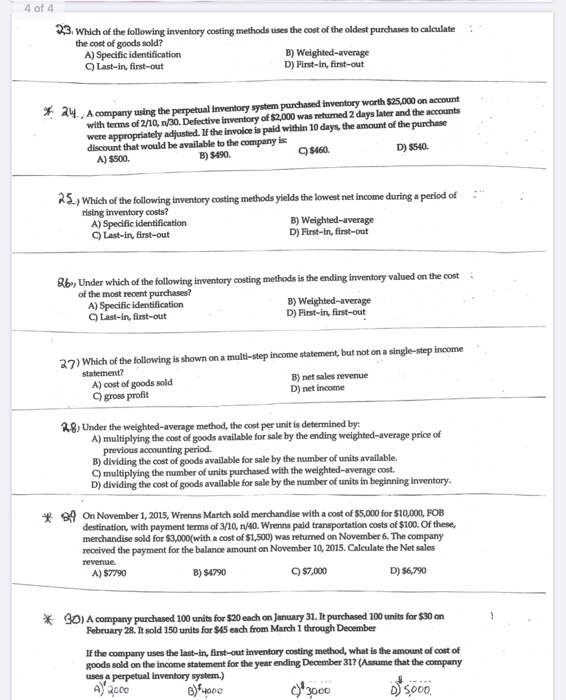

4 of 4 23. Which of the following inventory costing methods uses the cost of the oldest purchase to calculate the cost of goods sold? A) Specific identification B) Weighted average Last-in, first-out D) First-in, first-out 24. A company using the perpetual inventory system purchased Inventory worth $25,000 on account with terms of 2/10, 1/30. Defective inventory of $2,000 was returned 2 days later and the accounts were appropriately adjusted. If the invoice is paid within 10 days, the amount of the purchase discount that would be available to the company is A) $500. B) 5190 95160 D) $540. 25., Which of the following inventory costing methods yields the lowest net income during a period of rising inventory costs? A) Specific identification B) Weighted average Last-in, first-out D) First-in, first-out i Rb, Under which of the following inventory costing methods is the ending inventory valued on the cost of the most recent purchases? A) Specific identification B) Weighted average Last-in, first-out D) First-in, first-out 22) Which of the following is shown on a multi-step income statement, but not on a single-step income statement? A) cost of goods sold B) net sales revenue gross profit D) net income 28. Under the weighted average method, the cost per unit is determined by: A) multiplying the cost of goods available for sale by the ending weighted average price of previous accounting period. B) dividing the cost of goods available for sale by the number of units available multiplying the number of units purchased with the weighted average cost. D) dividing the cost of goods available for sale by the number of units in beginning inventory. + 84 On November 1, 2015, Wrens Martch sold merchandise with a cost of $5,000 for $10,000, POB destination, with payment terms of 3/10, 1/40. Wrenns paid transportation costs of $100. Of these, merchandise sold for $3,000 with a cost of $1,500) was returned on November 6. The company received the payment for the balance amount on November 10, 2015. Calculate the Net sales revenue A) $7790 B) $4790 $7,000 D) 86,790 * 30) A company purchased 100 units for $20 each on January 31. It purchased 100 units for $30 on February 28. It sold 150 units for $45 each from March 1 through December If the company uses the last-in, first-out inventory costing method, what is the amount of cost of goods sold on the income statement for the year ending December 317 (Asume that the company uses a perpetual inventory system.) A) 2000 4000 C) 3000 D5000