Answered step by step

Verified Expert Solution

Question

1 Approved Answer

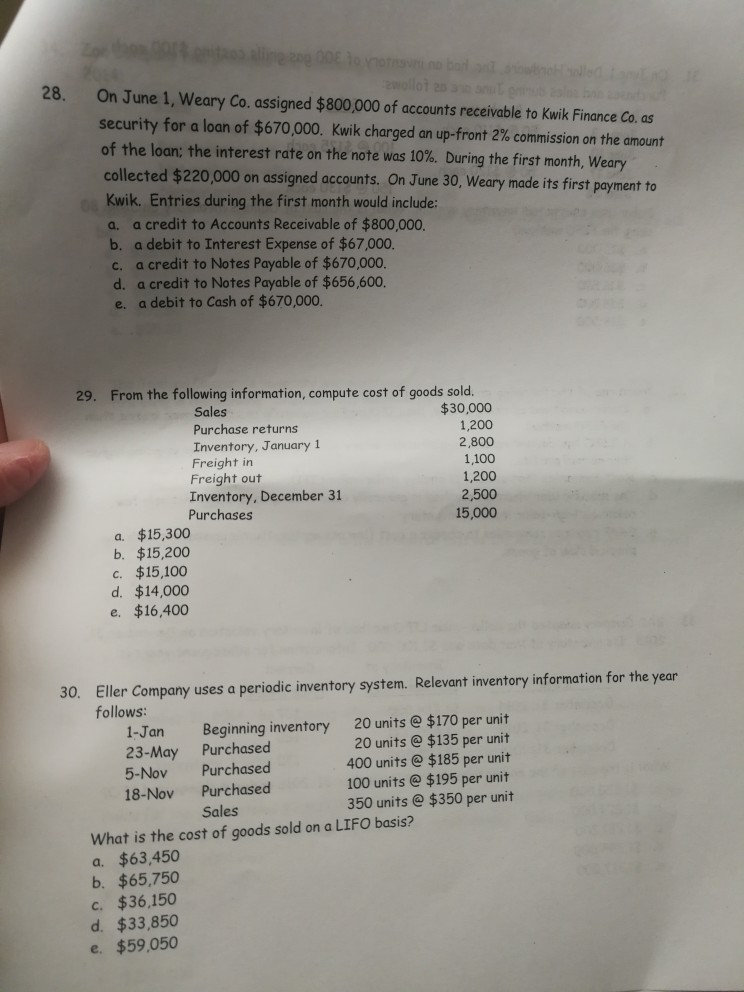

28. On June 1, Weary Co. assigned $800,000 of accounts receivable to Kwik Finance Co, as security for a loan of $670,000, Kwik charged an

28. On June 1, Weary Co. assigned $800,000 of accounts receivable to Kwik Finance Co, as security for a loan of $670,000, Kwik charged an up-front 2% commission on the amount of the loan: the interest rate on the note was 10%. During the first month, weary collected $220,000 on assigned accounts. On June 30, Weary made its first payment to Kwik. Entries during the first month would include: a, a credit to Accounts Receivable of $800,000. b. a debit to Interest Expense of $67,000. c. a credit to Notes Payable of $670,000. d. a credit to Notes Payable of $656,600. e. a debit to Cash of $670,000. 29. From the following information, compute cost of goods sold. Sales Purchase returns Inventory, January 1 Freight in Freight out Inventory, December 31 Purchases $30,000 1,200 2,800 1,100 1,200 2,500 15,000 a. $15,300 b. $15,200 c. $15,100 d. $14,000 e. $16,400 Eller Company uses a periodic inventory system. Relevant inventory information for the year follows: 30. 20 units@ $170 per unit 20 units @ $135 per unit 400 units@ $185 per unit 100 units $195 per unit 350 units @ $350 per unit Beginning inventory 1-Jan 23-May Purchased 5-Nov Purchased 18-Nov Purchased Sales What is the cost of goods sold on a LIFO basis? a $63,450 b. $65,750 c. $36,150 d. $33,850 e $59,050

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started