Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3, 4, 5, 6, 7 please The beginning PPE balance of Hawkeye Games Inc. is $29K. In the year, it sold equipment with a book

3, 4, 5, 6, 7 please

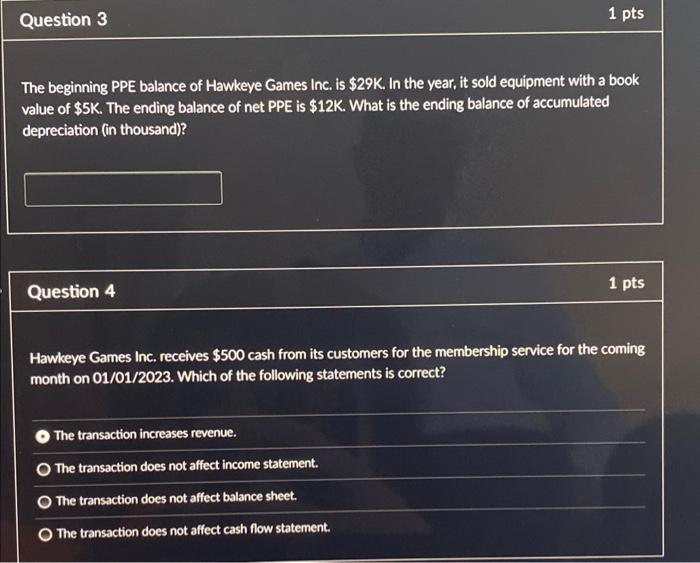

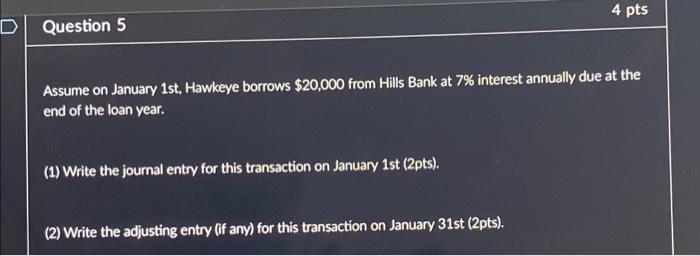

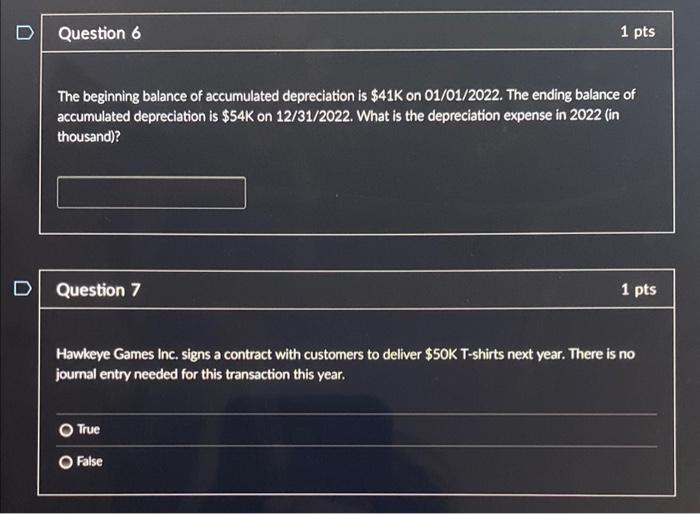

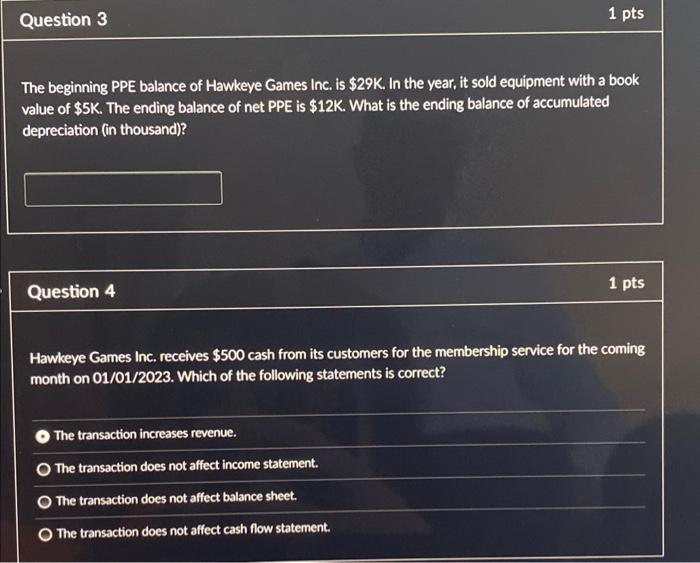

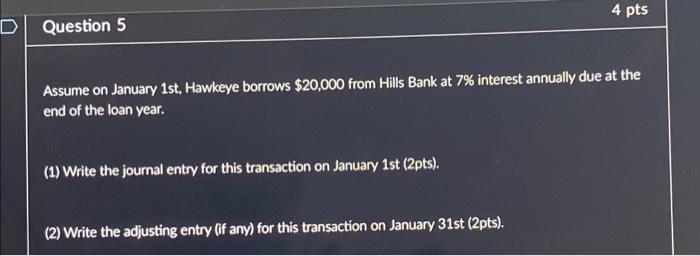

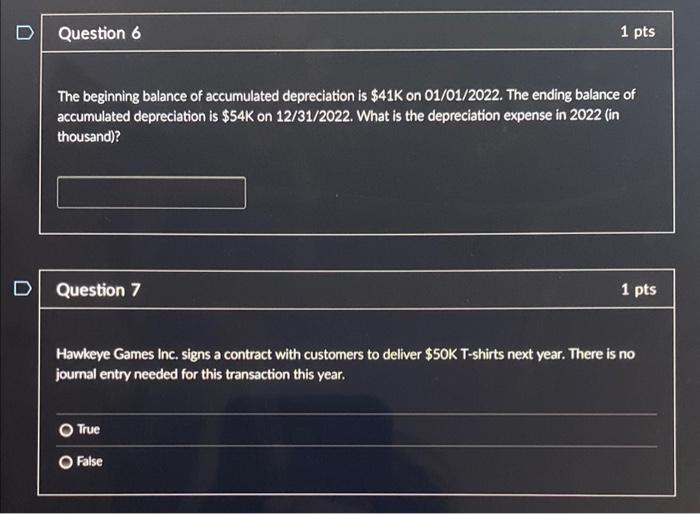

The beginning PPE balance of Hawkeye Games Inc. is $29K. In the year, it sold equipment with a book value of $5K. The ending balance of net PPE is $12K. What is the ending balance of accumulated depreciation (in thousand)? Question 4 1 pts Hawkeye Games Inc. receives $500 cash from its customers for the membership service for the coming month on 01/01/2023. Which of the following statements is correct? The transaction increases revenue. The transaction does not affect income statement. The transaction does not affect balance sheet. The transaction does not affect cash flow statement. Assume on January 1st, Hawkeye borrows $20,000 from Hills Bank at 7% interest annually due at the end of the loan year. (1) Write the journal entry for this transaction on January 1st (2pts). (2) Write the adjusting entry (if any) for this transaction on January 31 st (2pts). The beginning balance of accumulated depreciation is $41K on 01/01/2022. The ending balance of accumulated depreciation is $54K on 12/31/2022. What is the depreciation expense in 2022 (in thousand)? Question 7 Hawkeye Games Inc. signs a contract with customers to deliver $50K T-shirts next year. There is no journal entry needed for this transaction this year. The beginning PPE balance of Hawkeye Games Inc. is $29K. In the year, it sold equipment with a book value of $5K. The ending balance of net PPE is $12K. What is the ending balance of accumulated depreciation (in thousand)? Question 4 1 pts Hawkeye Games Inc. receives $500 cash from its customers for the membership service for the coming month on 01/01/2023. Which of the following statements is correct? The transaction increases revenue. The transaction does not affect income statement. The transaction does not affect balance sheet. The transaction does not affect cash flow statement. Assume on January 1st, Hawkeye borrows $20,000 from Hills Bank at 7% interest annually due at the end of the loan year. (1) Write the journal entry for this transaction on January 1st (2pts). (2) Write the adjusting entry (if any) for this transaction on January 31 st (2pts). The beginning balance of accumulated depreciation is $41K on 01/01/2022. The ending balance of accumulated depreciation is $54K on 12/31/2022. What is the depreciation expense in 2022 (in thousand)? Question 7 Hawkeye Games Inc. signs a contract with customers to deliver $50K T-shirts next year. There is no journal entry needed for this transaction this year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started