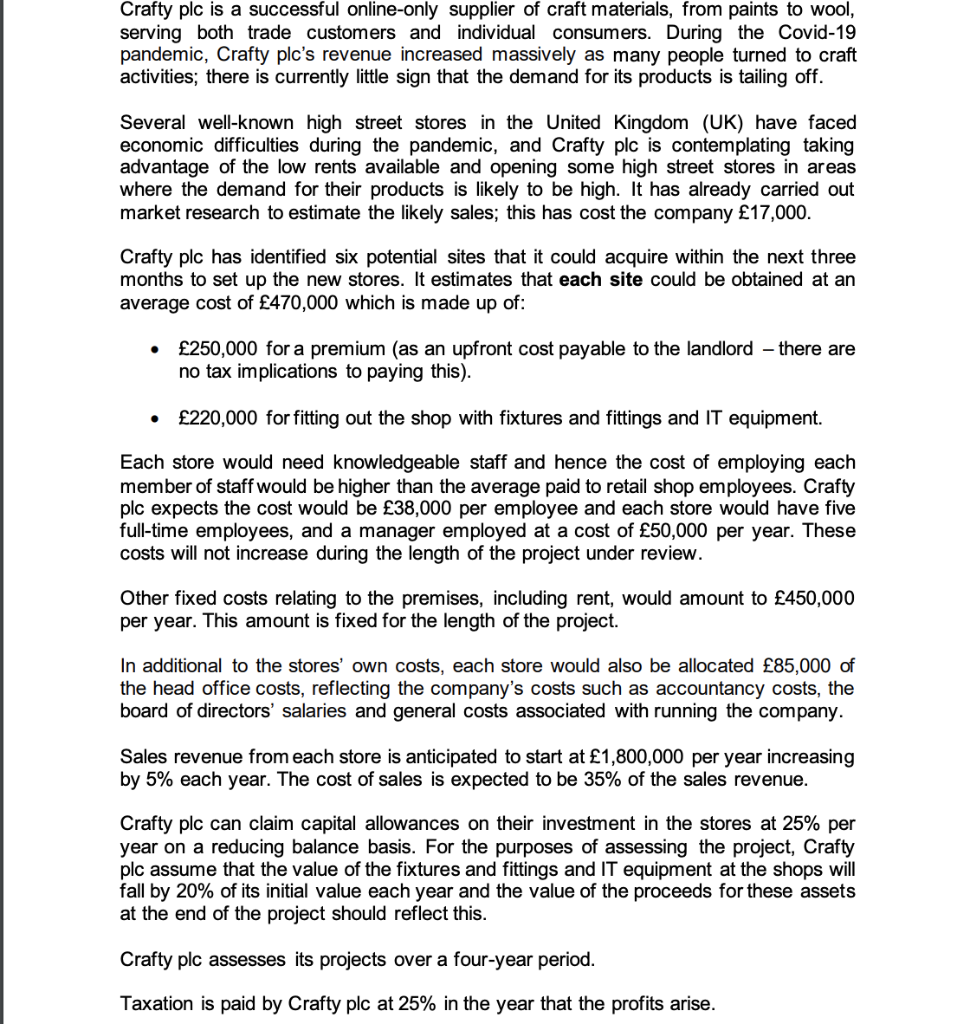

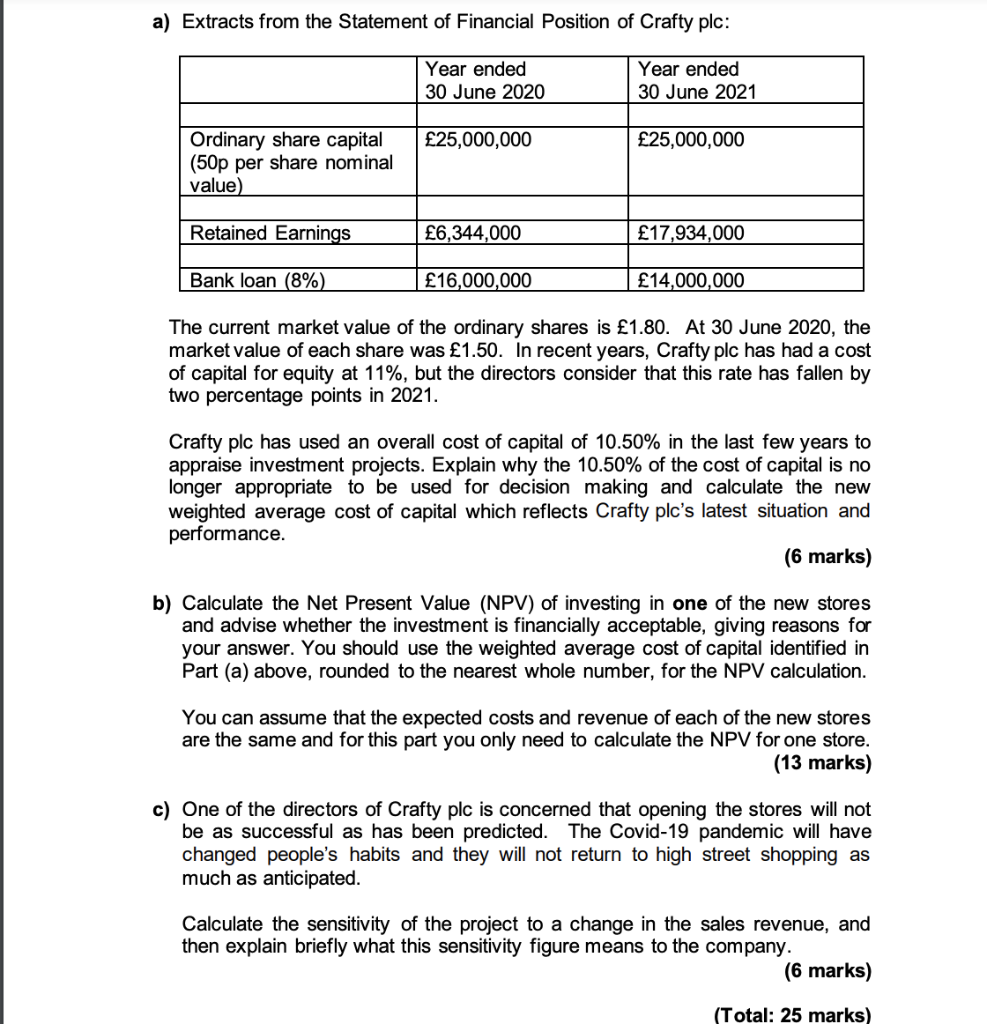

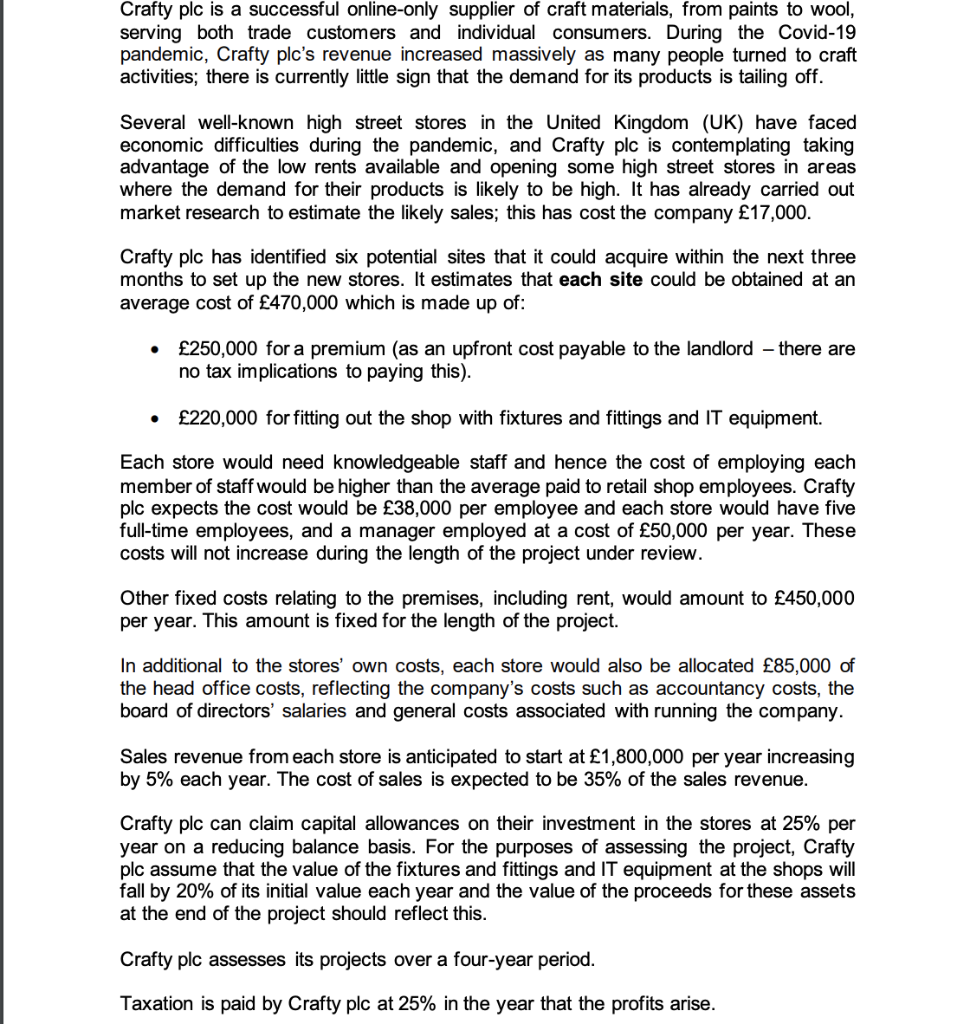

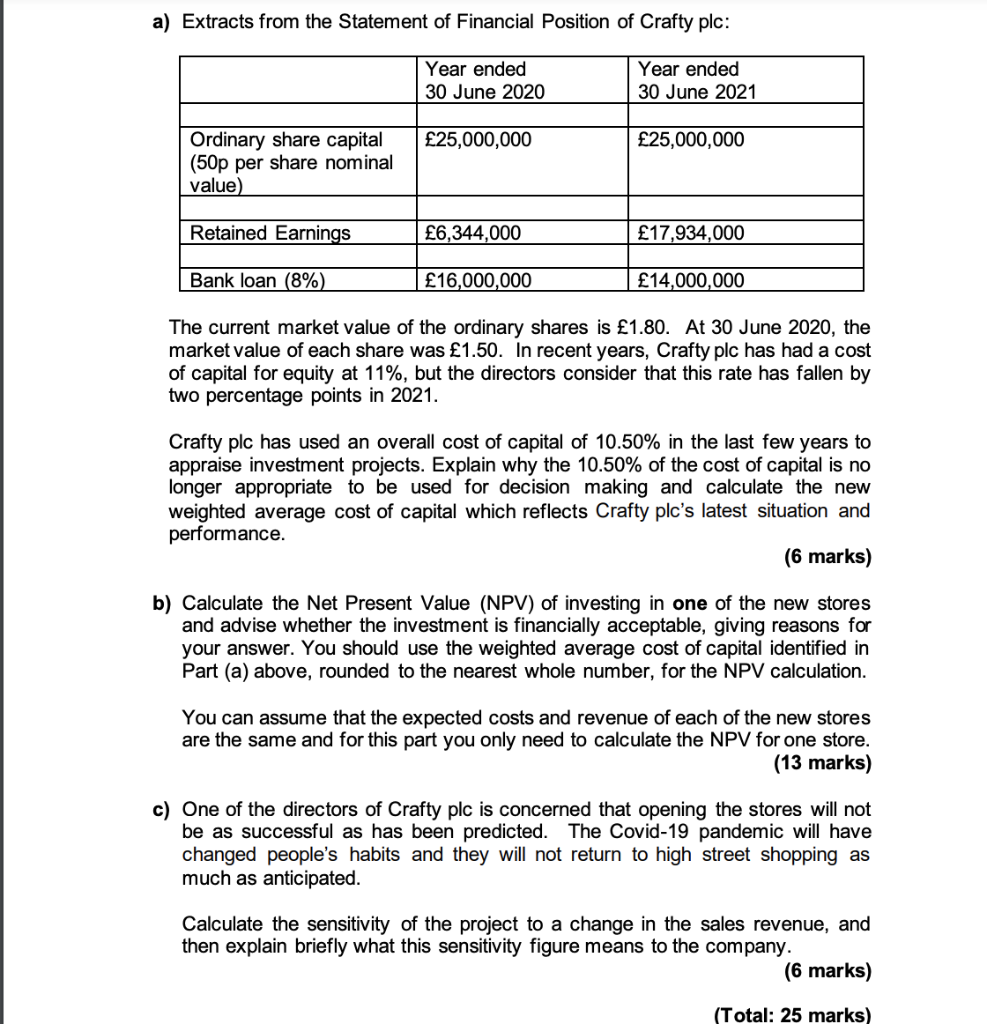

Crafty plc is a successful online-only supplier of craft materials, from paints to wool, serving both trade customers and individual consumers. During the Covid-19 pandemic, Crafty plc's revenue increased massively as many people turned to craft activities; there is currently little sign that the demand for its products is tailing off. Several well-known high street stores in the United Kingdom (UK) have faced economic difficulties during the pandemic, and Crafty plc is contemplating taking advantage of the low rents available and opening some high street stores in areas where the demand for their products is likely to be high. It has already carried out market research to estimate the likely sales; this has cost the company 17,000. Crafty plc has identified six potential sites that it could acquire within the next three months to set up the new stores. It estimates that each site could be obtained at an average cost of 470,000 which is made up of: . 250,000 for a premium (as an upfront cost payable to the landlord there are no tax implications to paying this). 220,000 for fitting out the shop with fixtures and fittings and IT equipment. Each store would need knowledgeable staff and hence the cost of employing each member of staff would be higher than the average paid to retail shop employees. Crafty plc expects the cost would be 38,000 per employee and each store would have five full-time employees, and a manager employed at a cost of 50,000 per year. These costs will not increase during the length of the project under review. Other fixed costs relating to the premises, including rent, would amount to 450,000 per