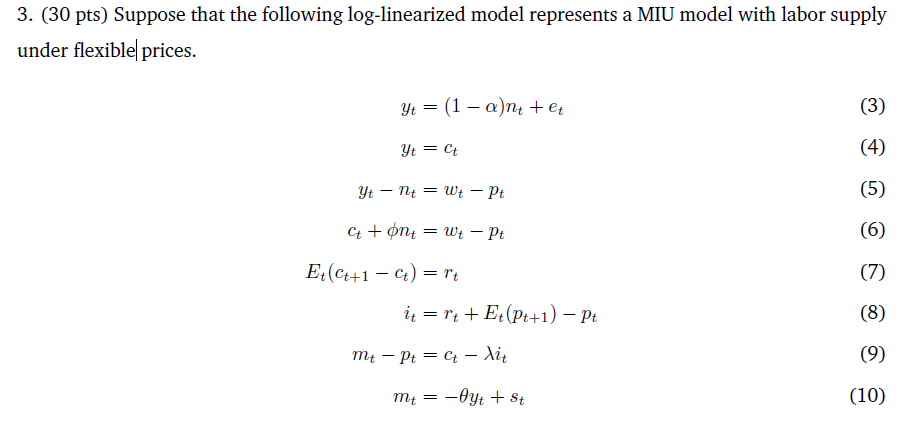

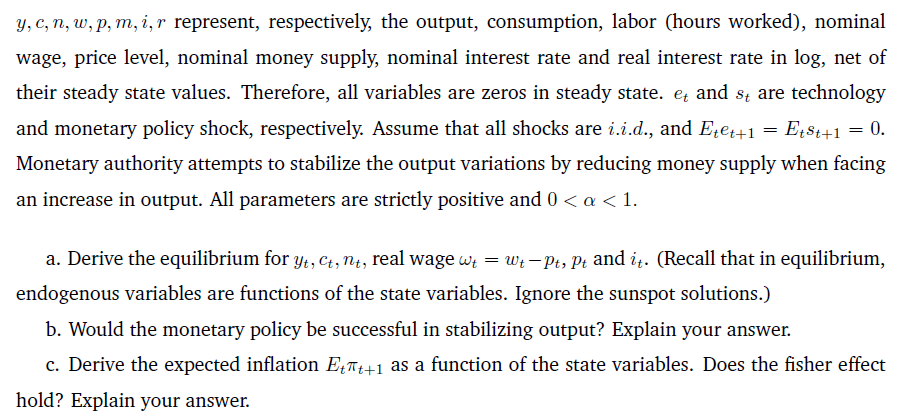

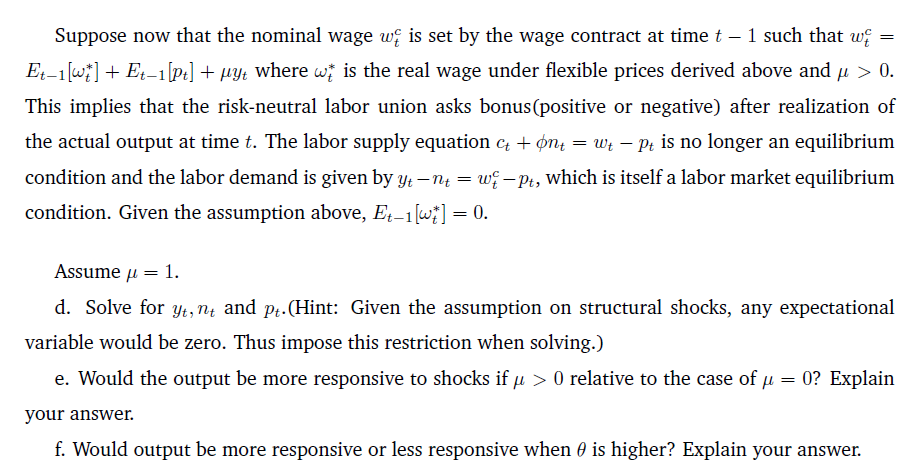

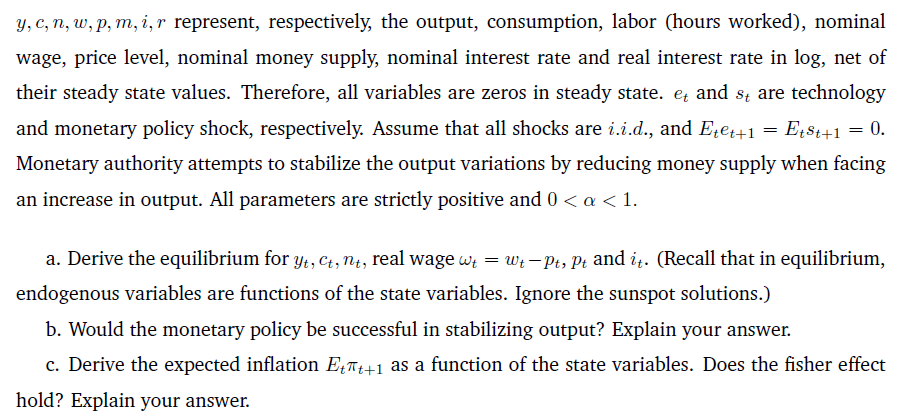

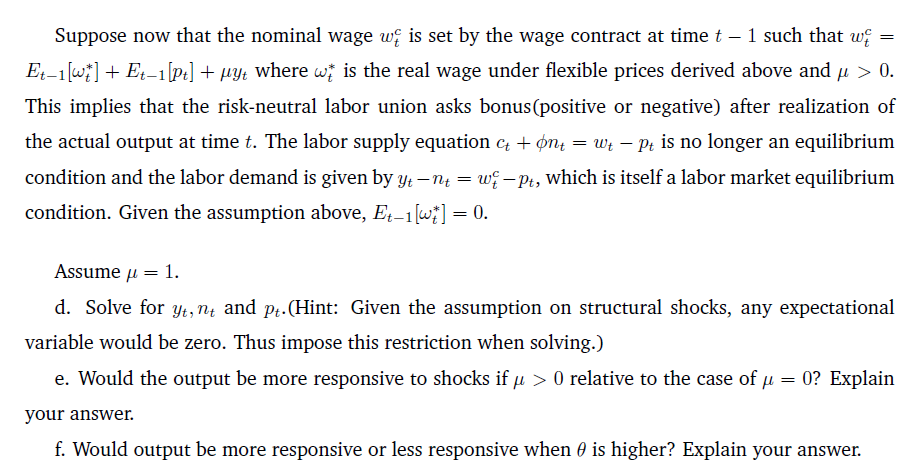

3. (30 pts) Suppose that the following log-linearized model represents a MIU model with labor supply under flexible| prices. ytytytntct+ntEt(ct+1ct)itmtptmt=(1)nt+et=ct=wtpt=wtpt=rt=rt+Et(pt+1)pt=ctit=yt+st y,c,n,w,p,m,i,r represent, respectively, the output, consumption, labor (hours worked), nominal wage, price level, nominal money supply, nominal interest rate and real interest rate in log, net of their steady state values. Therefore, all variables are zeros in steady state. et and st are technology and monetary policy shock, respectively. Assume that all shocks are i.i.d., and Etet+1=Etst+1=0. Monetary authority attempts to stabilize the output variations by reducing money supply when facing an increase in output. All parameters are strictly positive and 00. This implies that the risk-neutral labor union asks bonus(positive or negative) after realization of the actual output at time t. The labor supply equation ct+nt=wtpt is no longer an equilibrium condition and the labor demand is given by ytnt=wtcpt, which is itself a labor market equilibrium condition. Given the assumption above, Et1[t]=0. Assume =1. d. Solve for yt,nt and pt.(Hint: Given the assumption on structural shocks, any expectational variable would be zero. Thus impose this restriction when solving.) e. Would the output be more responsive to shocks if >0 relative to the case of =0 ? Explain your answer. f. Would output be more responsive or less responsive when is higher? Explain your answer. 