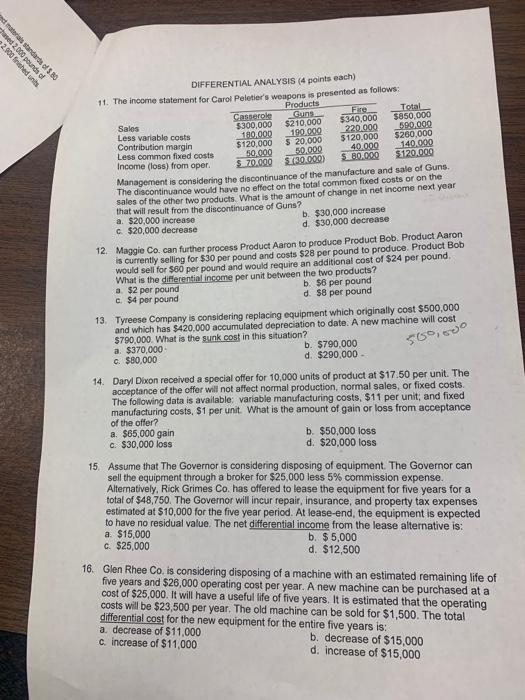

2.900 frihed used 2.000 pounds of to standards of 580 DIFFERENTIAL ANALYSIS (4 points each) 11. The income statement for Carol Peletier's weapons is presented as follows Products Casserole Guns Total Sales $300,000 $210,000 $340,000 5850,000 Less variable costs 190.000 190.000 220.000 590.000 Contribution margin $120,000 $ 20.000 $120.000 $260.000 Less common fixed costs 50.000 50.000 40.000 140.000 Income (loss) from oper. $ 70.000 $130.000 $ 80.000 $120.000 Management is considering the discontinuance of the manufacture and sale of Guns The discontinuance would have no effect on the total common fixed costs or on the sales of the other two products. What is the amount of change in net income next year that will result from the discontinuance of Guns? a $20,000 increase b. $30,000 increase $20,000 decrease d. $30,000 decrease 12. Maggie Co. can further process Product Aaron to produce Product Bob Product Aaron is currently seling for $30 per pound and costs $28 per pound to produce Product Bob would sell for $60 per pound and would require an additional cost of $24 per pound What is the differential income per unit between the two products? a $2 per pound b. $6 per pound c. $4 per pound d. $8 per pound 13. Tyreese Company is considering replacing equipment which originally cost $500,000 and which has $420.000 accumulated depreciation to date. A new machine will cost $790,000. What is the sunk cost in this situation? a $370,000 b. $790.000 c. $80,000 d. $290,000 500,00 14. Daryl Dixon received a special offer for 10,000 units of product at $17.50 per unit. The acceptance of the offer will not affect normal production, normal sales, or fixed costs. The following data is available: variable manufacturing costs, $11 per unit and fixed manufacturing costs, $1 per unit. What is the amount of gain or loss from acceptance of the offer? a. $65,000 gain b. $50,000 loss c. $30,000 loss d. $20,000 loss 15. Assume that the Governor is considering disposing of equipment. The Governor can sell the equipment through a broker for $25,000 less 5% commission expense. Alternatively, Rick Grimes Co. has offered to lease the equipment for five years for a total of $48,750. The Governor will incur repair, insurance, and property tax expenses estimated at $10,000 for the five year period. At lease-end, the equipment is expected to have no residual value. The net differential income from the lease alternative is: a $15,000 b. $ 5,000 C. $25,000 d. $12,500 16. Glen Rhee Co. is considering disposing of a machine with an estimated remaining life of five years and $26,000 operating cost per year. A new machine can be purchased at a cost of $25,000. It will have a useful life of five years. It is estimated that the operating costs will be $23,500 per year. The old machine can be sold for $1,500. The total differential cost for the new equipment for the entire five years is: a decrease of $11,000 b. decrease of $15,000 c. increase of $11,000 d. increase of $15,000