Answered step by step

Verified Expert Solution

Question

1 Approved Answer

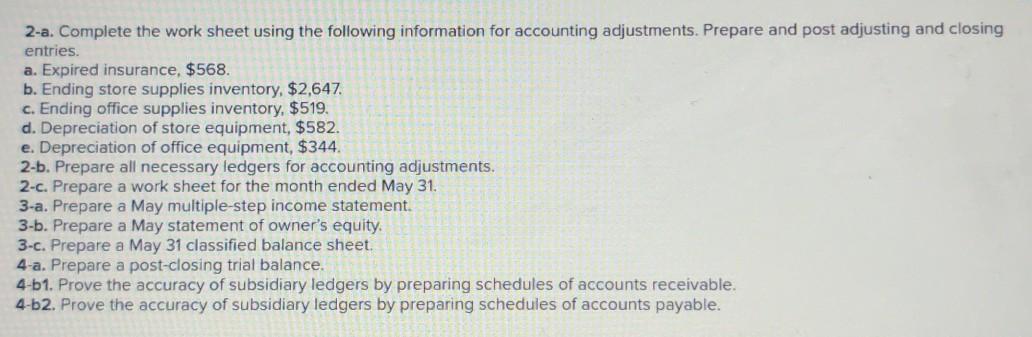

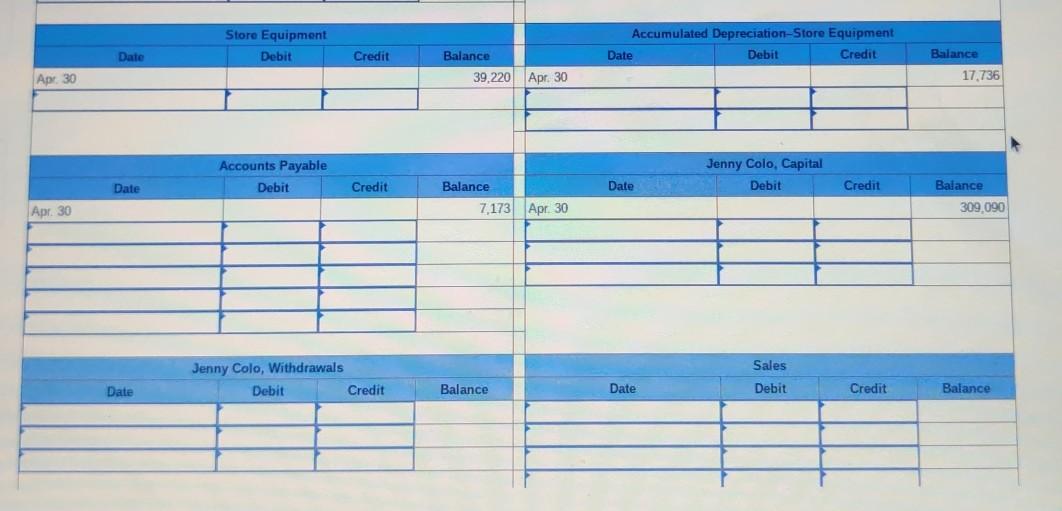

