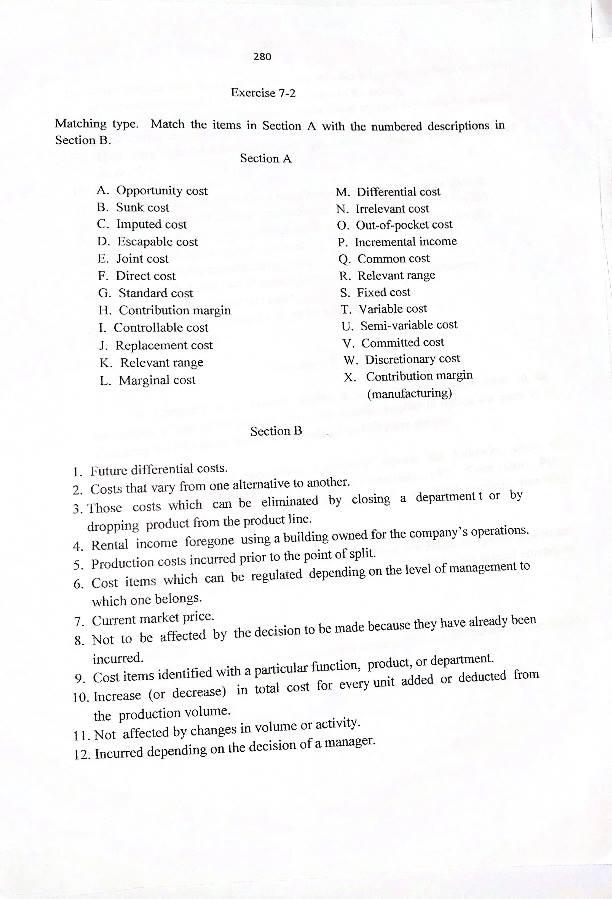

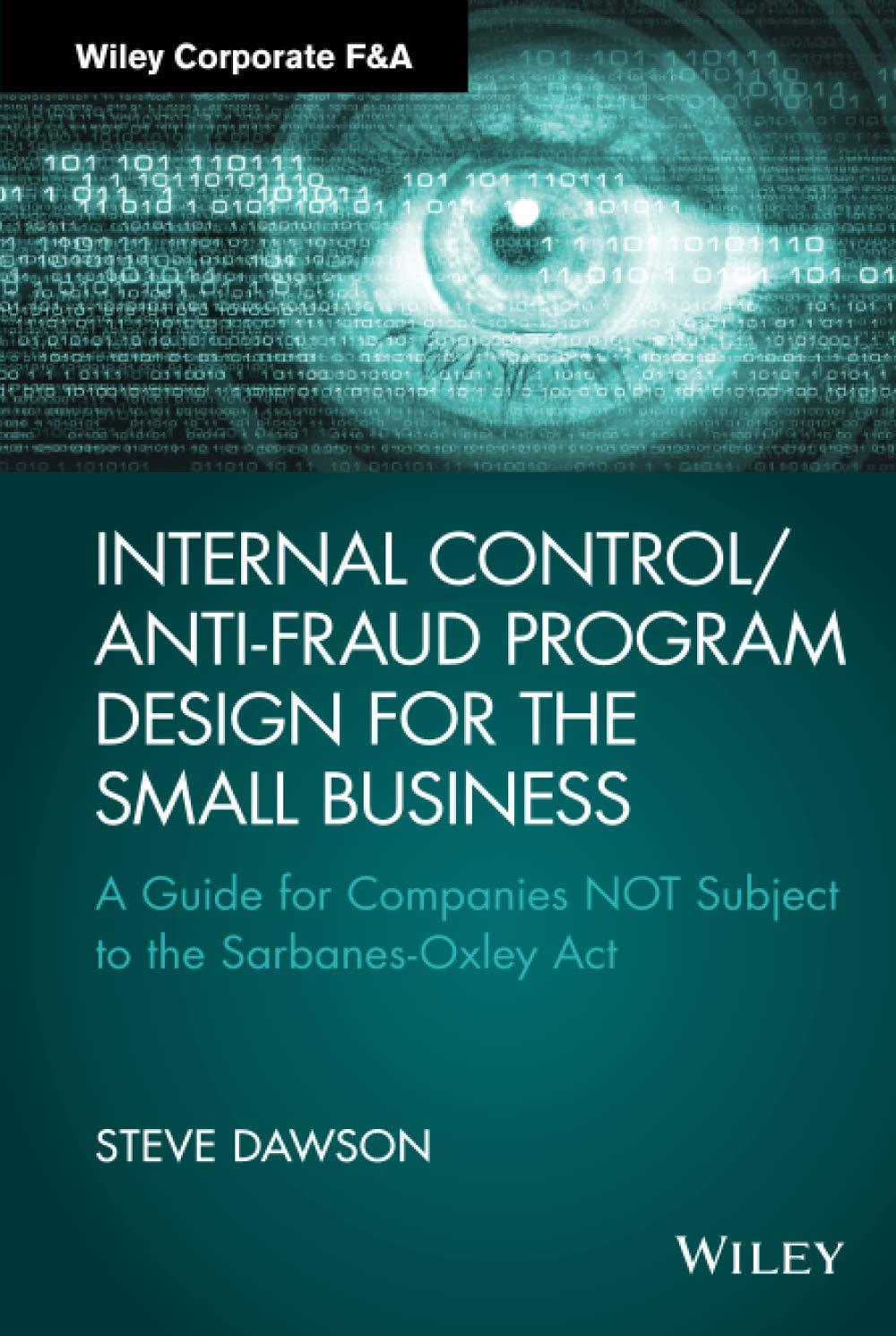

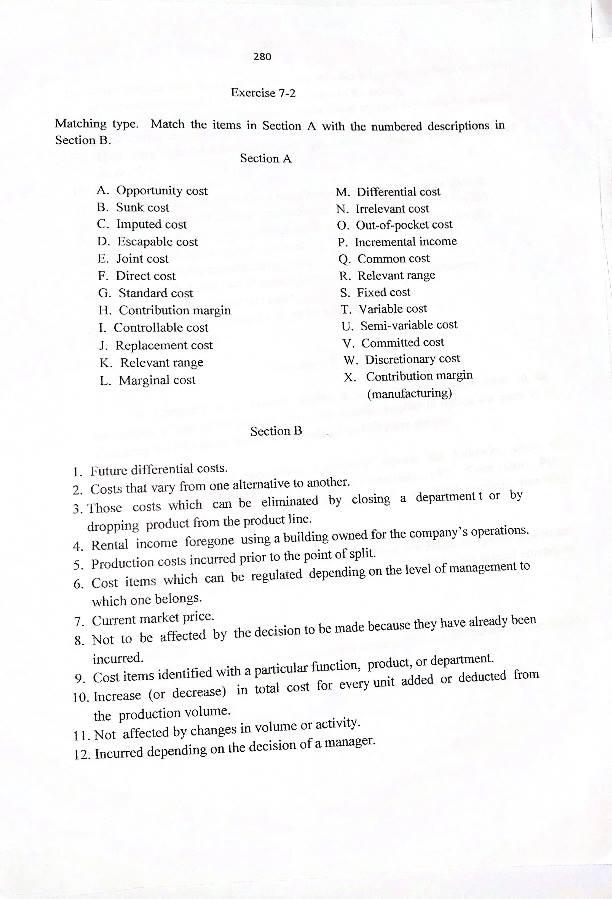

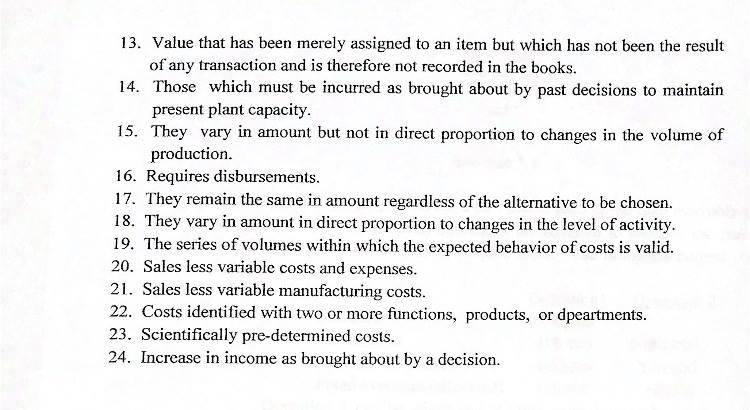

280 Exercise 7-2 Matching type. Match the items in Section with the numbered descriptions in Section B. Section A A. Opportunity cost B. Sunk cost C. Imputed cost D. Escapable cost E. Joint cost F. Direct cost G. Standard cost H. Contribution margin I. Controllable cost J. Replacement cost K. Relevant range L. Marginal cost M. Differential cost N. Irrelevant cost 0. Out-of-pocket cost P. Incremental income Q. Common cost R. Relevant range S. Fixed cost T. Variable cost U. Semi-variable cost V. Committed cost W. Discretionary cost X. Contribution margin (manufacturing) Section B 1. Future differential costs. 2. Costs that vary from one alternative to another. 3. Those costs which can be eliminated by closing a department or by dropping product from the product line. 4. Rental income foregone using a building owned for the company's operations. 5. Production costs incurred prior to the point of split 6. Cost items which can be regulated depending on the level of management to which one belongs 7. Current market price. 8. Not to be affected by the decision to be made because they have already been incurred. 9. Cost items identified with a particular function, product, or department. 10. Increase or decrease) in total cost for every unit added or deducted from the production volume. 11. Not affected by changes in volume or activity. 12. Incurred depending on the decision of a manager. 13. Value that has been merely assigned to an item but which has not been the result of any transaction and is therefore not recorded in the books. 14. Those which must be incurred as brought about by past decisions to maintain present plant capacity. 15. They vary in amount but not in direct proportion to changes in the volume of production. 16. Requires disbursements. 17. They remain the same in amount regardless of the alternative to be chosen. 18. They vary in amount in direct proportion to changes in the level of activity. 19. The series of volumes within which the expected behavior of costs is valid. 20. Sales less variable costs and expenses. 21. Sales less variable manufacturing costs. 22. Costs identified with two or more functions, products, or dpeartments. 23. Scientifically pre-determined costs. 24. Increase in income as brought about by a decision