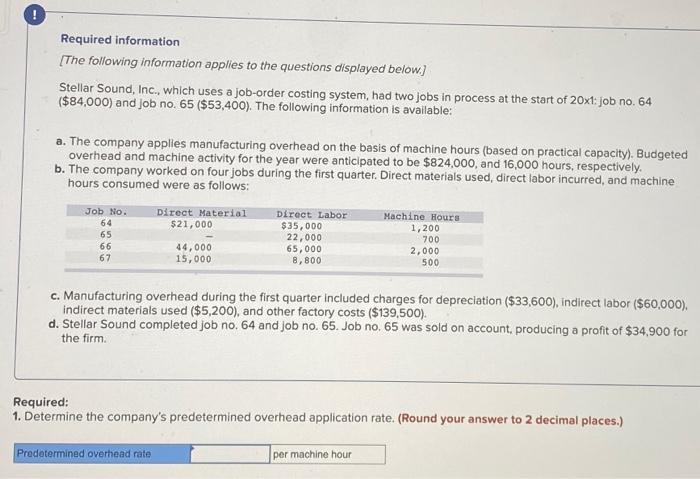

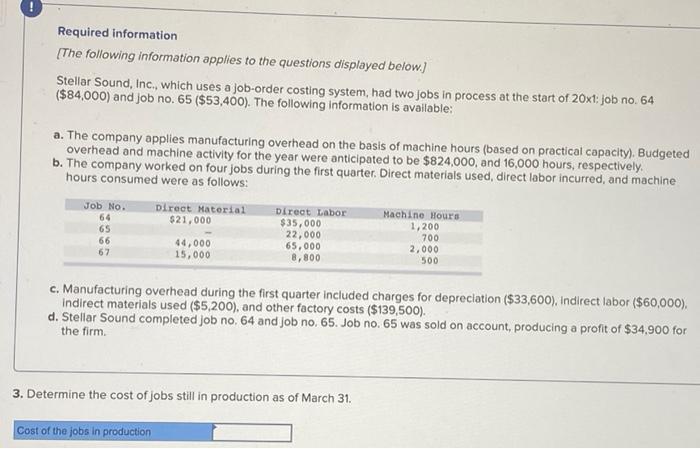

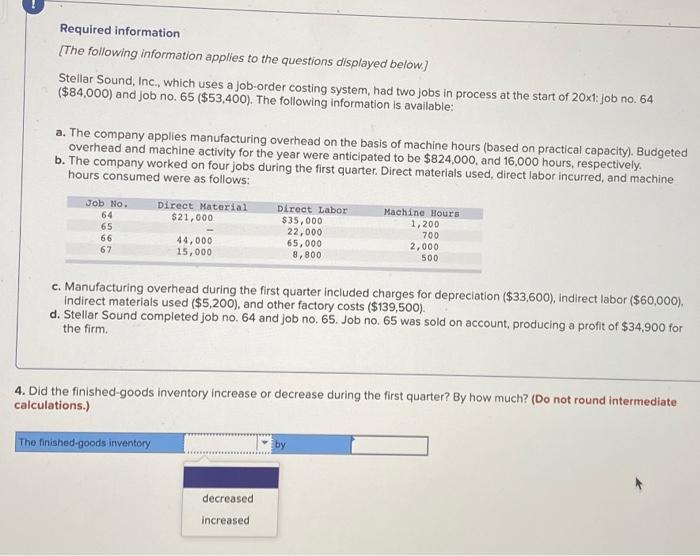

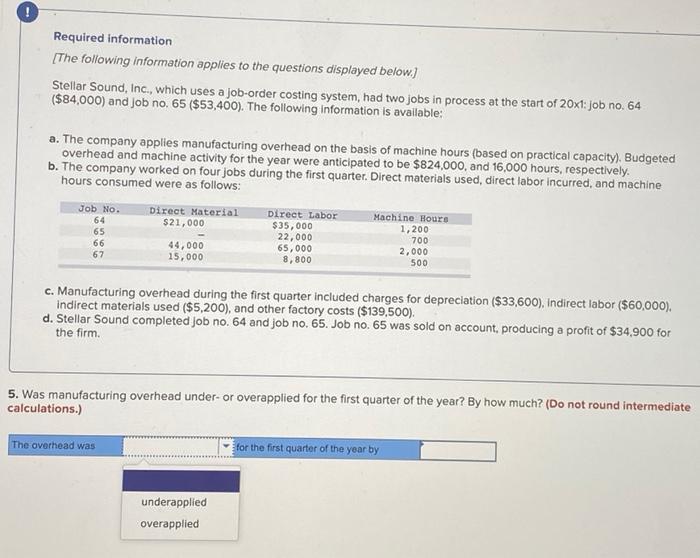

! Required information The following information applies to the questions displayed below.] Stellar Sound, Inc., which uses a job-order costing system, had two jobs in process at the start of 20xt: job no. 64 ($84,000) and job no. 65 ($53,400). The following information is available: a. The company applies manufacturing overhead on the basis of machine hours (based on practical capacity). Budgeted overhead and machine activity for the year were anticipated to be $824,000, and 16,000 hours, respectively, b. The company worked on four jobs during the first quarter. Direct materials used, direct labor incurred, and machine hours consumed were as follows: Job No. Direct Material Direct Labor Machine Hours 64 $21,000 $35,000 1,200 65 22,000 66 44,000 65,000 2,000 15,000 8,800 500 700 67 c. Manufacturing overhead during the first quarter included charges for depreciation ($33,600), indirect labor ($60,000), indirect materials used ($5,200), and other factory costs ($139,500). d. Stellar Sound completed job no. 64 and job no. 65. Job no. 65 was sold on account, producing a profit of $34,900 for the firm. Required: 1. Determine the company's predetermined overhead application rate. (Round your answer to 2 decimal places.) Predetermined overhead rate per machine hour Required information [The following information applies to the questions displayed below.) Stellar Sound, Inc., which uses a job-order costing system, had two jobs in process at the start of 20x1:job no. 64 ($84,000) and job no. 65 ($53,400). The following information is available: a. The company applies manufacturing overhead on the basis of machine hours (based on practical capacity). Budgeted overhead and machine activity for the year were anticipated to be $824,000, and 16,000 hours, respectively. b. The company worked on four jobs during the first quarter. Direct materials used, direct labor incurred, and machine hours consumed were as follows: Direct Material $21,000 Job No. 64 65 66 67 Direct Labor $35,000 22,000 65,000 8,800 Machine Hours 1,200 700 2,000 500 44,000 15,000 c. Manufacturing overhead during the first quarter included charges for depreciation ($33,600), Indirect labor ($60,000). indirect materials used ($5,200), and other factory costs ($139,500). d. Stellar Sound completed job no. 64 and job no. 65. Job no. 65 was sold on account, producing a profit of $34,900 for the firm 3. Determine the cost of jobs still in production as of March 31. Cost of the jobs in production Required information [The following information