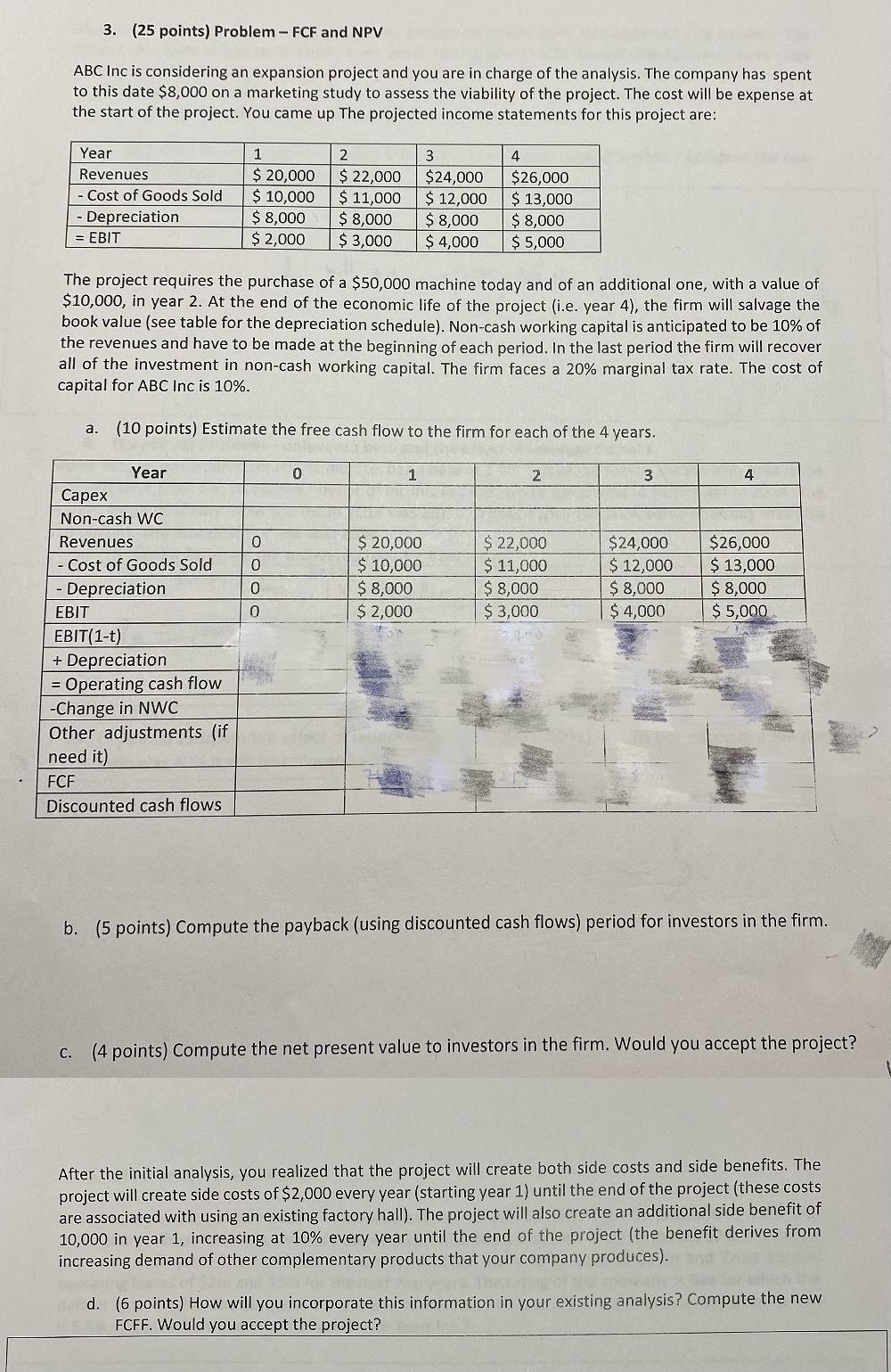

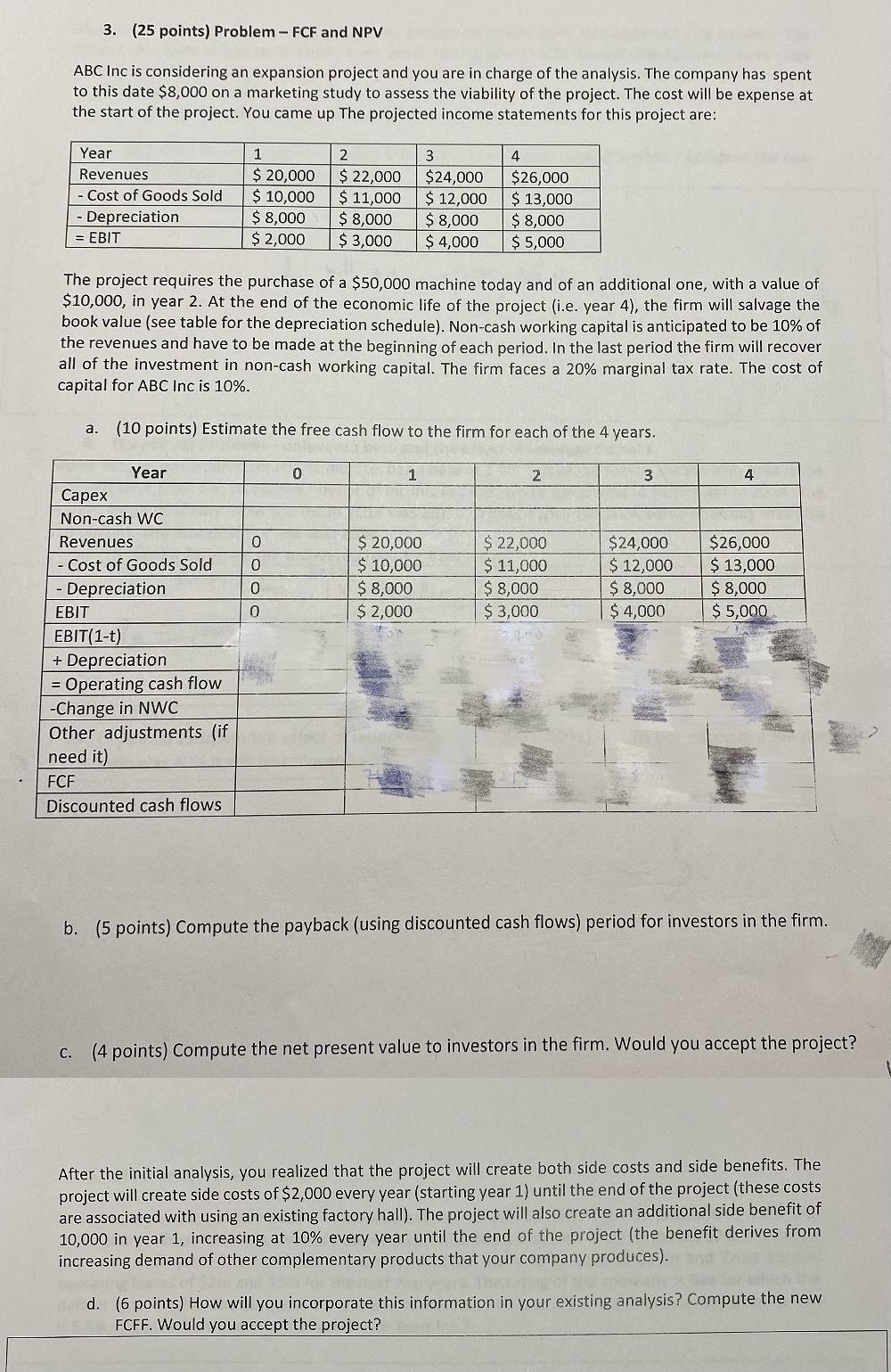

3. (25 points) Problem - FCF and NPV ABC Inc is considering an expansion project and you are in charge of the analysis. The company has spent to this date $8,000 on a marketing study to assess the viability of the project. The cost will be expense at the start of the project. You came up The projected income statements for this project are: 4 Year Revenues - Cost of Goods Sold Depreciation = EBIT 1 $ 20,000 $ 10,000 $ 8,000 $ 2,000 2 $ 22,000 $ 11,000 $ 8,000 $ 3,000 3 $24,000 $ 12,000 $ 8,000 $ 4,000 $26,000 $ 13,000 $ 8,000 $5,000 The project requires the purchase of a $50,000 machine today and of an additional one, with a value of $10,000, in year 2. At the end of the economic life of the project (i.e. year 4), the firm will salvage the book value (see table for the depreciation schedule). Non-cash working capital is anticipated to be 10% of the revenues and have to be made at the beginning of each period. In the last period the firm will recover all of the investment in non-cash working capital. The firm faces a 20% marginal tax rate. The cost of capital for ABC Inc is 10%. a. (10 points) Estimate the free cash flow to the firm for each of the 4 years. 0 2 3 4 0 0 $ 20,000 $ 10,000 $ 8,000 $ 2,000 $ 22,000 $ 11,000 $ 8,000 $ 3,000 $24,000 $ 12,000 $ 8,000 $ 4,000 $26,000 $ 13,000 $ 8,000 $ 5,000 0 0 Year Capex Non-cash WC Revenues Cost of Goods Sold - Depreciation EBIT EBIT(1-t) + Depreciation = Operating cash flow -Change in NWC Other adjustments (if need it) FCF Discounted cash flows