Answered step by step

Verified Expert Solution

Question

1 Approved Answer

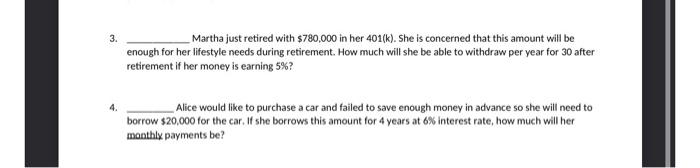

3. 4. Martha just retired with $780,000 in her 401(k). She is concerned that this amount will be enough for her lifestyle needs during retirement.

3. 4. Martha just retired with $780,000 in her 401(k). She is concerned that this amount will be enough for her lifestyle needs during retirement. How much will she be able to withdraw per year for 30 after retirement if her money is earning 5%? Alice would like to purchase a car and failed to save enough money in advance so she will need to borrow $20,000 for the car. If she borrows this amount for 4 years at 6% interest rate, how much will her monthly payments be?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started