3. (30 pts) Suppose that the following log-linearized model represents a MIU model with labor supply under flexible| prices. ytytytntct+ntEt(ct+1ct)itmtptmt=(1)nt+et=ct=wtpt=wtpt=rt=rt+Et(pt+1)pt=ctit=yt+st y,c,n,w,p,m,i,r represent, respectively, the output, consumption, labor (hours worked), nominal wage, price level, nominal money supply, nominal interest rate and real interest rate in log, net of their steady state values. Therefore, all variables are zeros in steady state. et and st are technology and monetary policy shock, respectively. Assume that all shocks are i.i.d., and Etet+1=Etst+1=0. Monetary authority attempts to stabilize the output variations by reducing money supply when facing an increase in output. All parameters are strictly positive and 00. This implies that the risk-neutral labor union asks bonus(positive or negative) after realization of the actual output at time t. The labor supply equation ct+nt=wtpt is no longer an equilibrium condition and the labor demand is given by ytnt=wtcpt, which is itself a labor market equilibrium condition. Given the assumption above, Et1[t]=0. Assume =1. d. Solve for yt,nt and pt.(Hint: Given the assumption on structural shocks, any expectational variable would be zero. Thus impose this restriction when solving.) e. Would the output be more responsive to shocks if >0 relative to the case of =0 ? Explain your answer. f. Would output be more responsive or less responsive when is higher? Explain your