Answered step by step

Verified Expert Solution

Question

1 Approved Answer

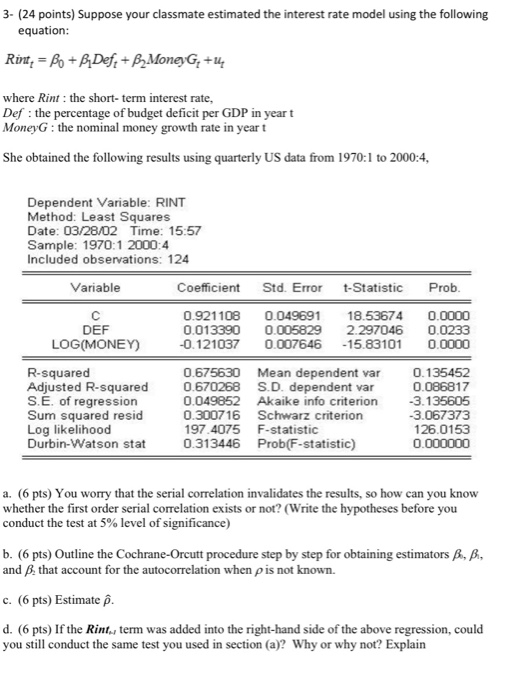

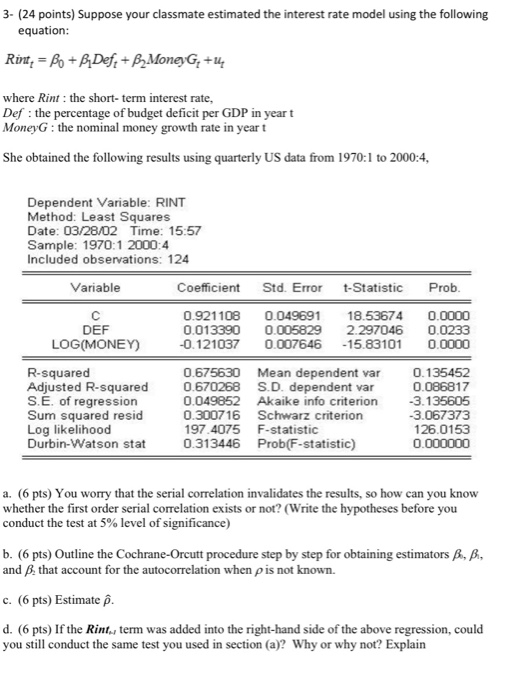

3- (24 points) Suppose your classmate estimated the interest rate model using the following equation: Rint, = Bo +B_Def,+B MoneyG, +14 where Rint: the short-term

3- (24 points) Suppose your classmate estimated the interest rate model using the following equation: Rint, = Bo +B_Def,+B MoneyG, +14 where Rint: the short-term interest rate, Def : the percentage of budget deficit per GDP in yeart MoneyG: the nominal money growth rate in yeart She obtained the following results using quarterly US data from 1970:1 to 2000:4, Dependent Variable: RINT Method: Least Squares Date: 03/28/02 Time: 15:57 Sample: 1970:1 2000:4 Included observations: 124 Variable Std. Error Prob. Coefficient 0.921108 0.013390 -0.121037 0.049691 0.005829 0.007646 t-Statistic 18.53674 2.297046 -15.83101 0.0000 0.0233 0.0000 DEF LOG(MONEY) R-squared Adjusted R-squared S. E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.675630 Mean dependent var 0.670268 S.D. dependent var 0.049852 Akaike info criterion 0.300716 Schwarz criterion 197 4075 F-statistic 0.313446 Prob(F-statistic) 0.135452 0.086817 -3.135605 -3.067373 126.0153 0.000000 a. (6 pts) You worry that the serial correlation invalidates the results, so how can you know whether the first order serial correlation exists or not? (Write the hypotheses before you conduct the test at 5% level of significance) b. (6 pts) Outline the Cochrane-Orcutt procedure step by step for obtaining estimators B, B, and B. that account for the autocorrelation when p is not known. c. (6 pts) Estimate p. d. (6 pts) If the Rint., term was added into the right-hand side of the above regression, could you still conduct the same test you used in section (a)? Why or why not? Explain 3- (24 points) Suppose your classmate estimated the interest rate model using the following equation: Rint, = Bo +B_Def,+B MoneyG, +14 where Rint: the short-term interest rate, Def : the percentage of budget deficit per GDP in yeart MoneyG: the nominal money growth rate in yeart She obtained the following results using quarterly US data from 1970:1 to 2000:4, Dependent Variable: RINT Method: Least Squares Date: 03/28/02 Time: 15:57 Sample: 1970:1 2000:4 Included observations: 124 Variable Std. Error Prob. Coefficient 0.921108 0.013390 -0.121037 0.049691 0.005829 0.007646 t-Statistic 18.53674 2.297046 -15.83101 0.0000 0.0233 0.0000 DEF LOG(MONEY) R-squared Adjusted R-squared S. E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.675630 Mean dependent var 0.670268 S.D. dependent var 0.049852 Akaike info criterion 0.300716 Schwarz criterion 197 4075 F-statistic 0.313446 Prob(F-statistic) 0.135452 0.086817 -3.135605 -3.067373 126.0153 0.000000 a. (6 pts) You worry that the serial correlation invalidates the results, so how can you know whether the first order serial correlation exists or not? (Write the hypotheses before you conduct the test at 5% level of significance) b. (6 pts) Outline the Cochrane-Orcutt procedure step by step for obtaining estimators B, B, and B. that account for the autocorrelation when p is not known. c. (6 pts) Estimate p. d. (6 pts) If the Rint., term was added into the right-hand side of the above regression, could you still conduct the same test you used in section (a)? Why or why not? Explain