year. This amount is fixed for the length of the project. In additional to the stores' own costs, each store would also be allocated 85,000 of the head office costs, reflecting the company's costs such as accountancy costs, the board of directors' salaries and general costs associated with running the company. Sales revenue from each store is anticipated to start at 1,800,000 per year increasing by 5% each year. The cost of sales is expected to be 35% of the sales revenue. Crafty plc can claim capital allowances on their investment in the stores at 25% per year on a reducing balance basis. For the purposes of assessing the project, Crafty plc assume that the value of the fixtures and fittings and IT equipment at the shops will fall by 20% of its initial value each year and the value of the proceeds for these assets at the end of the project should reflect this. Crafty plc assesses its projects over a four-year period. Taxation is paid by Crafty plc at 25% in the year that the profits arise. a) Extracts from the Statement of Financial Position of Crafty plc: Year ended 30 June 2020 Year ended 30 June 2021 25,000,000 25,000,000 Ordinary share capital (50p per share nominal value) Retained Earnings 6,344,000 17,934,000 Bank loan (8%) 16,000,000 14,000,000 The current market value of the ordinary shares is 1.80. At 30 June 2020, the market value of each share was 1.50. In recent years, Crafty plc has had a cost of capital for equity at 11%, but the directors consider that this rate has fallen by two percentage points in 2021. Crafty plc has used an overall cost of capital of 10.50% in the last few years to appraise investment projects. Explain why the 10.50% of the cost of capital is no longer appropriate to be used for decision making and calculate the new weighted average cost of capital