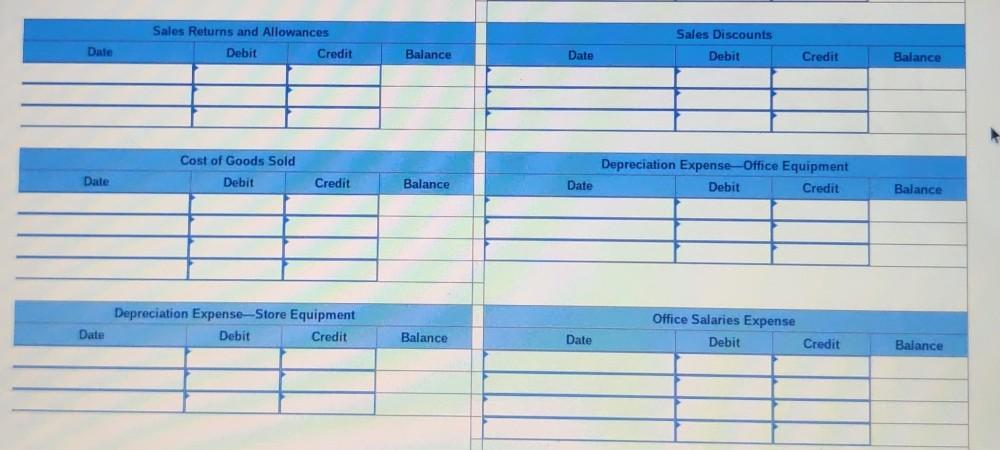

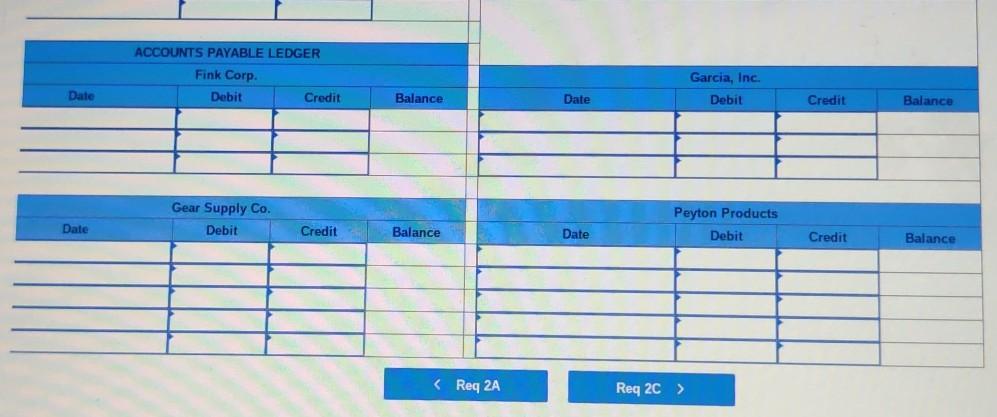

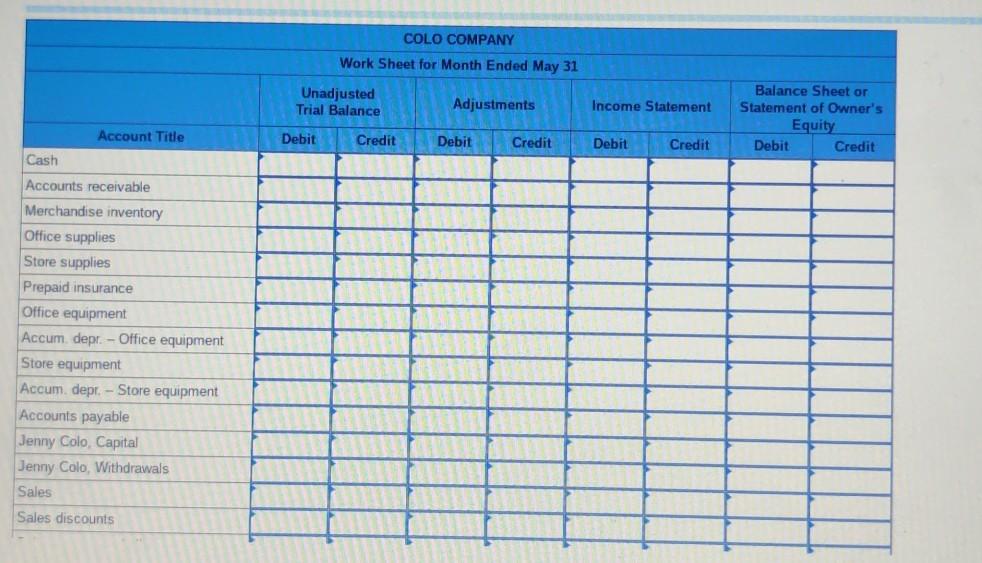

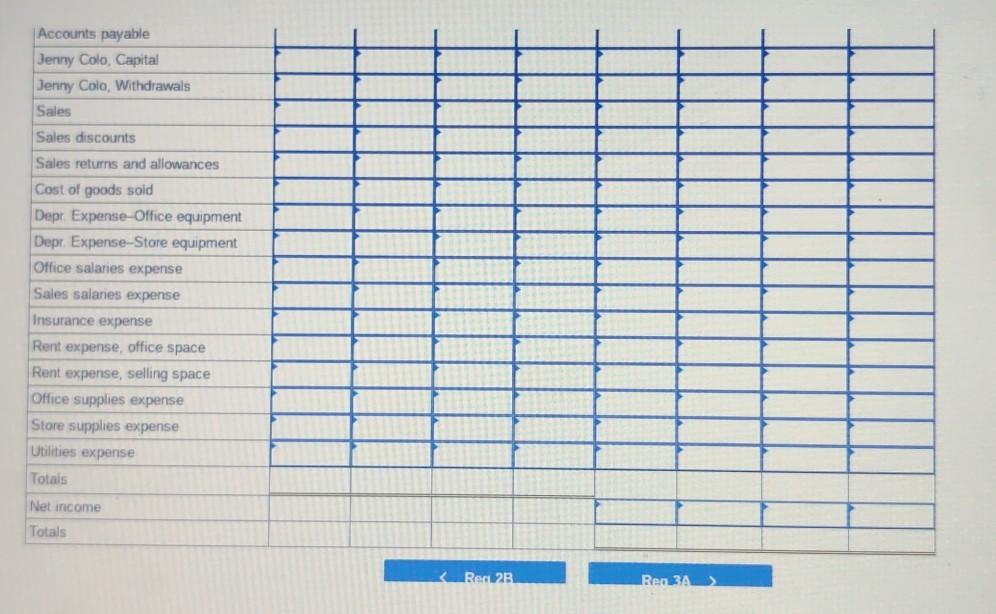

