Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2B must be done in addition rather than multiplication. If that does not make sense please just do what you can. Koontz Company manufactures two

2B must be done in addition rather than multiplication. If that does not make sense please just do what you can.

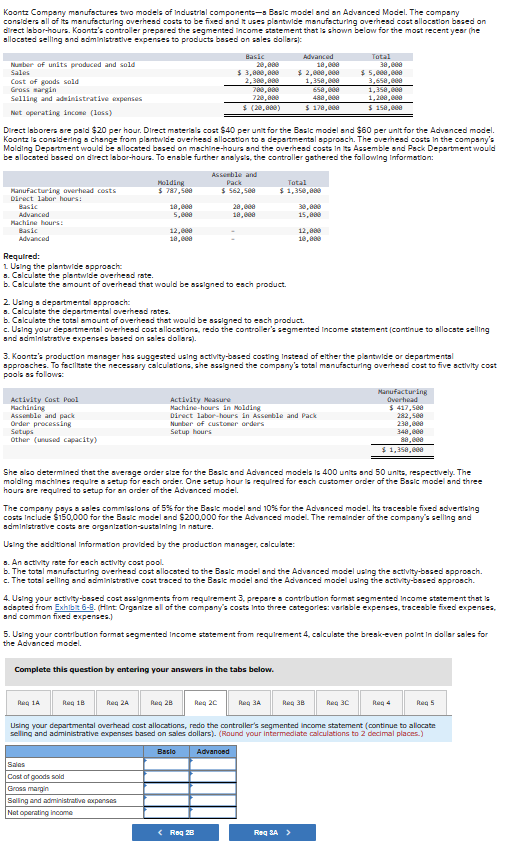

Koontz Company manufactures two models of industrial components-s Basic model and an Advanced Model. The compsny considers all of its manufocturing overhesd costs to be fixed snd it uses plantwide manufocturing overhesd cost sllocstion bosed on cl'rect labor-hours. Koontz's controler prepored the segmented income statement that ls shown below for the most recentyesr (he sllocsted selling and adminlstrative expenses to products bosed on sales dallarsi: Drect lsborers are psid $20 per hour. Direct materisls cost $40 per unit for the Bosic model snd $60 per unlt for the Advonced model. Koontz ls considering o change from plantwide overhesd allocation to a deportmental opprosch. The overhesd costa in the compsny's Molding Department would be allocoted bosed on moch'ne-hours and the overhesd costa in ita Assemble and Pack. Deportment would be allocated bosed on direct labor-hours. To ensble further analysk, the controller gathered the following linformation: Required: 2. Uaing the plantwide spprosch: s. Colculate the plantwide overhead rate. b. Calculate the amount of overhesd that would be assigned to each product. 2. Using o deportmentsil spprooch: s. Colculate the deportmental overhesd rates. b. Calculate the tatsl amount of overhead that would be sssigned to each product. c. Using your deportmental overhesd cost allocations, redo the controler's segmented income ststement (continue to sllocste selling snd sdministrative expenses bosed on soles dolars). 3. Koontz's production manoger has suggested using activity-bosed costing Instead of elther the plantwide ar deportmentsl spprooches. To facilitate the necesssy calculations, she ssalgned the compsny's total manufacturing averhead cost to five sctivity coat pools so follows: She olso determ'ned that the sversge order size for the Basic and Advanced models is 400 unlta snd 50 units, respectively. The molding mochines require a setup for each order. One setup hour ls requlred for esch customer order of the Bssic model and three hours are requ'red to setup for on order of the Advanced model. The compony psys a ssies commissions of 5% for the Bask model and 10% for the Advsnced model. Its tracesble fixed solvertising costs Include $150,000 for the Basic model and $200,000 for the Advonced model. The rema'nder of the compony's selling and sdministrative costs are arganizstion-sustaining in noture. Uaing the additionsl Information provided by the production manager, calculate: s. An activity rate for each sctlility cost pool. b. The total msnufacturing overhesd cost allacated to the Bssic model and the Advanced model us'ng the sctlvity-bssed spprosch. c. The totsl selling and odminlstrative cost troced to the Bask model and the Advanced model using the activity-bosed approsch. 4. Using your activity-bosed cost asignments from requirement 3, prepore a contribution formst segmented income statement thst is sind common fixed expences.) 5. Us'ng your contribution format segmented income statement from requirement 4, calculste the bresk-even point in dollar sales for the Advonced model. Complete this question by entering your answers in the tabs below. Using your departmental overhead cost allocations, redo the contraller's segmented income statement (continue to allocate seling and administrative expenses based on sales dallars). (Raund your intermediate calculatians to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started