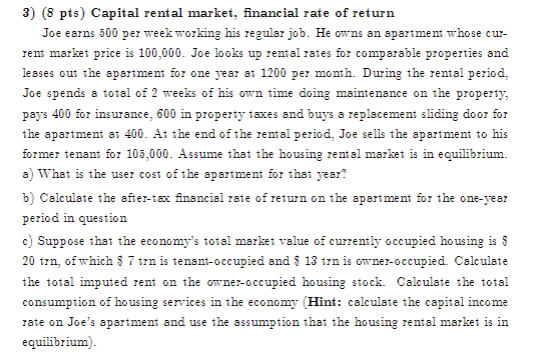

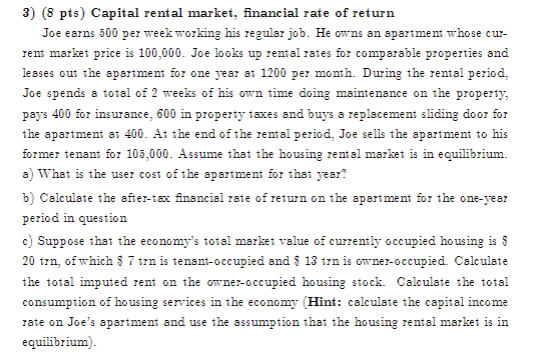

3) (8 pts) Capital rental market, financial rate of return Joe earns 500 per week working his regular job. He owns an apartment whose cur- rent market price is 100,000. Joe looks up rental rates for comparable properties and leases out the apartment for one year at 1200 per month. During the rental period, Joe spends a total of 2 weeks of his own time doing maintenance on the property, pays 400 for insurance, 600 in property taxes and buys a replacement sliding door for the apartment at 400. At the end of the rental period, Joe sells the apartment to his former tenant for 105,000. Assume that the housing rental market is in equilibrium. a) What is the user cost of the apartment for that year? b) Calculate the after-tax financial rate of return on the apartment for the one-year period in question c) Suppose that the economy's total market value of currently occupied housing is $ 20 tin, of which $ 7 ton is tenant-occupied and $ 13 trn is owner-occupied. Calculate the total imputed rent on the owner-occupied housing stock. Calculate the total consumption of housing services in the economy (Hint: calculate the capital income rate on Joe's apartment and use the assumption that the housing rental market is in equilibrium 3) (8 pts) Capital rental market, financial rate of return Joe earns 500 per week working his regular job. He owns an apartment whose cur- rent market price is 100,000. Joe looks up rental rates for comparable properties and leases out the apartment for one year at 1200 per month. During the rental period, Joe spends a total of 2 weeks of his own time doing maintenance on the property, pays 400 for insurance, 600 in property taxes and buys a replacement sliding door for the apartment at 400. At the end of the rental period, Joe sells the apartment to his former tenant for 105,000. Assume that the housing rental market is in equilibrium. a) What is the user cost of the apartment for that year? b) Calculate the after-tax financial rate of return on the apartment for the one-year period in question c) Suppose that the economy's total market value of currently occupied housing is $ 20 tin, of which $ 7 ton is tenant-occupied and $ 13 trn is owner-occupied. Calculate the total imputed rent on the owner-occupied housing stock. Calculate the total consumption of housing services in the economy (Hint: calculate the capital income rate on Joe's apartment and use the assumption that the housing rental market is in equilibrium