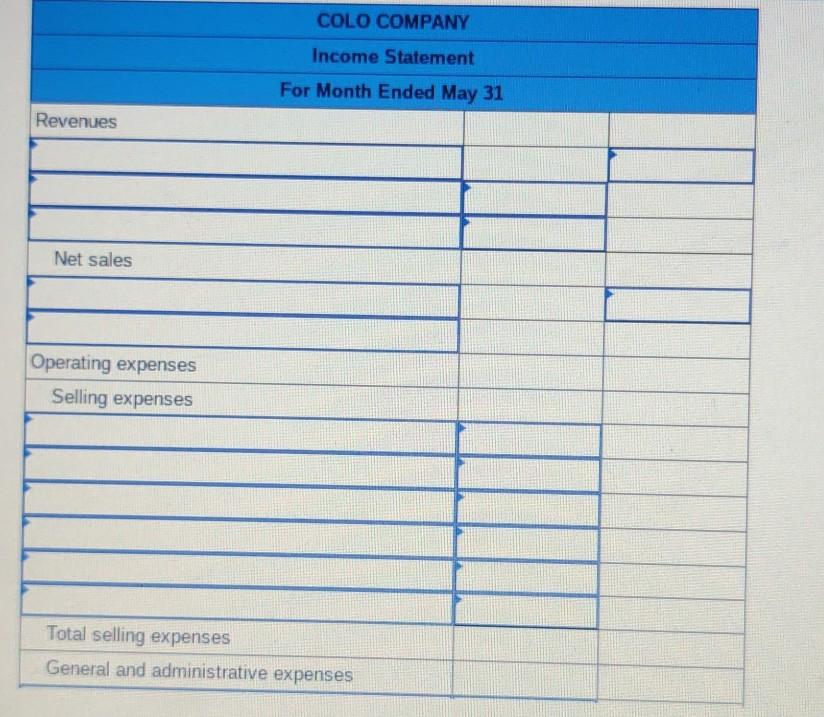

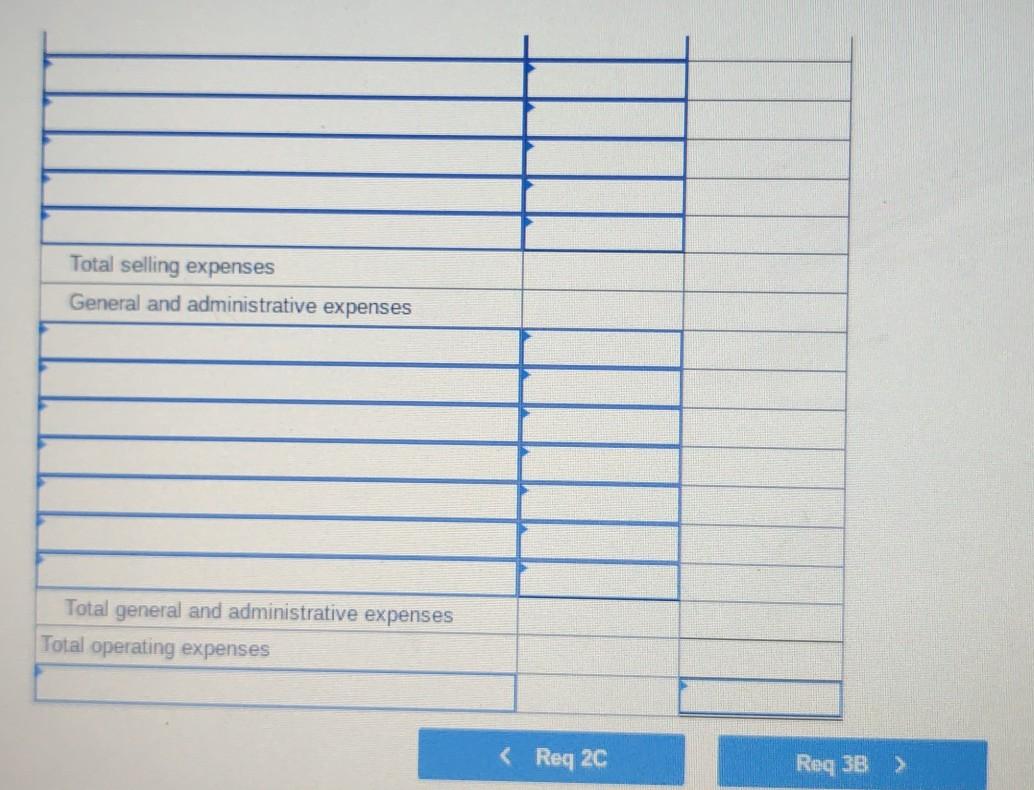

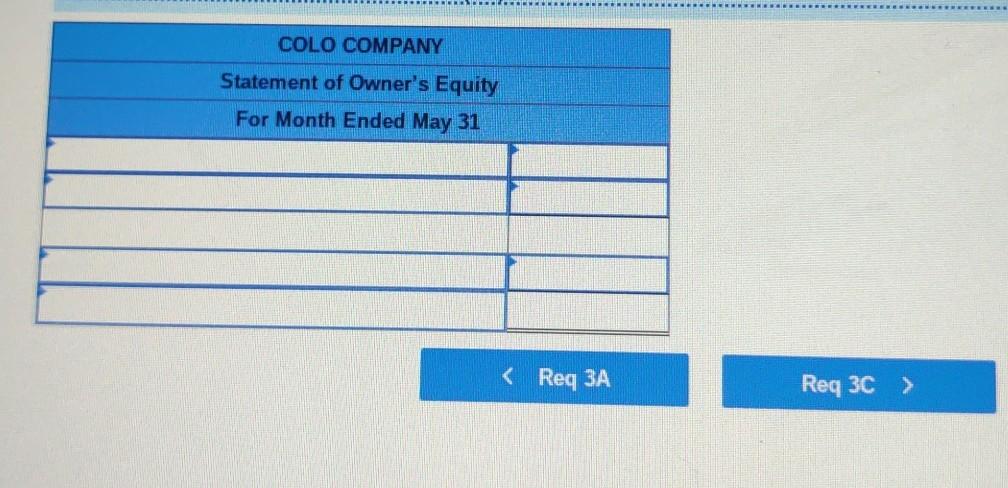

2-a. Complete the work sheet using the following information for accounting adjustments. Prepare and post adjusting and closing entries a. Expired insurance, $568. b. Ending