b. (5 points) Compute the payback (using discounted cash flows) period for investors in the firm. C. (4 points) Compute the net present value to investors in the firm. Would you accept the project? After the initial analysis, you realized that the project will create both side costs and side benefits. The project will create side costs of $2,000 every year (starting year 1) until the end of the project (these costs are associated with using an existing factory hall). The project will also create an additional side benefit of 10,000 in year 1, increasing at 10% every year until the end of the project (the benefit derives from increasing demand of other complementary products that your company produces). d. (6 points) How will you incorporate this information in your existing analysis? Compute the new FCFF. Would you accept the project? 3. (25 points) Problem - FCF and NPV ABC Inc is considering an expansion project and you are in charge of the analysis. The company has spent to this date $8,000 on a marketing study to assess the viability of the project. The cost will be expense at the start of the project. You came up The projected income statements for this project are: 4 Year Revenues - Cost of Goods Sold Depreciation = EBIT 1 $ 20,000 $ 10,000 $ 8,000 $ 2,000 2 $ 22,000 $ 11,000 $ 8,000 $ 3,000 3 $24,000 $ 12,000 $ 8,000 $ 4,000 $26,000 $ 13,000 $ 8,000 $5,000 The project requires the purchase of a $50,000 machine today and of an additional one, with a value of $10,000, in year 2. At the end of the economic life of the project (i.e. year 4), the firm will salvage the book