Answered step by step

Verified Expert Solution

Question

1 Approved Answer

28. 29. 30. 31. 32. Below are ways to stimulate sales in a firm, EXCEPT A. cash sale offer credit B. C. D. A.

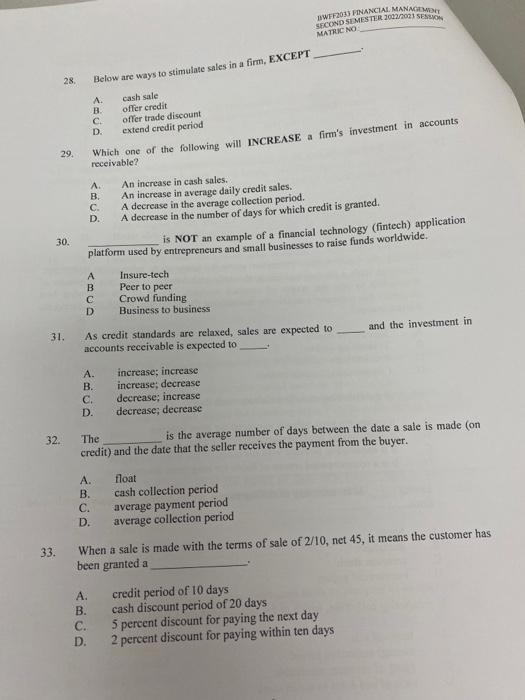

28. 29. 30. 31. 32. Below are ways to stimulate sales in a firm, EXCEPT A. cash sale offer credit B. C. D. A. B. C. D. Which one of the following will INCREASE a firm's investment in accounts receivable? C D ABCD A B A. B. C. D. D. offer trade discount extend credit period is NOT an example of a financial technology (fintech) application platform used by entrepreneurs and small businesses to raise funds worldwide. A. B. C. D. As credit standards are relaxed, sales are expected to accounts receivable is expected to An increase in cash sales. . An increase in average daily credit sales. A decrease in the average collection period. A decrease in the number of days for which credit is granted. Insure-tech Peer to peer Crowd funding Business to business SECOND SEMESTER 2002/2023 SESSION BWFF2013 FINANCIAL MANAGEMENT MATRIC NO increase; increase increase; decrease decrease; increase decrease; decrease The is the average number of days between the date a sale is made (on credit) and the date that the seller receives the payment from the buyer. float cash collection period average payment period average collection period A. credit period of 10 days B. cash discount period of 20 days 33. When a sale is made with the terms of sale of 2/10, net 45, it means the customer has been granted. and the investment in C. 5 percent discount for paying the next day 2 percent discount for paying within ten days

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Question 28 Ways to stimulate sales in a firm EXCEPT Explanation The correct answer is A Cash sale Offering credit trade discounts and exte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started