Answered step by step

Verified Expert Solution

Question

1 Approved Answer

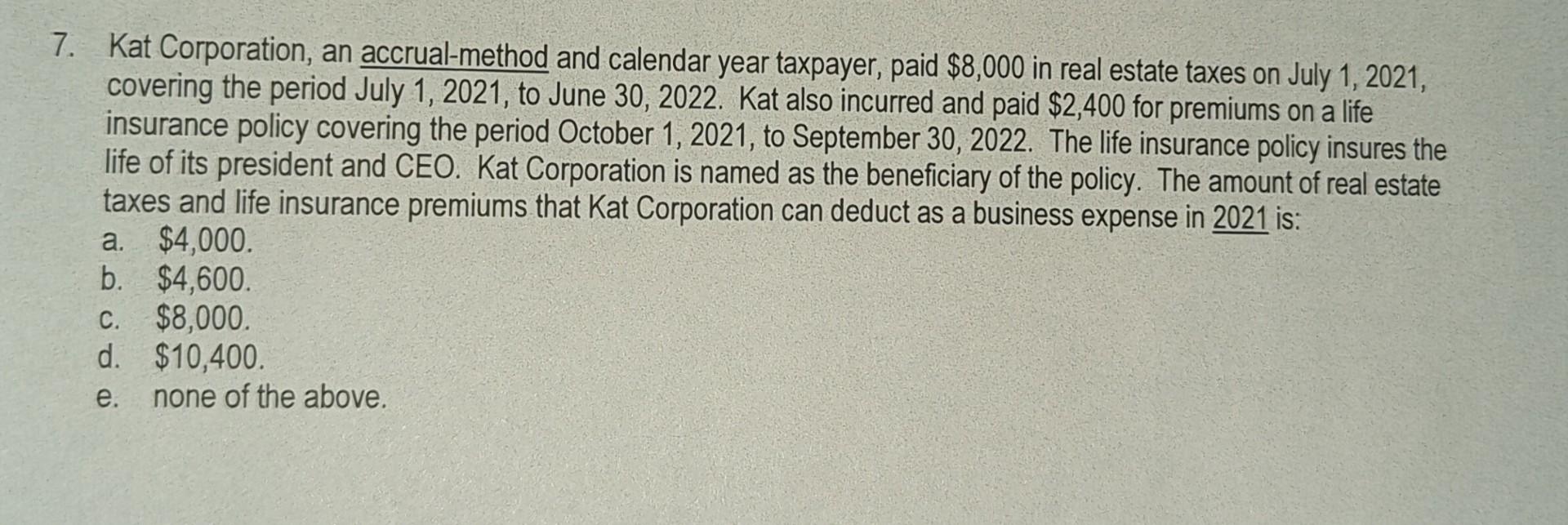

3 7. Kat Corporation, an accrual-method and calendar year taxpayer, paid $8,000 in real estate taxes on July 1, 2021, covering the period July 1,

3 7. Kat Corporation, an accrual-method and calendar year taxpayer, paid $8,000 in real estate taxes on July 1, 2021, covering the period July 1, 2021, to June 30, 2022. Kat also incurred and paid $2,400 for premiums on a life insurance policy covering the period October 1, 2021, to September 30, 2022. The life insurance policy insures the life of its president and CEO. Kat Corporation is named as the beneficiary of the policy. The amount of real estate taxes and life insurance premiums that Kat Corporation can deduct as a business expense in 2021 is: a. $4,000. b. $4,600. C. $8,000 d. $10,400. e. none of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started