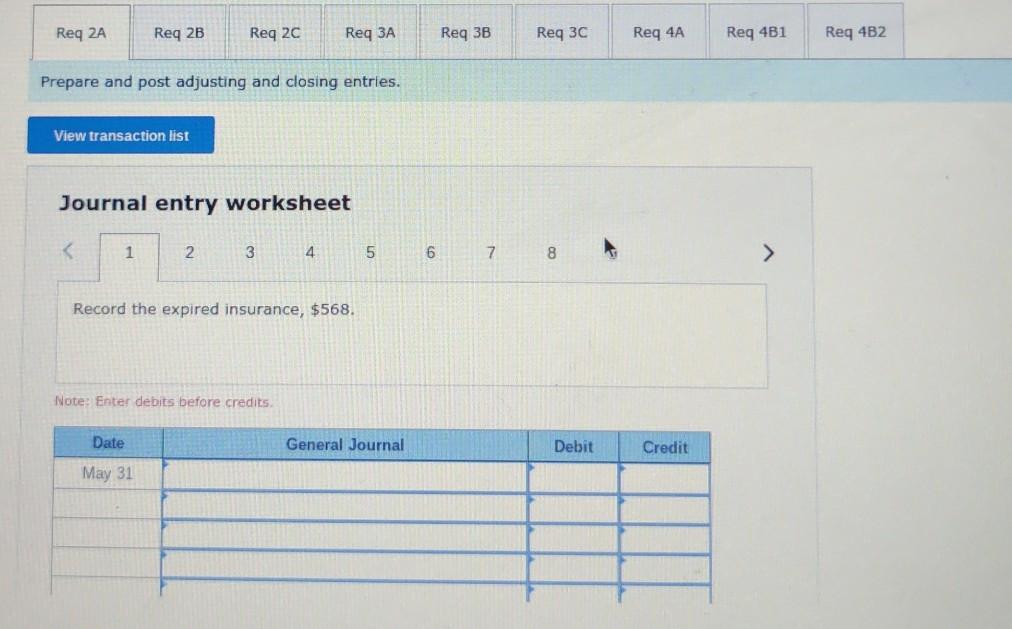

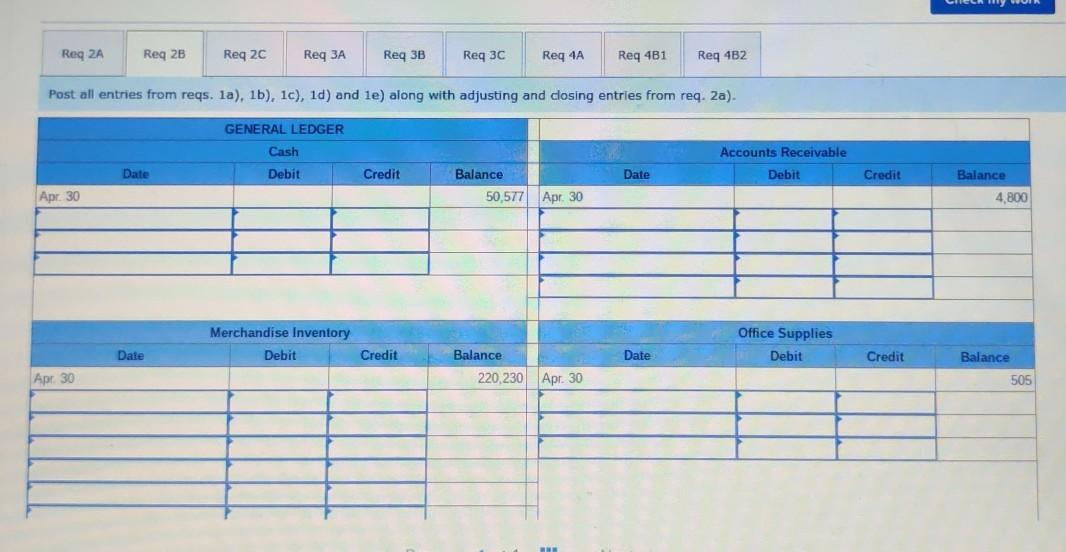

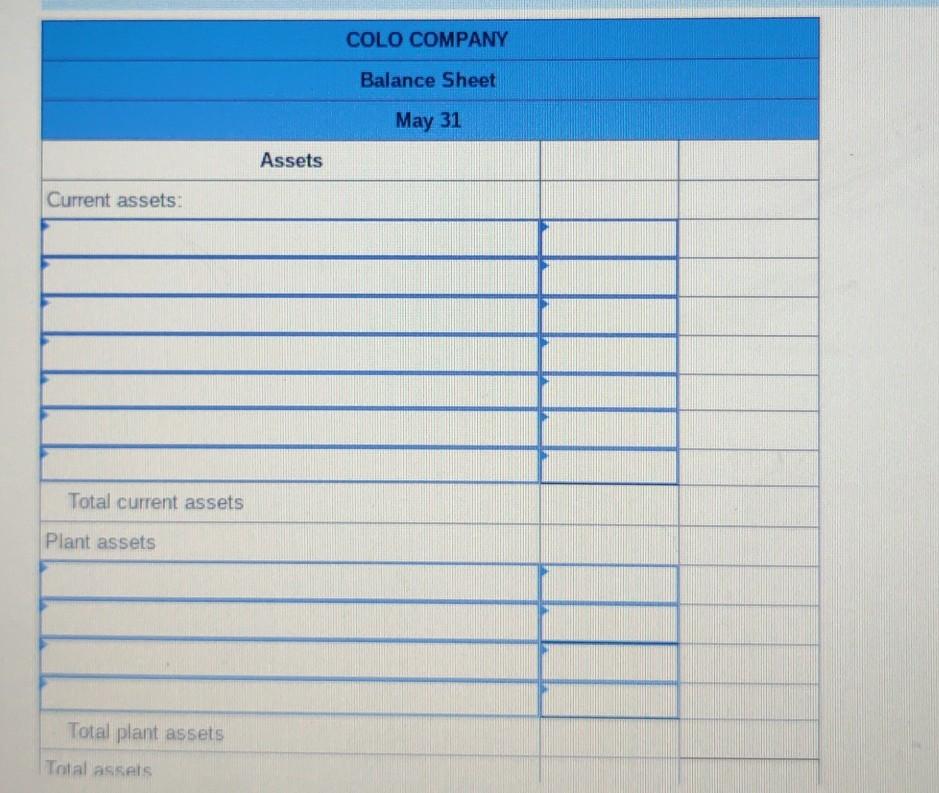

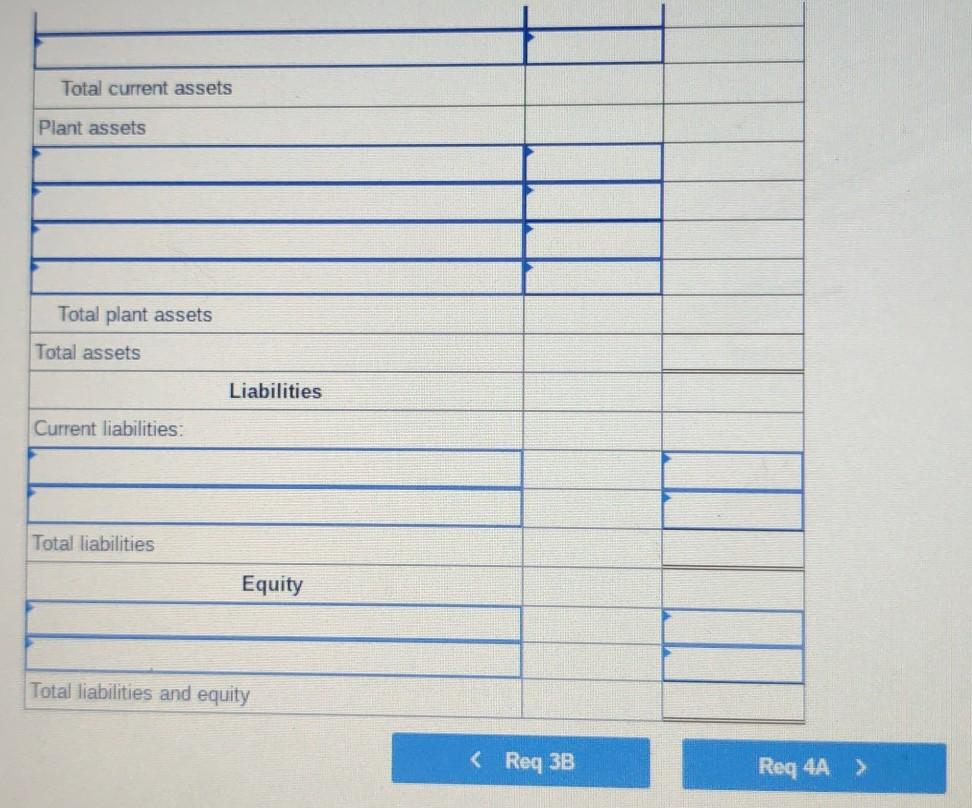

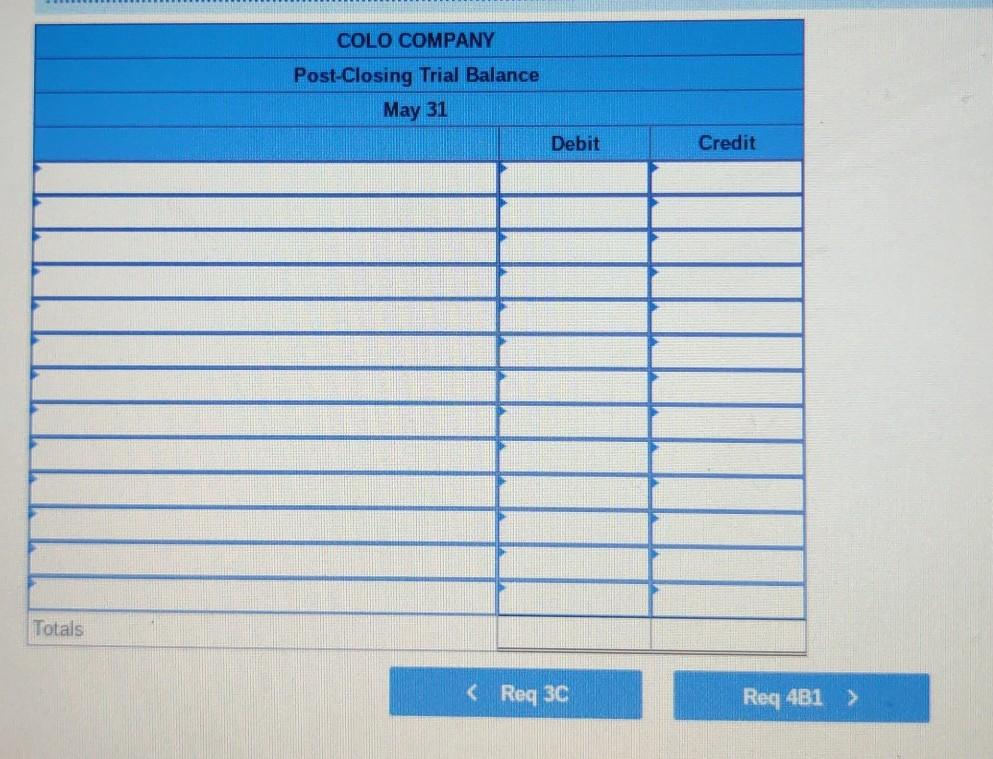

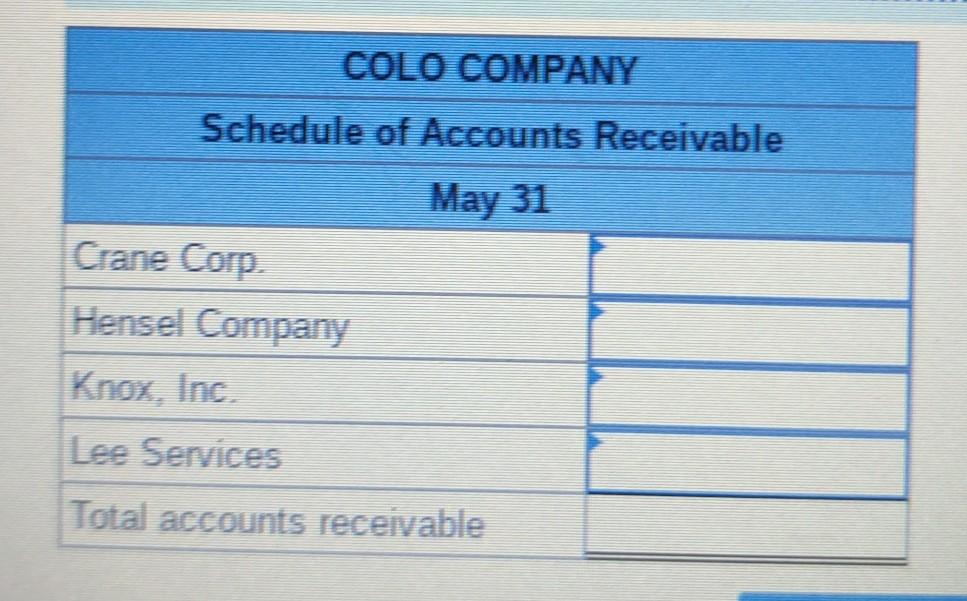

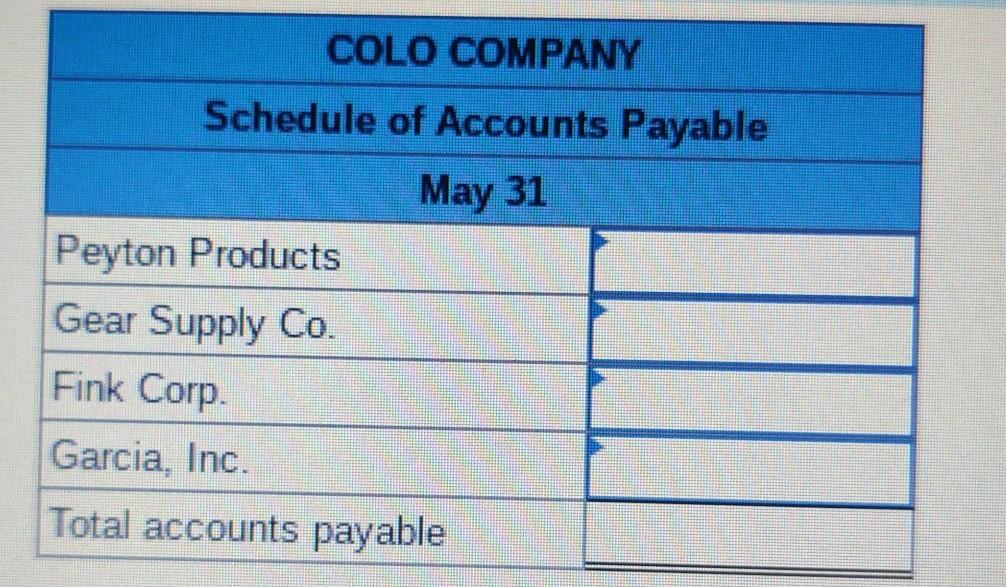

2-a. Complete the work sheet using the following information for accounting adjustments. Prepare and post adjusting and closing entries a. Expired insurance, $568. b. Ending store supplies inventory, $2,647. c. Ending office supplies inventory, $519. d. Depreciation of store equipment, $582. e. Depreciation of office equipment, $344. 2-b. Prepare all necessary ledgers for accounting adjustments. 2-c. Prepare a work sheet for the month ended May 31. 3-a. Prepare a May multiple-step income statement. 3-b. Prepare a May statement of owner's equity. 3-c. Prepare a May 31 classified balance sheet. 4-a. Prepare a post-closing trial balance. 4-b1. Prove the accuracy of subsidiary ledgers by preparing schedules of accounts receivable. 4-b2. Prove the accuracy of subsidiary ledgers by preparing schedules of accounts payable. Req 2A Req 2B Req 2c Req Req 3B Req 30 Req 4A Req 481 Req 4B2 Prepare and post adjusting and closing entries. View transaction list Journal entry worksheet COLO COMPANY Work Sheet for Month Ended May 