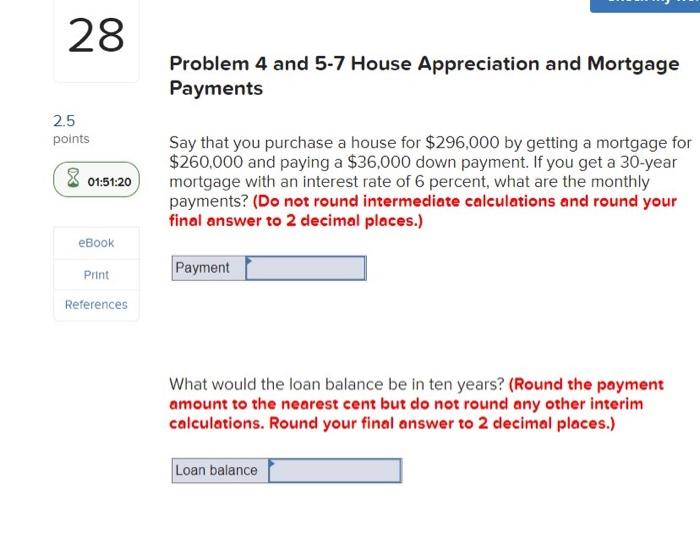

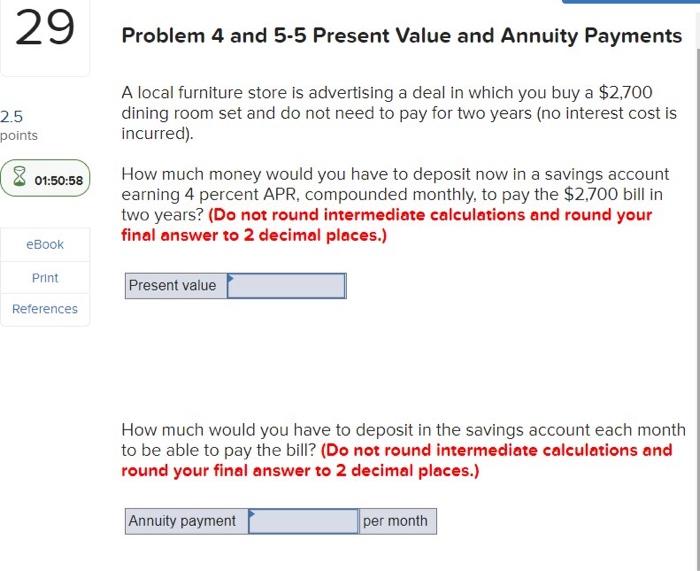

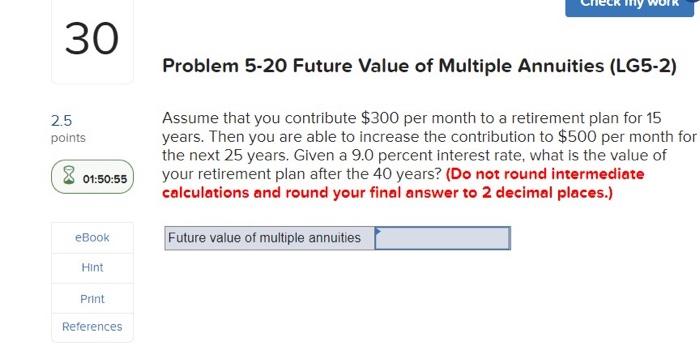

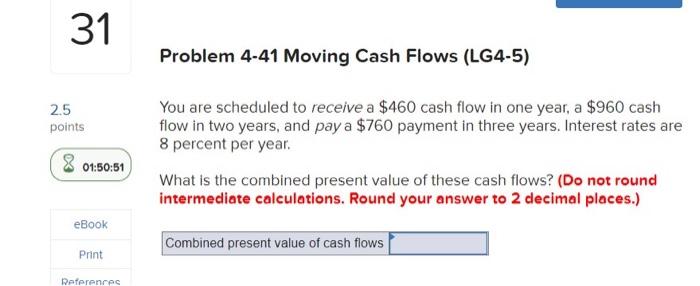

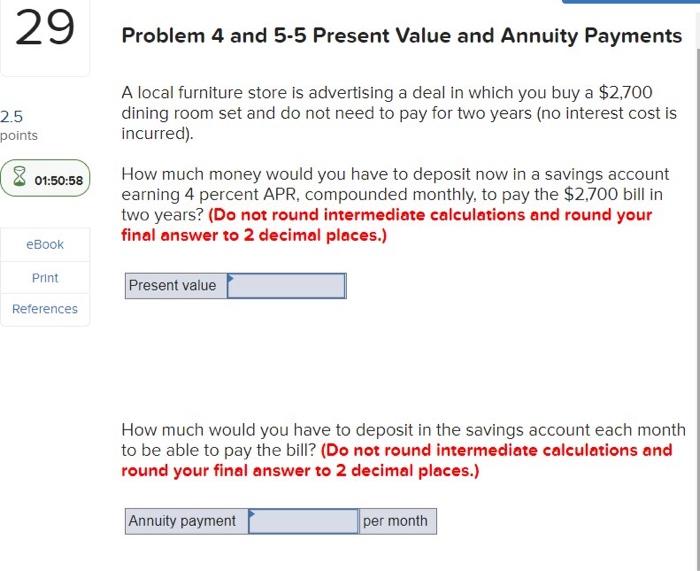

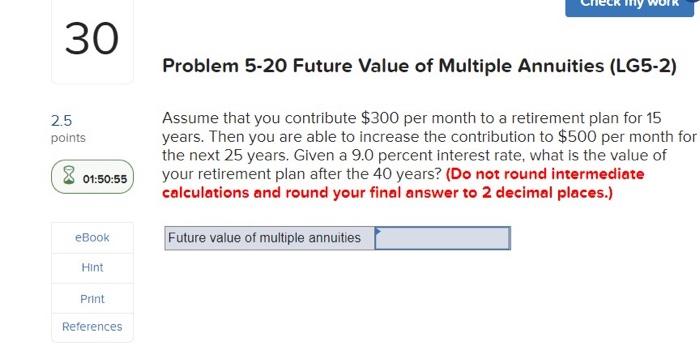

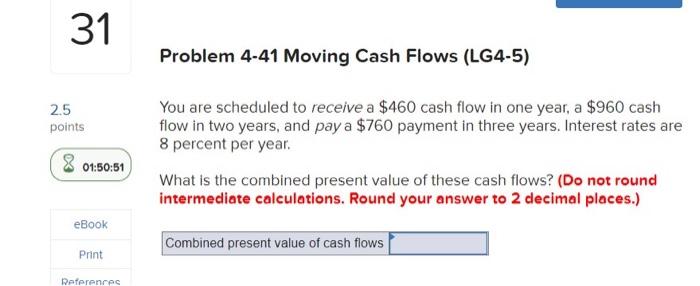

28 Problem 4 and 5-7 House Appreciation and Mortgage Payments 2.5 points 01:51:20 Say that you purchase a house for $296,000 by getting a mortgage for $260,000 and paying a $36,000 down payment. If you get a 30-year mortgage with an interest rate of 6 percent, what are the monthly payments? (Do not round intermediate calculations and round your final answer to 2 decimal places.) eBook Print Payment References What would the loan balance be in ten years? (Round the payment amount to the nearest cent but do not round any other interim calculations. Round your final answer to 2 decimal places.) Loan balance 29 Problem 4 and 5-5 Present Value and Annuity Payments 2.5 points A local furniture store is advertising a deal in which you buy a $2,700 dining room set and do not need to pay for two years (no interest cost is incurred). 01:50:58 How much money would you have to deposit now in a savings account earning 4 percent APR, compounded monthly, to pay the $2,700 bill in two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) eBook Print Present value References How much would you have to deposit in the savings account each month to be able to pay the bill? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Annuity payment per month 30 Problem 5-20 Future Value of Multiple Annuities (LG5-2) 2.5 points Assume that you contribute $300 per month to a retirement plan for 15 years. Then you are able to increase the contribution to $500 per month for the next 25 years. Given a 9.0 percent interest rate, what is the value of your retirement plan after the 40 years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) 01:50:55 eBook Future value of multiple annuities Hint Print References 31 Problem 4-41 Moving Cash Flows (LG4-5) 25 points You are scheduled to receive a $460 cash flow in one year, a $960 cash flow in two years, and pay a $760 payment in three years. Interest rates are 8 percent per year What is the combined present value of these cash flows? (Do not round intermediate calculations. Round your answer to 2 decimal places.) 01:50:51 eBook Combined present value of cash flows Print References