Answered step by step

Verified Expert Solution

Question

1 Approved Answer

28. Below are selected transactions of Tickner Company for the year ended December 31: Apr 12 Sold merchandise on account to Fong Company; 2/10, n/30;

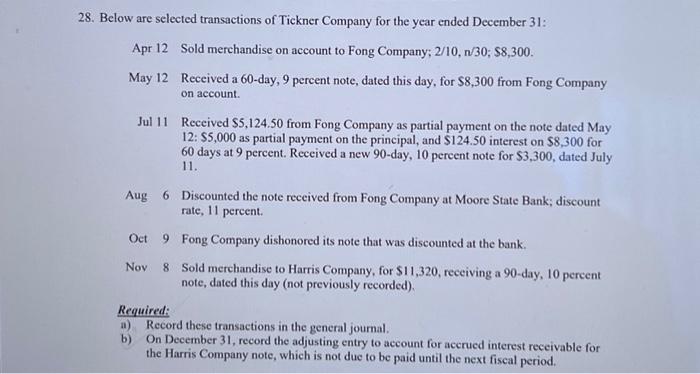

28. Below are selected transactions of Tickner Company for the year ended December 31: Apr 12 Sold merchandise on account to Fong Company; 2/10, n/30; $8,300. May 12 Received a 60-day, 9 percent note, dated this day, for $8,300 from Fong Company on account. Jul 11 Received $5,124.50 from Fong Company as partial payment on the note dated May 12: $5,000 as partial payment on the principal, and $124.50 interest on $8,300 for 60 days at 9 percent. Received a new 90-day, 10 percent note for $3,300, dated July 11. Aug 6 Discounted the note received from Fong Company at Moore State Bank; discount rate, 11 percent. Oct 9 Fong Company dishonored its note that was discounted at the bank. 8 Sold merchandise to Harris Company, for $11,320, receiving a 90-day, 10 percent note, dated this day (not previously recorded). Nov Required: a) Record these transactions in the general journal. b) On December 31, record the adjusting entry to account for accrued interest receivable for the Harris Company note, which is not due to be paid until the next fiscal period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started