Question

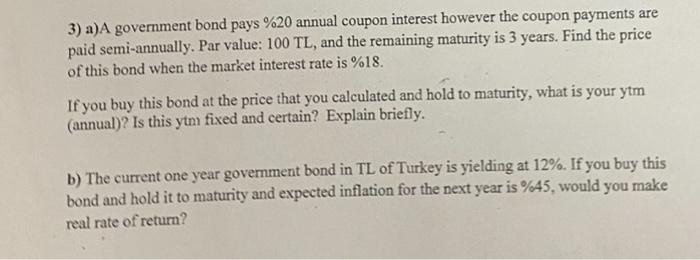

3) a) A government bond pays %20 annual coupon interest however the coupon payments are paid semi-annually. Par value: 100 TL, and the remaining

3) a) A government bond pays %20 annual coupon interest however the coupon payments are paid semi-annually. Par value: 100 TL, and the remaining maturity is 3 years. Find the price of this bond when the market interest rate is %18. If you buy this bond at the price that you calculated and hold to maturity, what is your ytm (annual)? Is this ytm fixed and certain? Explain briefly. b) The current one year government bond in TL of Turkey is yielding at 12%. If you buy this bond and hold it to maturity and expected inflation for the next year is %45, would you make real rate of return?

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the price of the bond we need to determine the present value of the future cash flows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Economics Principles and Policy

Authors: William J. Baumol, Alan S. Blinder

12th edition

978-0538453677, 538453672, 978-0538453622, 538453621, 978-0538453653

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App