Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Netflix Here below you will find selected financial data of Netflix. Use this data to study a hypothetical situation, when the otherwise very

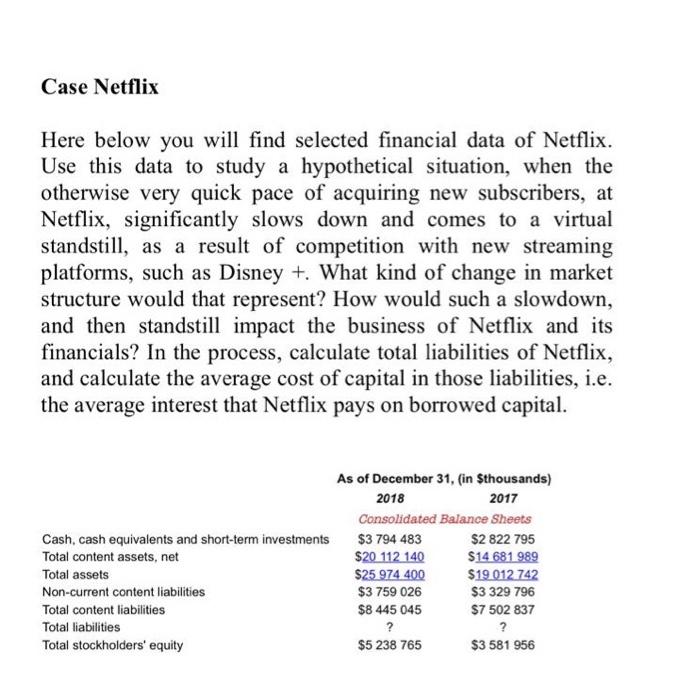

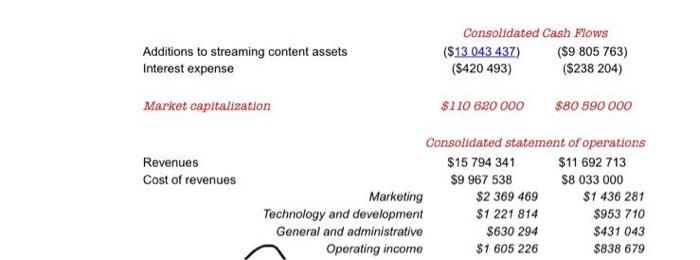

Case Netflix Here below you will find selected financial data of Netflix. Use this data to study a hypothetical situation, when the otherwise very quick pace of acquiring new subscribers, at Netflix, significantly slows down and comes to a virtual standstill, as a result of competition with new streaming platforms, such as Disney +. What kind of change in market structure would that represent? How would such a slowdown, and then standstill impact the business of Netflix and its financials? In the process, calculate total liabilities of Netflix, and calculate the average cost of capital in those liabilities, i.e. the average interest that Netflix pays on borrowed capital. Cash, cash equivalents and short-term investments Total content assets, net Total assets Non-current content liabilities Total content liabilities Total liabilities Total stockholders' equity As of December 31, (in $thousands) 2018 2017 Consolidated Balance Sheets $3 794 483 $20 112 140 $25.974 400 $3 759 026 $8 445 045 ? $5 238 765 $2 822 795 $14 681 989 $19 012 742 $3 329 796 $7 502 837 ? $3 581 956 Additions to streaming content assets Interest expense Market capitalization Revenues Cost of revenues Marketing Technology and development General and administrative Operating income Consolidated Cash Flows ($13 043 437) ($420 493) $110 620 000 ($9 805 763) ($238 204) $2 369 469 $1 221 814 $630 294 $1 605 226 $80 590 000 Consolidated statement $15 794 341 $9 967 538 of operations $11 692 713 $8 033 000 $1 436 281 $953 710 $431 043 $838 679

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

The change in market structure would represent a monopoly A monopoly is a market structure in which there is only one firm that produces a product or service This firm is the only one that can supply ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started