31 Unadjusted Trial Balance Adjustments Income Statement Balance Sheet or Statement of Owner's Equity Debit Credit Debit Credit Debit Credit Debit Credit Account Title Cash Accounts receivable Merchandise inventory Office supplies Store supplies Prepaid insurance Office equipment Accum. depr. - Office equipment Store equipment Accum depr. - Store equipment Accounts payable Jenny Colo Capital Jenny Colo, Withdrawals Sales Sales discounts Accounts payable Jenny Colo, Capital Jenny Colo, Withdrawals Sales Sales discounts Sales returns and allowances Cost of goods sold Depr Expense-Office equipment Depr. Expense-Store equipment Office salaries expense Sales salaries expense Insurance expense Rent expense, office space Rent expense, selling space Office supplies expense Store supplies expense Utilities expense Totals Net income Totals COLO COMPANY Balance Sheet May 31 Assets Current assets: Total current assets Plant assets Total plant assets Total assets Total current assets Plant assets Total plant assets Total assets Liabilities Current liabilities: Total liabilities Equity Total liabilities and equity COLO COMPANY Post-Closing Trial Balance May 31 Debit Credit Totals COLO COMPANY Schedule of Accounts Receivable May 31 Crane Corp Hensel Company Knox, Inc. Lee Services Total accounts receivable COLO