value (see table for the depreciation schedule). Non-cash working capital is anticipated to be 10% of the revenues and have to be made at the beginning of each period. In the last period the firm will recover all of the investment in non-cash working capital. The firm faces a 20% marginal tax rate. The cost of capital for ABC Inc is 10%. a. (10 points) Estimate the free cash flow to the firm for each of the 4 years. 0 2 3 4 0 0 $ 20,000 $ 10,000 $ 8,000 $ 2,000 $ 22,000 $ 11,000 $ 8,000 $ 3,000 $24,000 $ 12,000 $ 8,000 $ 4,000 $26,000 $ 13,000 $ 8,000 $ 5,000 0 0 Year Capex Non-cash WC Revenues Cost of Goods Sold - Depreciation EBIT EBIT(1-t) + Depreciation = Operating cash flow -Change in NWC Other adjustments (if need it) FCF Discounted cash flows b. (5 points) Compute the payback (using discounted cash flows) period for investors in the firm. C. (4 points) Compute the net present value to investors in the firm. Would you accept the project? After the initial analysis, you realized that the project will create both side costs and side benefits. The project will create side costs of $2,000 every year (starting year 1) until the end of the project (these costs are associated with using an existing factory hall). The project will also create an additional side benefit of 10,000 in year 1, increasing at 10% every year until the end of the project (the benefit derives from increasing demand of other complementary products that your company produces). d. (6 points) How will you incorporate this information in your existing analysis? Compute the new FCFF. Would you accept the project