applies to the questions displayed below) Stellar Sound, Inc., which uses a job-order costing system, had two jobs in process at the start of 20x1:job no. 64 ($84,000) and job no. 65 ($53,400). The following information is available: a. The company applies manufacturing overhead on the basis of machine hours (based on practical capacity). Budgeted overhead and machine activity for the year were anticipated to be $824,000, and 16,000 hours, respectively. b. The company worked on four jobs during the first quarter. Direct materials used direct labor incurred, and machine hours consumed were as follows: Job No. 64 65 Direct Material $21,000 Direct Labor $35,000 22,000 65,000 8,800 66 Machine Hours 1,200 700 2,000 500 67 44,000 15,000 c. Manufacturing overhead during the first quarter included charges for depreciation ($33,600), Indirect labor ($60,000). Indirect materials used ($5,200), and other factory costs ($139,500). d. Stellar Sound completed Job no. 64 and job no. 65. Job no. 65 was sold on account, producing a profit of $34,900 for the firm 4. Did the finished-goods inventory increase or decrease during the first quarter? By how much? (Do not round intermediate calculations.) The finished-goods inventory by decreased increased Required information (The following information applies to the questions displayed below.) Stellar Sound, Inc., which uses a job-order costing system, had two jobs in process at the start of 20x1: job no. 64 ($84,000) and job no. 65 ($53,400). The following information is available: a. The company applies manufacturing overhead on the basis of machine hours (based on practical capacity). Budgeted overhead and machine activity for the year were anticipated to be $824,000, and 16,000 hours, respectively. b. The company worked on four jobs during the first quarter. Direct materials used, direct labor incurred, and machine hours consumed were as follows: Job No. 64 65 66 Direct Material $21,000 Direct Labor $35,000 22,000 65,000 8,800 Machine Hours 1,200 700 2,000 67 44,000 15,000 500 c. Manufacturing overhead during the first quarter included charges for depreciation ($33,600), Indirect labor ($60,000). indirect materials used ($5,200), and other factory costs ($139,500). d. Stellar Sound completed job no. 64 and job no. 65. Job no. 65 was sold on account, producing a profit of $34.900 for the firm. 5. Was manufacturing overhead under-or overapplied for the first quarter of the year? By how much? (Do not round intermediate calculations.) The overhead was for the first quarter of the year by underapplied overapplied There are 5 different questions to go along with this problem

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started