COMPANY Schedule of Accounts Payable May 31 Peyton Products Gear Supply Co. Fink Corp Garcia, Inc. Total accounts payable 2-a. Complete the work sheet using the following information for accounting adjustments. Prepare and post adjusting and closing entries a. Expired insurance, $568. b. Ending store supplies inventory, $2,647. c. Ending office supplies inventory, $519. d. Depreciation of store equipment, $582. e. Depreciation of office equipment, $344. 2-b. Prepare all necessary ledgers for accounting adjustments. 2-c. Prepare a work sheet for the month ended May 31. 3-a. Prepare a May multiple-step income statement. 3-b. Prepare a May statement of owner's equity. 3-c. Prepare a May 31 classified balance sheet. 4-a. Prepare a post-closing trial balance. 4-b1. Prove the accuracy of subsidiary ledgers by preparing schedules of accounts receivable. 4-b2. Prove the accuracy of subsidiary ledgers by preparing schedules of accounts payable. Req 2A Req 2B Req 2c Req Req 3B Req 30 Req 4A Req 481 Req 4B2 Prepare and post adjusting and closing entries. View transaction list Journal entry worksheet COLO COMPANY Work Sheet for Month Ended May 31 Unadjusted Trial Balance Adjustments Income Statement Balance Sheet or Statement of Owner's Equity Debit Credit Debit Credit Debit Credit Debit Credit Account Title Cash Accounts receivable Merchandise inventory Office supplies Store supplies Prepaid insurance Office equipment Accum. depr. - Office equipment Store equipment Accum depr. - Store equipment Accounts payable Jenny Colo Capital Jenny Colo, Withdrawals Sales Sales discounts Accounts payable Jenny Colo, Capital Jenny Colo, Withdrawals Sales Sales discounts Sales returns and allowances Cost of goods sold Depr Expense-Office equipment Depr. Expense-Store equipment Office salaries expense Sales salaries expense Insurance expense Rent expense, office space Rent expense, selling space Office supplies expense Store supplies expense Utilities expense Totals Net income Totals COLO COMPANY Balance Sheet May 31 Assets Current assets: Total current assets Plant assets Total plant assets Total assets Total current assets Plant assets Total plant assets Total assets Liabilities Current liabilities: Total liabilities Equity Total liabilities and equity COLO COMPANY Post-Closing Trial Balance May 31 Debit Credit Totals COLO COMPANY Schedule of Accounts Receivable May 31 Crane Corp Hensel Company Knox, Inc. Lee Services Total accounts receivable COLO COMPANY Schedule of Accounts Payable May 31 Peyton Products Gear Supply Co. Fink Corp Garcia, Inc. Total accounts payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started