3- (24 points) Suppose your classmate estimated the interest rate model using the following equation: Rint, = Bo +B_Def,+B MoneyG, +14 where Rint: the short-term interest rate, Def : the percentage of budget deficit per GDP in yeart MoneyG: the nominal money growth rate in yeart She obtained the following results using quarterly US data from 1970:1 to 2000:4, Dependent Variable: RINT Method: Least Squares Date: 03/28/02 Time: 15:57 Sample: 1970:1 2000:4 Included observations: 124 Variable Std. Error Prob. Coefficient 0.921108 0.013390 -0.121037 0.049691 0.005829 0.007646 t-Statistic 18.53674 2.297046 -15.83101 0.0000 0.0233 0.0000 DEF LOG(MONEY) R-squared Adjusted R-squared S. E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.675630 Mean dependent var 0.670268 S.D. dependent var 0.049852 Akaike info criterion 0.300716 Schwarz criterion 197 4075 F-statistic 0.313446 Prob(F-statistic) 0.135452 0.086817 -3.135605 -3.067373 126.0153 0.000000 a. (6 pts) You worry that the serial correlation invalidates the results, so how can you know whether the first order serial correlation exists or not? (Write the hypotheses before you conduct the test at 5% level of significance) b. (6 pts) Outline the Cochrane-Orcutt procedure step by step for obtaining estimators B, B, and B. that account for the autocorrelation when p is not known. c. (6 pts) Estimate p. d. (6 pts) If the Rint., term was added into the right-hand side of the above regression, could you still conduct the same test you used in section (a)? Why or why not? Explain 3- (24 points) Suppose your classmate estimated the interest rate model using the following equation: Rint, = Bo +B_Def,+B MoneyG, +14 where Rint: the short-term interest rate, Def : the percentage of budget deficit per GDP in yeart MoneyG: the nominal money growth rate in yeart She obtained the following results using quarterly US data from 1970:1 to 2000:4, Dependent Variable: RINT Method: Least Squares Date: 03/28/02 Time: 15:57 Sample: 1970:1 2000:4 Included observations: 124 Variable Std. Error Prob. Coefficient 0.921108 0.013390 -0.121037 0.049691 0.005829 0.007646 t-Statistic 18.53674 2.297046 -15.83101 0.0000 0.0233 0.0000 DEF LOG(MONEY) R-squared Adjusted R-squared S. E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.675630 Mean dependent var 0.670268 S.D. dependent var 0.049852 Akaike info criterion 0.300716 Schwarz criterion 197 4075 F-statistic 0.313446 Prob(F-statistic) 0.135452 0.086817 -3.135605 -3.067373 126.0153 0.000000 a. (6 pts) You worry that the serial correlation invalidates the results, so how can you know whether the first order serial correlation exists or not? (Write the hypotheses before you conduct the test at 5% level of significance) b. (6 pts) Outline the Cochrane-Orcutt procedure step by step for obtaining estimators B, B, and B. that account for the autocorrelation when p is not known. c. (6 pts) Estimate p. d. (6 pts) If the Rint., term was added into the right-hand side of the above regression, could you still conduct the same test you used in section (a)? Why or why not? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started