which reflects Crafty plc's latest situation and performance. (6 marks) b) Calculate the Net Present Value (NPV) of investing in one of the new stores and advise whether the investment is financially acceptable, giving reasons for your answer. You should use the weighted average cost of capital identified in Part (a) above, rounded to the nearest whole number, for the NPV calculation. You can assume that the expected costs and revenue of each of the new stores are the same and for this part you only need to calculate the NPV for one store. (13 marks) c) One of the directors of Crafty plc is concerned that opening the stores will not be as successful as has been predicted. The Covid-19 pandemic will have changed people's habits and they will not return to high street shopping as much as anticipated. Calculate the sensitivity of the project to a change in the sales revenue, and then explain briefly what this sensitivity figure means to the company. (6 marks) (Total: 25 marks) Crafty plc is a successful online-only supplier of craft materials, from paints to wool, serving both trade customers and individual consumers. During the Covid-19 pandemic, Crafty plc's revenue increased massively as many people turned to craft activities; there is currently little sign that the demand for its products is tailing off. Several well-known high street stores in the United Kingdom (UK) have faced economic difficulties during the pandemic, and Crafty plc is contemplating taking advantage of the low rents available and opening some high street stores in areas where the demand for their products is likely to be high. It has already carried out market research to estimate the likely sales; this has cost the company 17,000. Crafty plc has identified six potential sites that it could acquire within the next three months to set up the new stores. It estimates that each site could be obtained at an average cost of 470,000 which is made up of: . 