Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2nd and 3rd pic answers please! ACME Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the

2nd and 3rd pic answers please!

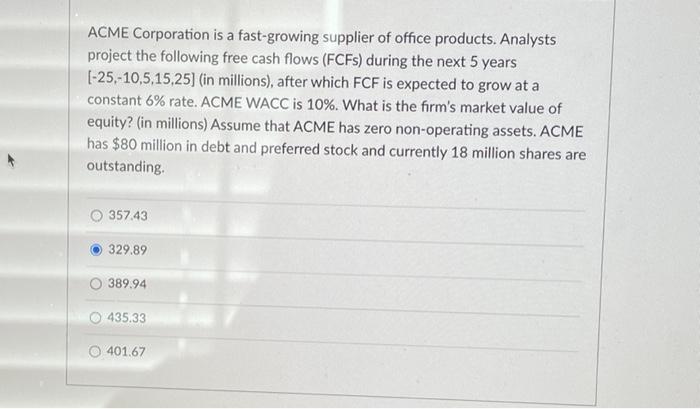

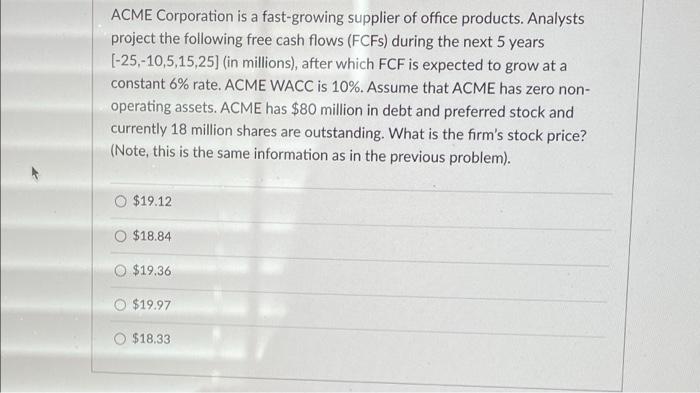

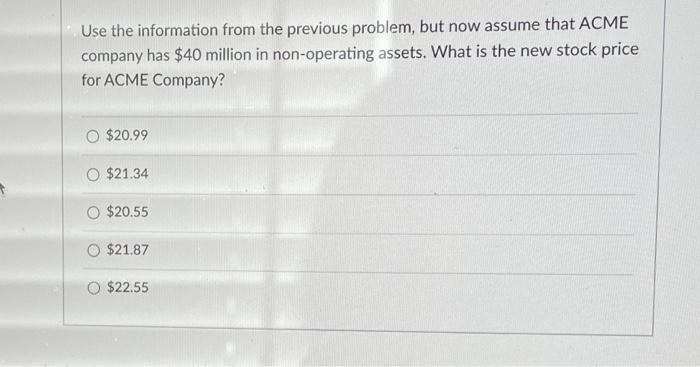

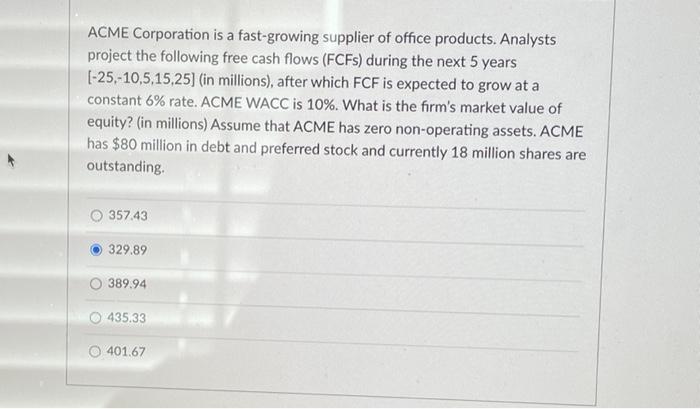

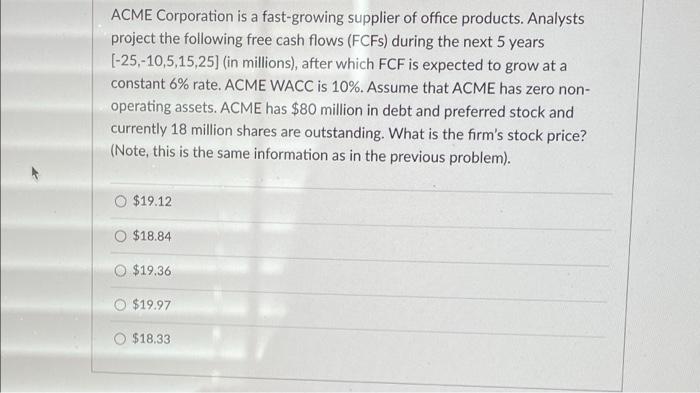

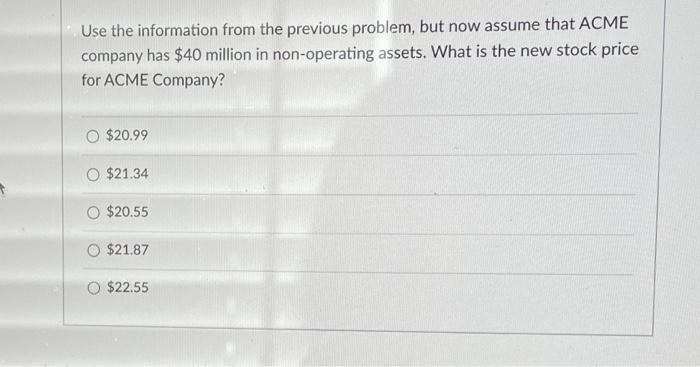

ACME Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 5 years [-25,-10,5,15,25) (in millions), after which FCF is expected to grow at a constant 6% rate. ACME WACC is 10%. What is the firm's market value of equity? (in millions) Assume that ACME has zero non-operating assets. ACME has $80 million in debt and preferred stock and currently 18 million shares are outstanding. 357.43 329.89 O 389.94 435.33 401.67 ACME Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 5 years [-25, -10,5,15,25) (in millions), after which FCF is expected to grow at a constant 6% rate. ACME WACC is 10%. Assume that ACME has zero non- operating assets. ACME has $80 million in debt and preferred stock and currently 18 million shares are outstanding. What is the firm's stock price? (Note, this is the same information as in the previous problem). $19.12 O $18.84 $19.36 O $19.97 $18.33 Use the information from the previous problem, but now assume that ACME company has $40 million in non-operating assets. What is the new stock price for ACME Company? $20.99 O $21.34 O $20.55 $21.87 $22.55

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started