250,000 for a premium (as an upfront cost payable to the landlord there are no tax implications to paying this). 220,000 for fitting out the shop with fixtures and fittings and IT equipment. Each store would need knowledgeable staff and hence the cost of employing each member of staff would be higher than the average paid to retail shop employees. Crafty plc expects the cost would be 38,000 per employee and each store would have five full-time employees, and a manager employed at a cost of 50,000 per year. These costs will not increase during the length of the project under review. Other fixed costs relating to the premises, including rent, would amount to 450,000 per year. This amount is fixed for the length of the project. In additional to the stores' own costs, each store would also be allocated 85,000 of the head office costs, reflecting the company's costs such as accountancy costs, the board of directors' salaries and general costs associated with running the company. Sales revenue from each store is anticipated to start at 1,800,000 per year increasing by 5% each year. The cost of sales is expected to be 35% of the sales revenue. Crafty plc can claim capital allowances on their investment in the stores at 25% per year on a reducing balance basis. For the purposes of assessing the project, Crafty plc assume that the value of the fixtures and fittings and IT equipment at the shops will fall by 20% of its initial value each year and the value of the proceeds for these assets at the end of the project should reflect this. Crafty plc assesses its projects over a four-year period. Taxation is paid by Crafty plc at 25% in the year that the profits arise. a) Extracts from the Statement of Financial Position of Crafty plc: Year ended 30 June 2020 Year ended 30 June 2021 25,000,000 25,000,000 Ordinary share capital (50p per share nominal value) Retained Earnings 6,344,000 17,934,000 Bank loan (8%) 16,000,000 14,000,000 The current market value of the ordinary shares is 1.80. At 30 June 2020, the market value of each share was 1.50. In recent years, Crafty plc has had a cost of capital for equity at 11%, but the directors consider that this rate has fallen by two percentage points in 2021. Crafty plc has used an overall cost of capital of 10.50% in the last few years to appraise investment projects. Explain why the 10.50% of the cost of capital is no longer appropriate to be used for decision making and calculate the new weighted average cost of capital which reflects Crafty plc's latest situation and performance. (6 marks) b) Calculate the Net Present Value (NPV) of investing in one of the new stores and advise whether the investment is financially acceptable, giving reasons for your answer. You should use the weighted average cost of capital identified in Part (a) above, rounded to the nearest whole number, for the NPV calculation. You can assume that the expected costs and revenue of each of the new stores are the same and for this part you only need to calculate the NPV for one store. (13 marks) c) One of the directors of Crafty plc is concerned that opening the stores will not be as successful as has been predicted. The Covid-19 pandemic will have changed people's habits and they will not return to high street shopping as much as anticipated. Calculate the sensitivity of the project to a change in the sales revenue, and then explain briefly what this sensitivity figure means to the company. (6 marks) (Total: 25 marks)